Only weeks after being accused of pushing hundreds of thousands of auto loan customers into paying for unwanted and unnecessary insurance plans, Wells Fargo finds itself in another possible insurance scandal, with banking regulators investigating claims that Wells allegedly failed to refund insurance money to some borrowers who paid off their car loans early. [More]

insurance

Wells Fargo Subpoenaed Over Alleged Insurance Scheme That Resulted In 25,000 Vehicle Repossessions

Less than a week after a report alleged, and Wells Fargo admitted, to charging its auto loan customers for unnecessary and unwanted insurance, the bank has been subpoenaed by New York state banking and insurance regulators over the matter. [More]

New York AG Says States Will Do “Whatever We Have To” To Make Sure Obamacare Subsidies Continue

A federal appeals court recently allowed a coalition of more than a dozen states to intervene in a long-running lawsuit challenging the legitimacy of billions of dollars in federal subsidy payments to insurance providers. But regardless of what happens in that case, President Trump has repeatedly dangled the threat that he could pull the plug on those payments at any time. The states coalition says it is preparing for that possibility and is ready to take the White House to court if necessary. [More]

Appeals Court Will Let States Defend Obamacare Subsidies That White House Likely Won’t

A federal appeals court has granted a request from 16 attorneys general to allow them to intervene in a long-running legal challenge to billions of dollars in federal subsidies provided by the Affordable Care Act. [More]

Can You Sue Your Insurance Company Over A Data Breach If Your Info Hasn’t Been Used By ID Thieves?

With data breaches now a daily occurrence for businesses large and small, there’s a good chance that at least some of your information has been compromised by cybercriminals at some point. But should you be able to sue a company for failing to keep your data safe when the stolen information hasn’t (yet) been misused? [More]

Report: 25,000 Wells Fargo Customers Lost Vehicles After Bank Charged For Unwanted Insurance

Nearly 25,000 Wells Fargo customers, including many servicemembers, lost their vehicles after failing to pay for unneeded, unwanted insurance the bank charged them for, according to a new report suggests. [More]

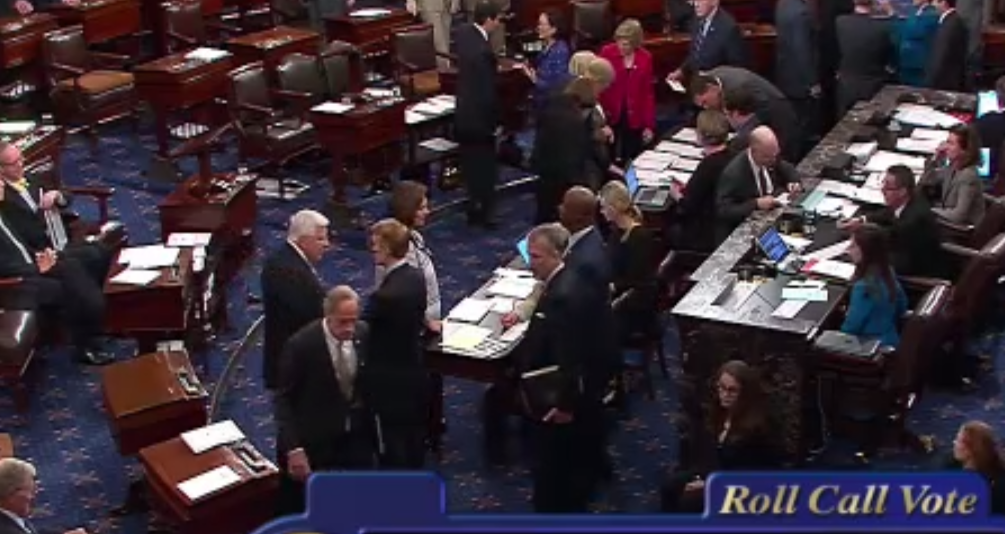

Obamacare Repeal Effort Falls Flat As GOP Can’t Muster Votes In Senate

After three days of debate and several fruitless votes on amendments, the Senate Republicans were unable to obtain enough support to pass their so-called “skinny” repeal of the Affordable Care Act. [More]

Insurance Companies, Actuaries, Physicians Warn Against Repeal Of Obamacare’s ‘Individual Mandate’

The various “repeal and replace” factions have targeted different aspects of the Affordable Care Act: Some want to slash Medicaid; some want to cut federal funding to Planned Parenthood; some say they must repeal taxes on tanning salons. One goal they all have in common is to get rid of the law’s “individual mandate,” the requirement that most people must have some sort of health insurance or pay a penalty. Now the insurance industry, along with physicians, and risk-assessing actuaries, are warning the Senate that gutting this mandate could cause big problems down the road. [More]

GOP Proposes, Then Immediately Rejects Plan For Single-Payer Health Insurance

Since the Affordable Care Act passed in 2010, Republican lawmakers have repeatedly decried it as “socialized” or “government-run” healthcare while calling for its repeal. But it was a GOP senator who today introduced legislation that, if passed, would have provided single-payer, government-run Medicare for everyone. [More]

First Attempt At Repeal-Only Of Obamacare Falls Short In Senate

After falling far short of the votes needed to move forward with its sweeping measure to repeal and replace large parts of the Affordable Care Act, the Senate took another vote this afternoon, this time on a bill that simply repeals key aspects of the ACA without including any replacement. [More]

Senate Votes Down Controversial Repeal, Replace Plan For Obamacare; More Proposals To Come

Hours after the Senate needed Vice President Mike Pence to break a 50-50 tie to move forward with debate on healthcare, the GOP’s controversial repeal-and-replace plan has come up several votes short of being accepted. Yet this is far from the end for this matter. [More]

Additional Parts Of Obamacare Repeal Bill Break Senate Rules, Says Parliamentarian

The Senate Parliamentarian — the nonpartisan official who advises the upper chamber on the rules regarding legislative matters — has added to her previous list of concerns about the Republican bill to repeal and replace the Affordable Care Act, raising new concerns about the GOP’s ability to pass the legislation in its current state. [More]

Senate Parliamentarian Says GOP Obamacare Replacement Goes Too Far, Rules Against Planned Parenthood Defunding

As you may be aware, the Republican effort to repeal and replace the Affordable Care Act is being pushed through Congress as a budget resolution, meaning it only needs a simple majority in the Senate (as opposed to 60 votes) to pass. However, budget resolutions are also very limited in what they can do, and today the Senate Parliamentarian issued her opinion that several key measures of the Senate replacement bill go beyond the scope of what’s allowed. [More]

Farmers To Pay $390K For Charging Renters More Than Homeowners On Car Insurance

Last year, a Consumer Federation of America report found that home renters pay up to 47% more for car insurance than their peers who own their homes. Now, one state is doing something about this: Minnesota has fined insurance giant Farmers $390,000 for charging higher rates to renters. [More]

What Is Going On With The GOP Effort To Repeal Obamacare?

The Republican plan to repeal and replace the Affordable Care Act has been dealt a number of potentially lethal blows in recent days, but some supporters of the effort — including President Trump — continue to push their colleagues to move forward with repeal. Will a vote happen? Will it succeed? And how does the news of Sen. John McCain’s brain tumor affect the numbers? [More]

Budget Office: Repeal Of Obamacare Would Double Premiums, Leave Additional 32 Million Without Insurance

Though it was effectively declared dead on arrival earlier this week, the latest Republican plan to repeal the Affordable Care Act is still technically on life support, with President Trump pushing for lawmakers to continue working on the measure. However, the Congressional Budget Office has once again confirmed that simply repealing Obamacare without a replacement would result in a huge number of additional Americans losing or going without health insurance, and significantly higher costs for those who remained on their policies. [More]

Trump, GOP Senators Suggest Simply Repealing Obamacare Without Replacement

With Republican lawmakers unable to reach a consensus on how to replace the Affordable Care Act, President Trump and some influential senators are now calling for a straightforward repeal of the law, with any replacement to come at some later date. [More]

Budget Office: Long-Term Medicaid Spending Would Drop 35% Under Obamacare Repeal Plan

As we mentioned in our coverage of the Congressional Budget Office’s review of the Senate proposal to repeal the Affordable Care Act, the ten-year focus of the CBO analysis could not fully illustrate the impact of Medicaid cuts that wouldn’t come until the latter half of that decade. Today, the CBO released a separate report that estimates what effect those cuts might have ten to twenty years from now. [More]