The magical disappearance of debt sounds like a wonderful thing, doesn’t it? Unless of course, someone else is getting their debt canceled while you’re still stuck in the mud. When homeowners in foreclosure in Charlotte, N.C. heard that the city wouldn’t have to pay back millions of debt it owed Bank of America and Wells Fargo for a underperforming NASCAR Hall of Fame, they couldn’t help but ask why they’re still facing the loss of their homes. [More]

foreclosure

N.C. Homeowners Wonder How Banks Could Disappear Charlotte’s NASCAR Debt While Taking Their Houses

HSBC To Customers: Merry Christmas, Pay Your Mortgage Or We’ll Take Your House

Holiday greetings generally contain salutations of thanks and wishes for a happy season. A note from HSBC hits all of those points, but then tacks on a quick threat you’d expect from Scrooge: pay us, or we’ll take your home. [More]

CFPB: Michigan Bank Must Pay $37.5M For Failure To Provide Consumers With Relief From Foreclosure

Consumers facing the prospect of losing their homes have few avenues of recourse and when even one of those options is taken away, the results can be devastating. That’s just one reason why the Consumer Financial Protection Bureau announced action – to the tune of a $37.5 million – against a Michigan bank for its illegal conduct in blocking borrowers’ attempts to save their homes. [More]

Detroit Selling Foreclosed Homes For $1,000 In City’s Latest Attempt To Rebuild

Neighborhoods in Detroit are in for some extreme, and much needed, renovations. In an effort to rehabilitate neighborhoods and get occupants into previously foreclosed properties, the city is auctioning off properties for as little as $1,000 starting next month. [More]

How Did Woman Who Died in 2008 Vote In 2010 Election?

We’ve been following the story out of Michigan of the woman who disappeared into her own house for more than five years, with no one noticing her absence because all of her bills were on auto-pay. As investigators try to figure out what happened to her, they’ve found another mystery: she appears to have voted in 2010, even though the evidence shows that she died in 2008. [More]

Couple Fought Wrongful Foreclosure In Court, Emerged Victorious

It’s nice to hear about a battle of consumer vs. bank that ends with a consumer victory. Better still when it means that the consumer gets to stay in their home, which they were in danger of losing to foreclosure. That’s the heartwarming story of one California couple who fought back in court. [More]

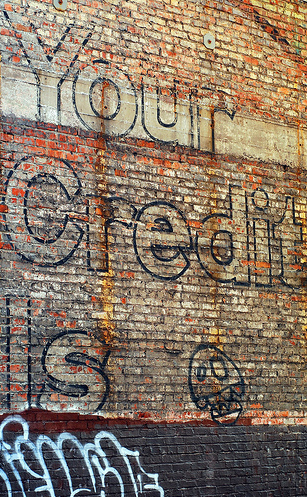

Poor Credit Reports Start Vicious Economic Cycle; Can It Be Stopped?

For some people, bad credit is a result of being irresponsible. For others, it’s a matter of bad luck and overwhelming circumstance. Alas, the credit reporting agencies don’t make such distinctions, meaning someone whose house went into foreclosure because he lost his job and also had to be hospitalized is treated the same as the person who stopped making mortgage payments because they didn’t feel like it. [More]

Bank Repossesses Wrong House, Won’t Give Homeowner Back All The Stuff It Took

Having your house repossessed is surely an awful, terrible, no good, very bad feeling. Especially when it isn’t even the house that’s supposed to be foreclosed on, and then all your stuff is missing and the bank wont give it back. That’s what one woman Ohio woman is claiming happened, saying First National Bank foreclosed on her home, even though it isn’t her bank. She says not only was her home broken into, but some of her belongings were taken, sold, given away or thrown out. [More]

Losing Your House To Foreclosure Doesn’t Necessarily Mean You No Longer Owe Money To The Bank

There’s a commonly held notion that losing one’s home to foreclosure is the final act in a sad drama, that the homeowner has hit bottom and has nowhere to go but up. But thousands of foreclosed-upon homeowners are finding out, years after turning their keys over to the bank, that they may still be on the hook — sometimes for hundreds of thousands of dollars. [More]

Man Stuffed $4 Million Lottery Ticket In Cookie Jar, Forgot About It For 3 Months

I have a secret fear that I will win a huge lottery prize, but never know it because I had stuffed the ticket in a coat pocket or a drawer. I deal with this fear by not buying lottery tickets. But this actually happened to a man who lives near Chicago. He says that he had stuffed old lottery tickets in a cookie jar, then took them to the store to see whether they had maybe won a couple of bucks for hitting a few numbers. They had: one ticket won $3. Yay, he could almost buy a gallon of gas! Then another ticket in the pile won more than $4 million. [More]

Homeowner Tries To Get Mortgage Adjustment, Ends Up Owing $14,500 More On Her House

When a retired Michigan homeowner applied for a mortgage adjustment back in 2009, little did she know that it would result in years of ongoing legal wranglings, a sizable increase in the amount of her mortgage and possible eviction. [More]

46 States Will Share $120 Million As Result Of Robo-Signing Settlement

Another day, another business hit over the head with a multi-million settlement over faulty foreclosure practices. We’ve already seen big retail banks and heavy-hitting investment banks pay the price for robo-signing foreclosures and engaging in other suspect loan servicing activities and now Florida-based business Lender Processing Services will be paying $120 million to 46 states to settle similar allegations. [More]

Man Buys All 650 Foreclosed Properties In One County For $4.8 Million In Back Taxes

Why settle for scooping up one tax-foreclosed property when you can nab say, 650 of them in one fell swoop? Of course, being a millionaire helped in the case of one Michigan man who plunked down $4.8 million to buy every foreclosed property in a recent county sale. All he had to do was pay off the total amount of back taxes owed, and voila! He’s got a bunch of property and is the only one in county history to have pulled off such a feat. [More]

California Goes Gangbusters Against Abusive Lending, Passes Sweeping Foreclosure-Protection Law

Hey, rest of the country that isn’t California! This is how you do it: California legislators went ahead and approved a sweeping bill on Monday that is basically a homeowner bill of rights, including ending abusive practices by mortgage lenders while at the same time helping homeowners evade the abyss of foreclosure. California ain’t kidding around. [More]

Condos Sold Without Owners’ Permission For 1/3 Their Value

Imagine that you’ve recently purchased a condo for $100,000. The complex where it’s located is about 90% rented, and 10% owner-occupied. The complex’s owner struggles, and the whole neighborhood goes up for sale in a foreclosure auction. The new owners dissolve the condo association, since they own all of the rentals, or 90% of the homes in the complex. This gives the owners permission to sell the entire complex at once, including what used to be condos. Your proceeds from having your home sold out from under you: $33,000. You still owe the rest of your mortgage, but have nowhere to live. Condo owners in Reading, Pennsylvania experienced this nightmare recently, and there is no legal way out for them. [More]

Church Buys Foreclosed Property, Ends Up With $170,000 Tax Bill

Members of a Dallas-area church congregation thought they had done their due diligence when they looked into buying some foreclosed property. They were told that all the back taxes had been cleared off the books; so why are they now facing a tax bill for $170,000? [More]

78-Year-Old Woman Forced To Leave House She & Her Husband Built In 1956

After the story of a 78-year-old grandmother being evicted from the home she and her husband built in 1956 hit the news, public outcry over the story has granted her a bit of a reprieve. The tricky part of all of this? Her daughter says her mental faculties are making it hard to figure out who exactly holds the mortgage. [More]