For three years in a row, we’ve been able to take note of a particularly heartwarming act by two of the country’s largest mortgage giants, Fannie Mae and Freddie Mac. Just as the two companies did in 2011 and 2010, they announced today that they’ll suspend all bank repossessions of homes starting Dec. 19 and Dec. 17, respectively, running through January 2, 2013. That simple act could help homeowners ensure they can stay home for the holidays. [More]

foreclosures

Botched Foreclosure Shines Spotlight On Banks’ Ignorance Of The Rules

In Georgia, there is a program called HomeSafe, intended to prevent homeowners who have just lost their jobs and are only a little behind on their mortgage from losing their homes. When someone is accepted into the program, lenders are required to pause foreclosure actions, but that didn’t stop Citi and Freddie Mac from trying to evict one woman. [More]

NY Atty. Gen. Calls Out Wells Fargo For Halting Loan Mods In Wake Of Hurricane Sandy

As portions of New York and New Jersey begin to rebuild following the path of destruction cut by Hurricane Sandy, there are a number of area homeowners whose loan modifications have become collateral damage, with Wells Fargo suspending decisions on these requests until further notice. [More]

Cancer Patient Says Wells Fargo Evicted Her In Spite Of Court Order; Wells Fargo Says It’s Not To Blame

According to a petition that now has more than 114,000 signatures, a breast cancer patient in California claims that Wells Fargo and the sheriff evicted her from her home of 20 years at gunpoint. Meanwhile, the bank says it wasn’t involved in the [More]

Homeowners Win Lawsuit Over Fraudulent Foreclosure But May Still Lose House

A California couple recently won a lawsuit claiming that their mortgage servicer fraudulently foreclosed on their home, but limits on the damages in the case mean that the homeowners can’t even cover their legal bills, let alone keep their house. [More]

Wells Fargo Sends Crew To Foreclose On Home That Doesn’t Even Have A Mortgage, Shrugs

There isn’t really a great way to make it up to homeowners that don’t even hold a mortgage when you’ve sent a crew to break into their house and take everything out of it, but we suppose “sorry” is an okay, if lackluster, start. A California couple says Wells Fargo made a huge mistake by trying to take their home and now they’re not being very helpful in getting the family’s belongings back to them. [More]

If You're Going To Leave Your House Vacant, Don't Be Surprised To Find Kids Partying There

Like bloodhounds on the scent — or maybe more like pigs sniffing for truffles — industrious teens will find places to get drunk and do other things they have seen in movies. And with a large number of houses sitting vacant while awaiting sale or foreclosure, it’s a partier’s market out there. [More]

Wells Fargo Working With Daughter To Make Her An Authorized Party On Late Mother's Loan

We’ve been closely following the case of a woman who was trying to save the home she inherited from her late mother, only to be confounded when Wells Fargo refused to deal with anyone but the dead woman. Earlier this week, Wells Fargo announced that they’d placed the foreclosure on hold and had reached out to the woman. In the latest update, both the woman and Wells Fargo have confirmed that negotiations are underway. [More]

Wells Fargo Pushes Pause On Foreclosure As Petition Nears 150,000 Signatures

Yesterday, we told you about the California woman who was trying to save the house she’d inherited when her mother passed away, but who claims she is facing foreclosure because the bank refuses to deal with anyone other than her late mom. Since then, more than 120,000 additional people have signed the daughter’s petition and the attention has moved Wells Fargo to put things on hold for a moment. [More]

Wells Fargo Won't Talk To Me Because I'm Not My Dead Mother

A woman in California says she she just wants to take over the mortgage for the family house she inherited when her mom passed away, but instead she’s facing eviction because the folks at Wells Fargo will only speak to her dead mother. [More]

Massachusetts City Decides To Maintain Foreclosures

We’ve written before about cities going after mortgage lenders for failing to properly maintain homes on which they have foreclosed, but one Massachusetts city has decided it’s just easier to fix up these properties, rather than have them fall into disrepair and drag neighborhood home prices down with them. [More]

Why Do So Many Servicemembers Not Receive Mortgage Protections They Have Legal Right To?

The Servicemembers Civil Relief Act (SCRA) includes a number of protections for members of the armed forces who took out a mortgage before going on active duty. But as we have learned in recent years, there are at least 15,000 instances where banks failed to follow those guidelines — and hundreds — perhaps thousands of times where lenders have illegally foreclosed on servicemembers’ homes. [More]

L.A. Sues U.S. Bank For Letting Foreclosures Fall Into Disrepair

When a lender forecloses on a home, it becomes responsible for keeping the property safe and reasonably kept-up. But officials in Los Angeles has accused U.S. Bank of ignoring hundreds of foreclosures as they fall into disrepair and/or become taken over by squatters and street gangs. [More]

How Does Someone Lose Their House Over A $474 Water Bill?

If a homeowner has to make a choice between paying their mortgage or paying a tax or public utility bill, they might feel like the mortgage is the obvious way to go, lest they lose their house. But the fact is that you may be putting your property at risk by missing any of these payments. [More]

California Lawmakers Move Forward With Homeowner Bill of Rights

California is one of the many states hit in the gut by the collapse of the housing market, with at least a million homes already lost to foreclosure and about half as many struggling homeowners simultaneously trying to stave off foreclosure while jumping through hoop after hoop in the hopes of getting a mortgage modification. Yesterday, pending legislation that could help these homeowners came one step closer to being a reality. [More]

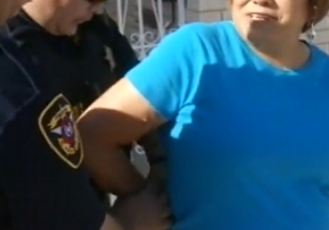

Woman Forcibly Removed From Home, In Spite Of Restraining Order Against Citibank

A woman in El Paso has been fighting foreclosure for several months, saying she was making payments and that Citibank was crediting them to an escrow account without telling her or explaining why. A federal court recently issued a temporary restraining order preventing the bank from foreclosing while the case is litigated, but that didn’t stop county constables from forcibly removing her from her home last week. [More]

Residents Of NY Town Face $1,000 Fines If They Fail To Mow Lawns

Most suburban neighborhoods have at least a handful of residents who just can’t be bothered to roll out the lawnmower and opt for the “natural” look on their yards. The problem has gotten worse in some areas hit hard by foreclosures. Now one town on New York’s Long Island has decided that folks who can’t maintain their lawns are deserving of thousands of dollars in fines. [More]