It’s tax season, which means it’s the prime time for scammers to crawl out from underneath their scammy rocks and try to nab taxpayers’ personal info. So far, this year’s electronic tax scams are even more prevalent than before, the Internal Revenue Service says, surging 400%. [More]

internal revenue service

IRS Computer Issues Could Delay Some Tax Returns

Consumer trying to get a jump on the tax filing and refund ball may have to wait a bit longer, as the Internal Revenue Service suffered a severe computer crash on Wednesday that prevented it from accepting any taxpayer information for several hours. [More]

IRS: You’ll Have Until April 18 To File Your Taxes This Year

Already stressing over doing your income taxes? You’ll have a few more days of breathing room before they’re due this year: the Internal Revenue Service has set a filing deadline of April 18. [More]

Advocate: Additional IRS Funding Should Be “Extremely Helpful” In Actually Helping Taxpayers

As we approach 2016, taxpayers might be wary of dealing with the Internal Revenue Service after last year’s identity theft problems. But according to the IRS’ national taxpayer advocate, the agency is going to be much better at dealing with taxpayers than it was last year. [More]

Provision In Highway Funding Bill Would Require The IRS To Use Private Debt Collectors

While federal regulators continually work to crack down on private debt collectors that utilize unsavory, illegal tactics to make consumers pay up, government agencies often contract these entities to collect a variety of debts. That practice could continue if a provision in the Highway Trust Fund Bill receives approval. [More]

Sorry, You Can’t Pay The IRS With A Check For $100 Million Anymore

You there! The one ready to write a big, fat check to the Internal Revenue Service — drop that pen. The agency has announced that it will no longer accept checks for $100 million, so you’ll just have to write more than one check. So yeah, you can go ahead and pick that pen up again now. [More]

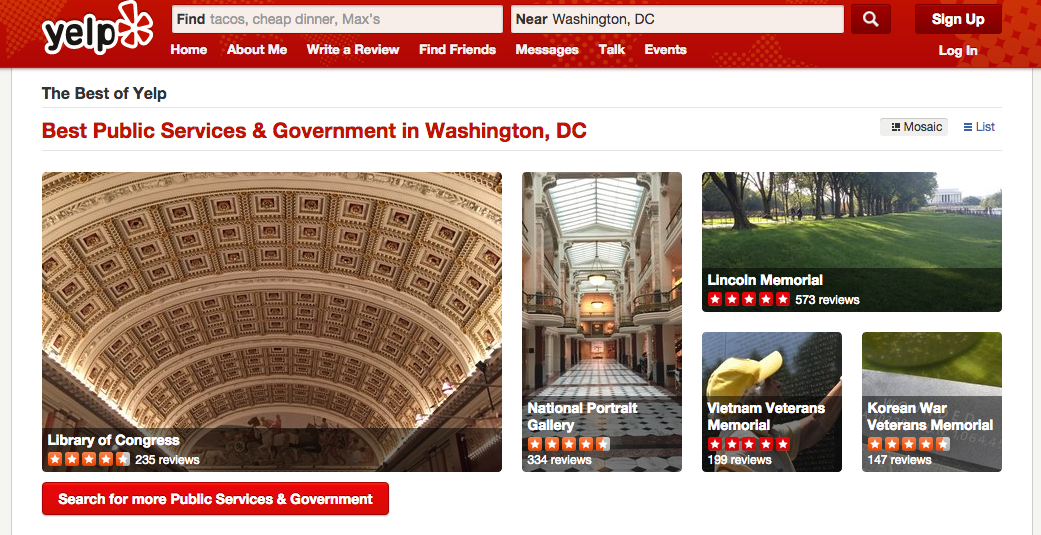

You Can Now Rate And Review U.S. Government Services On Yelp

The wait time to get customer support from the Internal Revenue Service is stretching on into infinity. The Transportation Security Administration agents at one particular airport checkpoint always seem to have it out for you. There’s one particular bathroom at Yellowstone National Park that is the best and everyone should know about it. Whatever your experience with U.S. government services, you can now review it on Yelp. [More]

IRS: Identity Thieves Accessed More Taxpayer Accounts Than We Thought

Almost three months after the Internal Revenue Service said identity thieves accessed more than 100,000 taxpayer accounts in its databases, the agency says that a review shows more accounts were exposed and there were more attempts to gain access to them than previously reported. [More]

IRS Agrees To Share Copies Of Fake Tax Returns With Victims Of Identity Theft

After lawmakers called on the Internal Revenue Service for more transparency for victims of identity theft, the agency says it will give those people copies of fake tax returns filed using their name and information. [More]

The IRS Is Still Using Windows XP, Has A Cybersecurity Staff Of 363 People

In the last few years, tax return fraud has become a serious problem at the state and federal levels, thanks to the growth of e-filing and security holes in IRS and third-party tax software systems. Is the IRS to blame for this trend? There are really only two options: the IRS is either broke or incompetent. [More]

FBI Opening Investigation Into IRS Breach That Affected 100,000 Taxpayers

After the news yesterday that the Internal Revenue Service reportedly suspects Russian identity thieves were behind a breach that allowed thieves to access information for approximately 100,000 taxpayers, the Federal Bureau of Investigation says it’s now investigating the incident. [More]

How To Verify Your Identity In Case The IRS Suspects Suspicious Tax Return Activity

In the aftermath of revelations that fraudsters exploited TurboTax and had possibly filed bogus returns in many states, the Internal Revenue Service is contacting people linked to suspiciously filed returns, and asking them to verify their identity to find out if the return is real or not. [More]

Lawmakers In House, Senate Investigating Fraudulent Returns Filed With TurboTax

Joining the Federal Bureau of Investigation and the Internal Revenue Service on the case of bogus tax returns filed used Intuit’s TurboTax software will now be lawmakers from both the House and Senate, who have started probing the recent flurry of fraudulent activity. [More]

IRS Issues List Of “Dirty Dozen” Scams Taxpayers Should Be On The Lookout For This Year

Each tax season fraudsters manage to separate taxpayers from billions of dollars by using aggressive schemes such as impersonating Internal Revenue Service agents or employing emails and websites designed to gather consumers’ personal information for fraudulent use. This year, the IRS has issued a list of the “Dirty Dozen” scams consumers should guard against. [More]

Alert Safeway Employees Save Woman From Losing Thousands In IRS Back Taxes Scam

Only weeks after Internal Revenue Service officials announced that more than 290,000 consumers have fallen victim to an ongoing back taxes scam in the last 15 months, alert employees at a Safeway supermarket in Washington prevented a woman from being added to the list of victims. [More]

IRS Turning Its Baleful Gaze At Company Cafeterias That Churn Out Free Food

Do you hear that noise? It’s thousands of forks clattering in the hands of Silicon Valley employees currently enjoying a free lunch. The Internal Revenue Service is taking a closer look at the trend of company cafeterias shoveling free food onto employees’ plates, saying that smorgasbord is a taxable fringe benefit. [More]

People Still Falling For Fake IRS Phone Demand Scam

Remember the scam that we kept hearing about during tax season, where victims received a phone call from a person pretending to represent the Internal Revenue Service who demanded immediate payment on a prepaid debit card? People just keep on falling for it. Yes, even now that most people have turned in their tax returns. [More]

Fewer IRS Agents Mean Less Chance You’ll Get Audited This Year

Consumers with a perpetual worry of being audited each year can breathe a sigh of relief. Okay, maybe not totally, some people are still going to be audited after tomorrow’s tax deadline comes and goes, but the chances of such an audit are unusually slim this year. [More]