Last Friday, Jan. 27, was the deadline for the deal to close in the proposed acquisition of drugstore chain Rite Aid by competitor Walgreens. Today, the companies announced a revised deal with an eye to meeting Federal Trade Commission approval. This deal values Rite Aid at over $2 billion less, and proposes the sale of hundreds more stores to another drugstore chain. [More]

ftc

5 Things We’ve Learned About How Companies Track You Online And Off

Is there an ad that seems to be following you everywhere? Perhaps you browsed for new sneakers in a slow moment at work a week ago, and now you see ads for them on every site you view on your phone? Or maybe you clicked an ad on Facebook, and now that company’s product seems to be stalking you around the internet, asking you to buy it in every sidebar ad you see. [More]

Uber Ordered To Pay $20 Million For Allegedly Exaggerating Drivers’ Potential Earnings

Popular ride-hailing service Uber has agreed to pay $20 million to close the book on federal charges that it used misleading and exaggerated earnings figures to attract new drivers to work with the company. [More]

Western Union Will Pay $585 Million For Not Doing Enough To Stop Wire Fraud

Whether it’s the “distant relative stranded in a foreign country” scam or the “you’ve won the lottery but you have to pay us scam” or any other variation on this remotely operated ruse, wire transfer services like Western Union are often the conduit for getting that money from the victim to the scammer. After years of being accused of not doing enough to clamp down on fraud by its customers, Western Union has agreed to pay $585 million to federal authorities and admit that its policies — and some of its agents — aided and abetted wire fraud. [More]

Feds Shut Down Two Massive Illegal Robocall Operations

Fighting robocalls might seem as pointless as chasing a greased pig, but occasionally you’re able to get your slick mitts on a slippery swine and hold on, if only for a moment. Today, the Federal Trade Commission managed to nab a pair of particularly large robocalling pigs, who have allegedly been violating the Do Not Call Registry for at least five years. [More]

Feds Accuse D-Link Of Failing To Properly Secure Routers & Webcams

Federal regulators have accused D-Link, a manufacturer of popular networking and smart-home products, of leaving its routers and webcam devices vulnerable to hackers. [More]

Got An Idea On How To Make ‘Internet Of Things’ More Secure? You Could Win $25,000

Internet-connected (“smart”) devices are becoming ubiquitous, but they have this persistent problem: they’re internet-connected. A huge number are extremely vulnerable to being taken over by bad actors, for a whole host of reasons. And so, before your fridge becomes part of the next record-breaking botnet, the Federal Trade Commission wants to give someone cold, hard, cash money for coming up with a way to prevent it. [More]

The FTC Has Some Questions About The Bass Pro Shops-Cabela’s Merger

Earlier this year, Bass Pro Shops offered to buy up one of its biggest competitors, Cabela’s, for $5.5 billion. The Federal Trade Commission is reviewing the deal now, and is raising concerns that this might be too much consolidation in the hunting and fishing market. [More]

No, The FTC Did Not Email You That You’re Under Investigation

If the Federal Trade Commission is investigating you or your business, they will not send you an email asking you to click on a link for more information. How do we know that? The Federal Trade Commission says so. [More]

Settlements Allow Auto Dealers To Continue Selling Unrepaired Recalled Vehicles As “Safe”

If you bought a used car from a dealership that proudly claims to put each vehicle through “125-point” or “172-point” inspections, you might assume that your vehicle is safe to drive and that it isn’t under recall for a potentially deadly defect. However, a number of big names in used cars — including CarMax and General Motors — have recently entered into settlements with federal regulators that could allow used car dealers to continue marketing their vehicles as safe even while they may have unrepaired defects. [More]

FTC Settlement Permanently Halts Alleged Energy Drink-Slinging Pyramid Scheme

A year ago, a court agreed to put a temporary halt to an alleged pyramid scheme that made its money by convincing college students they could make big bucks shilling energy drinks — but only paying up for recruiting more sales friends instead. Today, the FTC has announced a settlement with the Vemma Nutrition Company that puts a halt to those practices for good. [More]

DeVry University Must Pay $100 Million To Former Students For Misleading Ads

At the beginning of the year, the Federal Trade Commission sued popular for-profit college DeVry University, claiming the school’s advertising misled would-be students about how likely a DeVry degree is to get them a job. And now to ring out the year, the school and the Commission have reached a $100 million settlement that sends all that money right back into students’ pockets. [More]

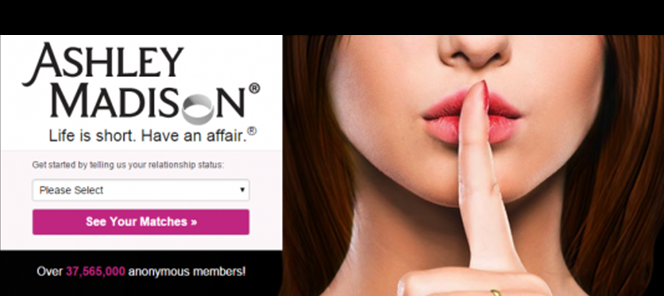

Ashley Madison’s Penalty For Exposing Details On 36 Million Users? About $.04 Per Person

In 2015, a major data breach at AshleyMadison.com — the dating site targeted at cheaters — exposed information for some 36 million accounts. The company has now entered into a deal that settles federal and state charges that Ashley Madison: misled users about data security and failed to protect user information; charged users to delete profiles (but didn’t); and used fake profiles to lure in customers. While the settlement has a price tag of $8.75 million, Ashley Madison will actually pay significantly less than that. [More]

Pressing Your Phone Camera Against Your Finger Will Not Measure Your Blood Pressure

The tiny sensors in our smartphones can do amazing things, but what they cannot do is substitute for a blood pressure cuff. That’s unfortunate, because having your blood pressure measured can be painful and unpleasant. However, one app-maker ran afoul of federal regulators by claiming that your smartphone camera could be used to accurately check your vitals. [More]

Don’t Fall For The ‘Missed Delivery Notice’ Email Scam This Holiday Season

If you’re like everyone else you know, you’ve probably been doing — or plan to do — a bit of online holiday shopping this year. Missing a delivery could put a serious kink in your day, but don’t let that fear draw you into a scammer’s net. [More]