../../../..//2008/05/12/hr-block-says-you-paid/

H&R Block says you paid it $2.8 billion to do your taxes this year. It was their best tax season in 9 years thanks to the company’s decision to increase fees by 7%-9.8% [CNNMoney ]

Thanks for visiting Consumerist.com. As of October 2017, Consumerist is no longer producing new content, but feel free to browse through our archives. Here you can find 12 years worth of articles on everything from how to avoid dodgy scams to writing an effective complaint letter. Check out some of our greatest hits below, explore the categories listed on the left-hand side of the page, or head to CR.org for ratings, reviews, and consumer news.

../../../..//2008/05/12/hr-block-says-you-paid/

H&R Block says you paid it $2.8 billion to do your taxes this year. It was their best tax season in 9 years thanks to the company’s decision to increase fees by 7%-9.8% [CNNMoney ]

As an educated consumer you may wonder why people would choose to use a Refund Anticipation Loan when they can e-file and receive their refund in only a few days.

H&R Block recently got into trouble because when a Connecticut same-sex couple tried to file their taxes through H&R Block’s website, the system spat back, “”We don’t support Connecticut Civil Union returns.” One of our readers wrote H&R Block about our post and their VP of Marketing actually wrote back to him to describe what she felt was media sensationalization of the story. She says that the problem happens because the Federal government doesn’t recognize same-sex civil unions. The information for state tax returns gets inputted based on the federal, so in this specific case, it’s not “flowing” correctly. It sounds like they’re working on fixing that, though. Here’s her email in full:

H&R Block is an extremely generous company! They’ve sent you a $5,666.10 refund check and you didn’t even file your taxes with them! Isn’t that nice?

After 23 months of same-sex, civil-union bliss, Jason Smith and Settimio Pisu had grown accustomed to some institutions being not quite ready for the concept of gay spouses.

../../../..//2008/03/25/if-youre-on-ssdi-social/

If you’re on SSDI (Social Security Disability Insurance) and used Taxcut Online from H&R Block to file for your stimulus payment, it may have told you to print out the wrong form. The right form is 1040A, not 1040EZ.

Last week we wrote about I-Can! E-File, a free electronic filing service for your federal income taxes. It’s a great idea, and we’re thankful to the Legal Aid Society of Orange County for doing something like this—but you might want to find an alternative this year and give them some time to work out the kinks. Today a reader emailed us to point out that icanefile.org’s password system can be easily cracked, because instead of letting you choose an original password, it requires you to use your name and social security number to set up an account.

I-CAN! is a web-based tax preparation tool that will file your tax return completely free of charge. I-CAN has no eligibility criteria or income restrictions and will eFile your state return for free if you live in California, Michigan, New York, Pennsylvania or Montana. It almost sounds too good to be true. So why isn’t I-CAN! a member of the IRS’ Free File Alliance?

Reader Justin writes in to tell us how to opt-out of H&R Block’s arbitration clause in their 2007 Client Service Agreement.

Refund anticipation loans are bad enough, but H&R Block and Jackson Hewitt want you to get a RAL, and then put it on a fee-riddled pre-paid debit card. What a great idea!

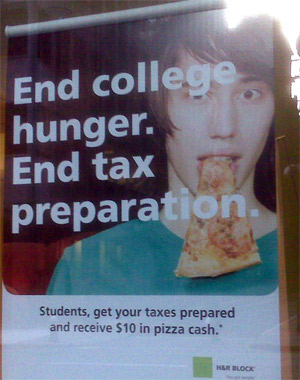

Kevin sent in this ad for H&R Block trying to market to college kids by giving them $10 in “pizza cash” if you file through H&R Block. This sounds tasty, except that due to their low income, most college kids won’t have to pay any taxes and it’s pretty easy to do with FreeFile through the IRS.gov website, for free, natch. But file through H&R Block and you’ll probably be paying at least $60. So, you could buy yourself $10 of pizza, or pay $50+ for H&R Block pizza. They still teach math in college, right?

../../../..//2008/01/02/the-disgraced-former-hr-block/

The disgraced former H&R Block CEO responsible for the company’s disastrous foray into subprime mortgage lending, Mark Ernst, will receive a $2.5 million dollar cash bonus, stock options, and free health care until 2010. [Reuters]

H&R Block has decided to admit defeat after a plan to sell its troubled subprime lending operation to Cerberus Capital Management LP finally unraveled.

H&R Block Inc., our nation’s largest tax preparer, is now missing CEO Mark “Anybody Wanna Buy A Subprime Lender?” Ernst, after losing $1 billion in the subprime meltdown.

The subprime lending arm of tax giant H&R Block continues to hemorrhage money, to the extent that it’s close to being unsalable, according to Bloomberg.

H&R Block Inc.’s mortgage unit lost a $1.5 billion credit line, falling “dangerously close” to the minimum amount demanded by a hedge fund firm that has agreed to buy the money-losing home lender.

The company reported losing $85.5 million, or 26 cents per share, during the February-April period, which is when the nation’s largest tax preparer sees the majority of its revenue. By comparison, the company earned $587.5 million, or $1.79, during the same period a year ago.

H&R Block says it will sell its subprime lending operation to a private equity firm.

We haven’t been getting many complaints about tax places this year but as far as we know, they still suck. They’re known for messing some people’s returns up pretty bad, or encouraging people to take questionable deductions. Like making up a child, for instance. Here’s a walk down memory lane, a lane that’s definitely shady…

The number of refund anticipation loans declined 22.5% last year as consumers took advantage of cheaper and only slightly slower alternatives, NYT reports.

![]()

Part of ![]()

Founded in 2005, Consumerist® is an independent source of consumer news and information published by Consumer Reports.