When you think of mobsters involved in trafficking stolen goods, perhaps you drugs, cigarettes, and guns come to mind. But the more than 30 people associated with an alleged Russian crime syndicate in New York arrested this week are also accused of dealing in something a bit sweeter — 10,000 pounds of pilfered chocolate. [More]

fraud

Schemer Claims Subway Manager Needs Bail, Scams $200 From Employee

Combining the juvenile tradition of pranking fast food restaurants with the “your relative is in jail” wire fraud scam, someone managed to trick employees at a Subway restaurant to fork over $200 to a complete stranger. [More]

Online Eyeglass Vendor Who Threatened Customers Arrested Again For Running Another Bogus Store

You may remember the bizarre tale of Vitaly Borker, the man who served three years in prison for trying to boost his Google search ranking by harassing his customers online. Federal prosecutors say he’s back at it, once again selling eyewear on the internet, and allegedly bullying customers who dare to ask for refunds. [More]

Cancer Faker Who Raked In $130K In Donations Gets 6-Month Sentence

After lying about having terminal breast cancer and collecting almost $130,000 in donations for her treatment, a woman pleaded no contest to grand theft and has been sentenced to six months in county jail, 30 days of community labor, and five years of felony probation. She also has to repay the fraudulently obtained donations. [More]

Former Bank Of America VP Accused Of Making $2.7M In Bogus Donations

A former Bank of America executive, along with her husband and another person, have been accused of bank fraud for their alleged involvement in an embezzlement scheme that involved making millions of dollars of fake donations in the bank’s name. [More]

Ponzi Scheme Victims Say PayPal Knew User Was A Scammer

Victims of a Ponzi scheme that raked in hundreds of millions of dollars allege that online payment system PayPal were aware of the scam operator’s past but turned a blind eye because the company was making so much money from these fraudulent transactions. [More]

Wells Fargo Shareholders Say Bank Staff “Rounded Up” Undocumented Workers As Part Of Phony Account Scam

We’re all well aware by this point that Wells Fargo employees opened up more than 2 million bogus accounts in customers’ names in order to game the bank’s sales incentive/quota system. Some former bank staffers revealed what they claim are some of the tricks used to create these fake accounts — including rounding up undocumented day laborers at convenience stores and construction sites to get them to sign up for accounts (only to then allegedly give them additional accounts they didn’t ask for). [More]

Google, Facebook Employees Targeted In $100M Phishing Scam

When the Justice Department recently said that two major tech companies had paid out a total of $100 million to a scammer posing as a hardware manufacturer, it chose to not name the businesses that had been conned. But now, both Google and Facebook are confirming that they were the ones victimized by this phishing scheme. [More]

Dentist Accused Of Medicaid Fraud, Pulling Teeth While On Hoverboard

Going to the dentist is often unpleasant enough without worrying that your doctor will perform a procedure while riding a hoverboard, but prosecutors in Alaska say one dentist not only defrauded the state out of millions, but he apparently did so while moving around on motorized wheels. [More]

American Airlines Workers Targeted In $16.7M Hearing Aid Scheme

Thousands of American Airlines employees unknowingly became the targets of a multi-million dollar insurance fraud scheme carried out by a father-son duo who claimed to provide the airline workers with free hearing aids for simply taking a test. [More]

Man Stole $11,000 In Stuff From Home Depot, Then Returned It All For Refunds

Most practitioners of the “hot exchange” — the retail grift where a fraudster steals an item then “returns” it to the store for a refund — are happy to chisel away a criminal living, earning $50 here, $100 there. But one Texas man was thinking big when he stole — and then returned — more than $11,000 from Home Depot stores. [More]

Hackers Targeting Amazon Third-Party Sellers

If you’ve seen something with a too-good-to-be-true price in the Amazon Marketplace lately, there’s probably a good reason for that. Or, rather, a bad one, as it seems some fraudsters’ new favorite trick is to hijack unsuspecting Amazon sellers’ accounts and fleece shoppers for every penny they can. [More]

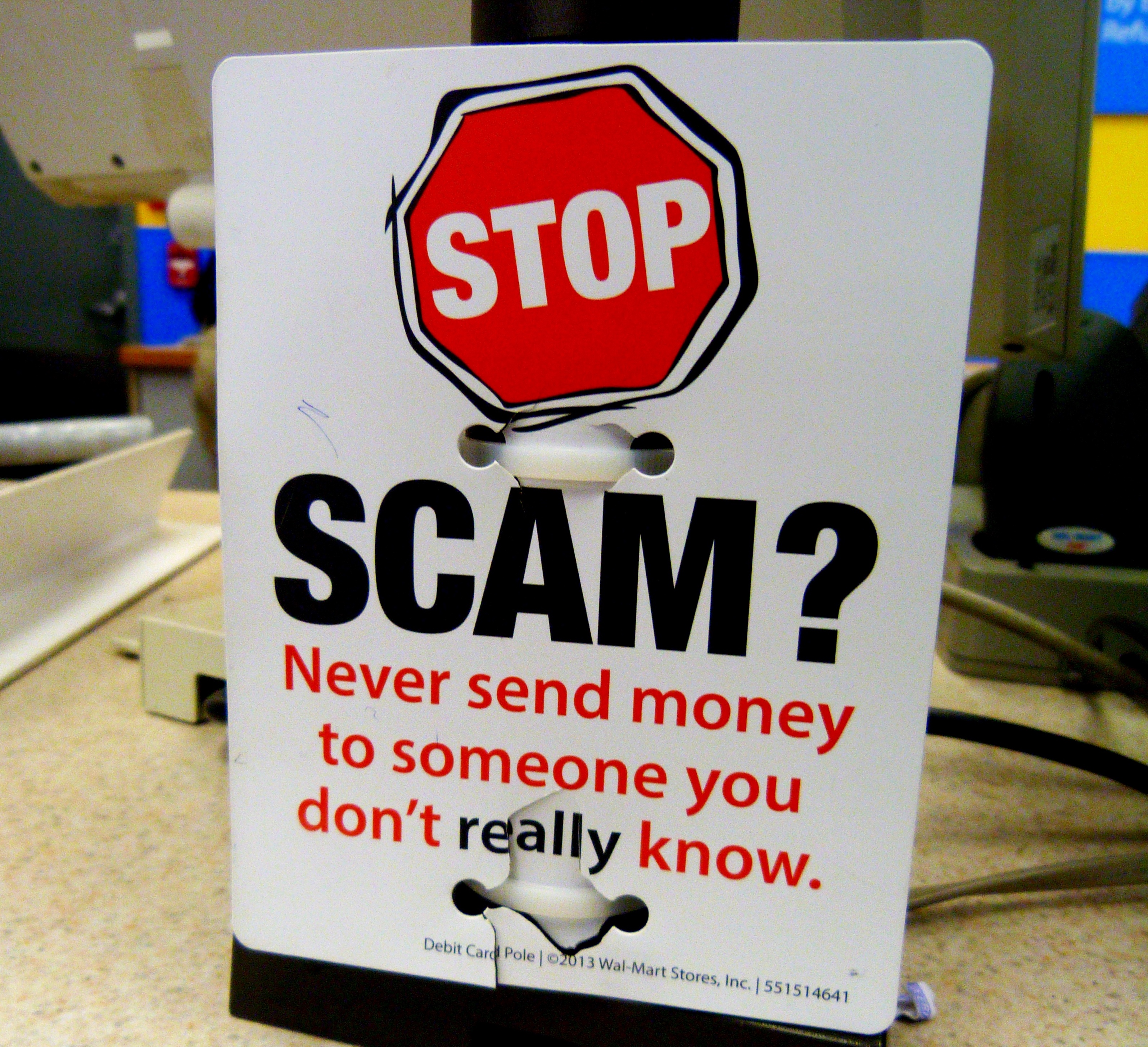

Maybe Don’t Answer Calls From These Area Codes If You Don’t Want To Be Scammed

Yesterday, in honor of National Consumer Protection Week, we highlighted four scams consumers should be aware of in order to keep their money. One way to avoid some of these telephone-based scams is to just avoid picking up the phone at all when receiving calls from certain area codes. [More]

4 Scams You Should Always Be Aware Of

In honor of National Consumer Protection Week — don’t worry; we forgot to get you a gift too — we wanted to take a few moments to remind everyone of some of the most common scams so that they can do their best to avoid them. [More]

19 People Indicted For Money Laundering, CEO Scams, Imaginary Car Scams

Have you ever wondered about the people who lurk behind scam emails asking for mysterious wire transfers, or who post ads for suspiciously cheap cars that never materialize after the buyer sends a payment? Today, the Department of Justice outed a few of these unscrupulous types, indicting 19 people for allegedly laundering money and perpetrating a variety of international financial scams. [More]

Here’s A Snap-On Bluetooth Skimmer Spotted Out In The Wild

Have you ever wondered how a retailer can leave a Bluetooth skimmer on a payment card terminal in its stores for weeks at a time? It’s harder to detect the devices than you might think, because crooks have their own places to shop for spare parts that snap right on a payment terminal and are hard to spot if you aren’t looking for them. [More]

Immigration Fraud Reports Increasing Amid Deportation Fears

Four months after New York Attorney General Eric Schneiderman and a number of immigration advocates warned of a potential increase in immigration scams following the November election and the uncertain status of many consumers, the office says it has seen an uptick in fraudsters preying on immigrants uncertain about their status. [More]

Two Women Charged With Filing More Than 850 Fraudulent Tax Returns Worth $2.78M

Every year you hear about identity thieves filing tax returns in other peoples’ names in order to snatch their refunds, but you may not realize what a big business this is for some crooks. Case in point: A pair of Illinois women who have pleaded guilty to filing more than 850 bogus returns worth nearly $2.8 million in refunds. [More]