If a bank wants to offer a checking account that isn’t as terrible as most of what’s out there, that’s fine. But that bank shouldn’t pat itself on the back and act like it’s doing consumers a favor just because it gives them a slightly easier way to avoid being nickel-and-dimed. [More]

free checking

Free Checking Accounts Are Vanishing And Consumers Are Letting It Happen

U.S. consumers and businesses currently have $1.4 trillion stashed away in checking accounts and banks and credit unions around the country. That’s more than ever before, and most of that cash is being held in accounts that earn absolutely no interest. At the same time, financial institutions are continuing to cut down on the availability of unconditional free checking. [More]

Survey: When It Comes To Free Checking, Small Banks & Credit Unions Do The Best

There’s somewhat of a stark difference between big banks and their smaller counterparts and credit unions in the realm of free checking. Not having to pay for such an account is a big draw for consumers, and according to a new survey from the U.S. Public Interest Research Group, you’ll have much better luck finding gratis checking services at those small banks and credit unions. [More]

New Dilemma For Some Wells Fargo Customers: Keep $7500 In The Bank Or Pay $15 Fee

As banks look for new and exciting sources of revenue, free checking is slowly fading away at the nation’s large financial institutions. This week, we heard from several Wells Fargo customers who are annoyed that they’ll have to pay $15 per month to keep their current account type if they don’t have an average of $7,500 in the bank, across all of their accounts. Is this impossible? No, but it’s a drastic change from the old requirements. [More]

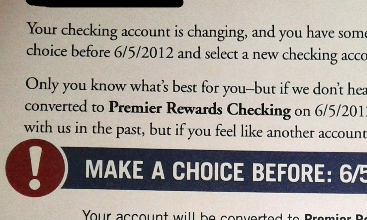

SunTrust Sunsets Free Checking

The next bank to do away with free checking is SunTrust, and they’ve got their own unique twist on it. [More]

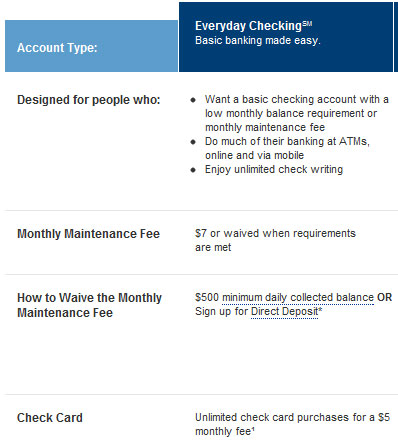

US Bank Replaces "Free Checking" With "Easy" Checking (Hint: It's Not Free)

US Bank was one of the last large banks to keep offering free checking but that will be no more after May 15. All customers will migrated over from “Free Checking” to “Easy Checking.” While it’s not certain how it might be any easier, like a US Bank truck drives to your house and picks up your deposits and gives you a free lollipop, it is certain that the checking accounts will have monthly maintenance fees. But you can avoid those fees if you sign up for the right level package and abide by certain behaviors. [More]

Free Checking Lives On At Smaller And Online Banks

Now that free checking is dead at each of the four major retail banks, is there any where you can go to just have a simple checking account without paying a bunch of fees? Yup, look at your smaller local bank or credit union, or think about an online checking account, reports American Banker. Unlike the big banks that have such dominant market presence that they don’t need to compete on price, just who has more ATMs, the scrappier outfits are going to to use free checking as a competitive advantage and a way to get people in the door so they can try to upsell them to other banking products and services. [More]

We'll Give You Free Checking If We Don't Have To See Your Stupid Face

Bank of America introduced a new free checking account. The catch is you have to do all your banking without stepping foot inside a branch. If a teller has to deal with your nonsense in person or you request a paper statement, you’re slapped with a $9 fee that month. [More]

Bank of America: "Free" Checking Means You Have To Call And Have The Fee Waived Every Month

Reader Tara has a checking account with Bank of America that’s supposed to be “free” if she meets 1 of 3 balance requirements. She meets one of them, but Bank of America keeps charging her $20 — and they don’t intend to stop.

Don't Want A Debit Card? Key Bank Will Charge You $1 A Month

After hearing about Hannaford’s giant customer data breach yesterday, Brian decided to cancel the debit card he’d used there. That’s when he found out that Key Bank really wants you to have a debit card. In fact, they’ll charge you a small monthly fee to not have one linked to your “free checking” account. We figure that this means Key Bank makes about $12 a year more off of customers who have linked debit cards—and that if you want greater security on your account, it’s going to cost you.

"Free Checking" Is Different Than "WaMu Free Checking." What?

Reader Edward would like to let you know that “Free Checking” at Washington Mutual is different than “WaMu Free Checking,” and if you’d like those “free checks” they’ve been advertising, you’d better make sure you’ve been upgraded to “WaMu Free Checking.” If you’ve got “Free Checking” like Edward did, and you try to order checks, you will be charged $20.