The money from a multibillion-dollar federal program to help unemployed and underemployed workers in certain states hold onto their homes failed to reach some of the people who needed the most help, especially in two states hit particularly hard by the recession. [More]

foreclosures

One Detroit Neighborhood Actively Looking For Squatters

Some neighborhood groups would look at squatters — people who live rent-free in vacant buildings — as a negative to be shooed away in favor of paying tenants. But the folks in one part of Detroit would rather have squatters occupying the empty homes in their area than see these buildings stripped or burned to the ground. [More]

CFPB Proposes Rules To Protect Consumers From Shoddy Foreclosure Practices

Since the recession began in the late 2000s, many homeowners have struggled to keep their homes, often fighting off aggressive and shady foreclosure attempts. Over the years, consumers groups have fought to extend protections for these consumers. On Thursday, the Consumer Financial Protection Bureau took steps to ensure that homeowners and struggling borrowers are treated fairly by mortgage servicers. [More]

Man Buys Foreclosed House, Finds Decomposed Previous Occupant

Earlier this week, a man won a foreclosure auction in Cape Coral, Florida. He stopped by yesterday to check out his new purchase, a pink house with metal bars on every window. Neighbors hadn’t seen the previous occupant in a few years…because she had moved away. Or so they thought. The house’s new owner found a very decomposed body inside. [More]

Body Found After 5 Years Of Auto-Paid Bills Finally Identified As Homeowner

The story of a woman in Michigan whose mortgage and other bills were paid automatically out of her five-figure checking account balance account while friends and family assumed that she was doing her own thing captured the public’s imagination. The idea that anyone could die and not be missed is chilling. Now DNA tests have confirmed that the homeowner was indeed the mummified body found in the back seat of her Jeep. [More]

Michigan Woman’s Death Unnoticed For 5 Years Because Her Bills Were On Autopay

Last week, a woman in Michigan who was found dead in the backseat of her Jeep, which was parked in her garage. No neighbors remembered seeing her around since maybe 2008, and the bank started foreclosure proceedings. A contractor making repairs on behalf of the bank found the homeowner, who lived alone and was estranged from family. How could such a thing happen? [More]

Contractor Cleans Out Foreclosed House, Finds Deceased Owner

If you suddenly disappeared, who would notice that you were gone? The neighbors of one woman in Pontiac, Michigan hadn’t seen her in years. She traveled a lot for work–maybe she was working offsite for an extended period, or she had moved away and simply not sold her house yet. No, she was home the whole time. In her Jeep. Dead. [More]

Publicity From Kentucky Case Prompts Lots Of People To Pay Their HOA Dues

If there’s any good that has come from the case in Lexington, Kentucky where a woman lost her home over unpaid homeowners’ association dues, it’s this: according to a local attorney who represents HOAs, a lot of people heard about the case and hurried to pay their back dues. [More]

Bank Of America Accused Of Neglecting Foreclosures In Non-White Neighborhoods

In 2012, a National Fair Housing Alliance survey of bank-owned properties in nine metro areas found that those buildings in predominantly white neighborhoods were more likely to be properly maintained by the bank while those homes in non-white parts of town were often being allowed to fall into disrepair, driving property values down for neighbors and causing public health and safety concerns. Since then, the NFHA has filed a federal discrimination complaint against the bank for what it alleges are violations of the Fair Housing Act. [More]

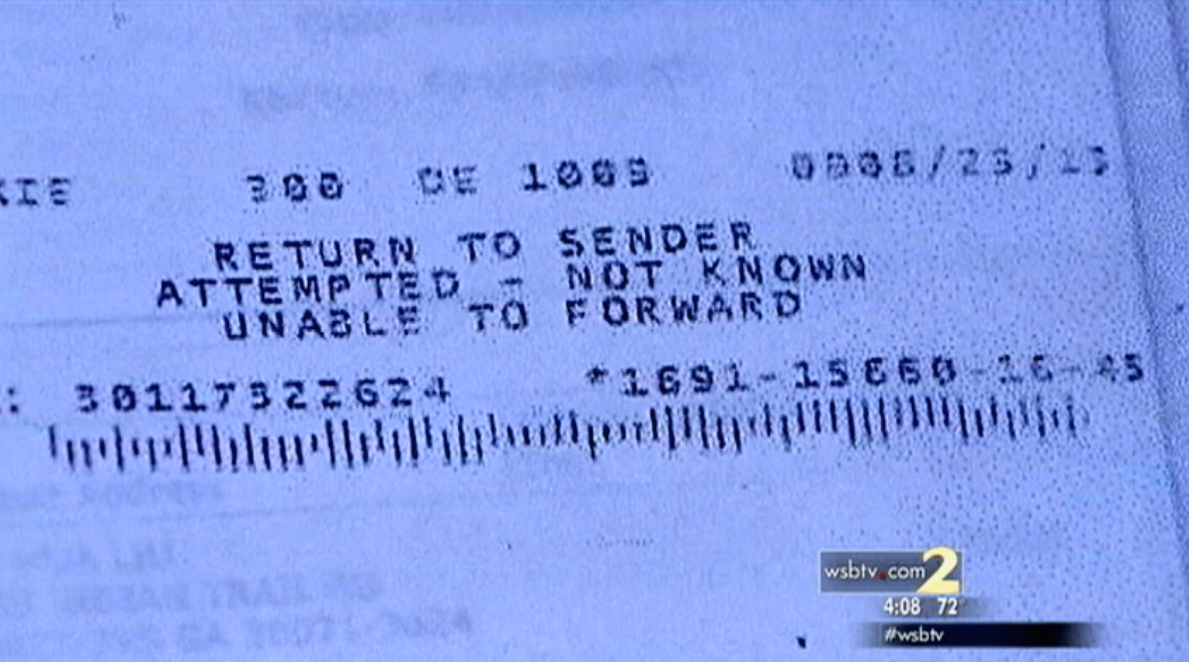

Illinois Sues Company For Breaking Into Homes To Evict Homeowners Facing Foreclosure

When a mortgage servicer forecloses on a home, it becomes responsible for the maintenance of the property (though banks don’t always live up to that obligation), and will often hire an outside firm to determine if a property is vacant and to handle the upkeep until the building is sold. However, a lawsuit filed by the Illinois Attorney General accuses the nation’s largest foreclosed-property maintenance company of illegally evicting homeowners and tenants in that state by, among other things, breaking in and changing the locks so that the residents can’t get back in. [More]

Bank Cleans Out, Forecloses On Wrong House

The crew got their orders from the bank: a house was getting repossessed, and it was their job to clean it out. They did. What they didn’t know was that they had the wrong house. The real target was a home on a street with the same name in a different town. Who screwed up? The repo crew? The bank? The person who named the streets? [More]

$1 Homes For Sale In Indiana, But Don’t Go Counting Quarters Just Yet

When you hear that Gary, IN, has a dozen homes for sale for $1 each, you might be inclined to dig into your wallet and ask, “Will you take a 10-spot for the whole lot of them?” But these home aren’t available to just anyone with four quarters to rub together, so nearly 94% of interested buyers have been turned away. [More]

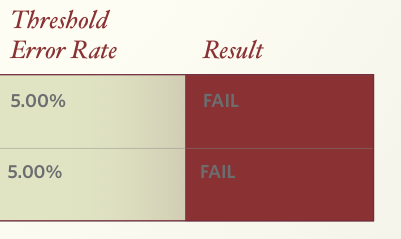

Big Banks Failing To Comply With All The Rules For National Mortgage Settlement

Remember that massive $25 billion settlement between the nation’s largest mortgage servicers — Bank of America, Wells Fargo, Chase, Citi, Ally — and attorneys general from around the nation? Well, it comes with a lot of rules for these institutions to follow. But the person in charge of monitoring the settlement says most of the banks are failing to comply fully. [More]

Former Staffers: Bank Of America Rewarded Us For Lying To Homeowners, Losing Paperwork, Denying Modifications

In sworn statements provided for a lawsuit by homeowners against Bank of America, a half-dozen people who reviewed loan modification applications for BofA say the company encouraged staffers to lose applicants paperwork so that it could later be denied, putting homeowners at further risk of losing their homes. And if these people are to be believed, some folks out there may have lost their homes so that a BofA employee could get a Target gift card. [More]

Fannie Mae Fires Head Of Office At Center Of Kickback Scandal

A few weeks back, we told you about the Fannie Mae office in Irvine, CA, where some employees have been accused of taking kickbacks from real estate brokers in exchange for priority access to the bailed-out mortgage-backer’s lists of repossessed properties. Now comes news that the head of that office has been given the boot “for performance issues.” [More]

Wells Fargo To Pay $38.5 Million In Response To Claims It Neglected Bank-Owned Homes In Minority Neighborhoods

Add another stack of zeros to the running total of mortgage-meltdown-related cash laid out by banks, as Wells Fargo has agreed to pay a total of $38.5 million to advocacy groups and regulators to resolve complaints that the bank neglected foreclosure properties in predominantly non-white areas. [More]

Fannie Mae Staffer Accused Of Taking Kickbacks Says He’s Not The Only One

Since 2009, bailed-out mortgage-backer Fannie Mae has sold nearly three quarters of a million repossessed properties. And considering that there are plenty of investors and speculators looking to snap up bottom-dollar homes with the hopes of eventually reselling at a profit, someone with inside information could be tempted to put a premium on that data, even if doing so is against the law. [More]