Lawmakers who regularly claim to love the Constitution and espouse their trust of the American consumer have done both a disservice, passing a resolution that makes sure that bank and credit card customers can be blocked from exercising their constitutional rights to a day in court. [More]

forced arbitration

Treasury Dept. Says You Shouldn’t Have The Right To Sue Your Bank Or Credit Card Company

Forget the Sixth Amendment, which guarantees the “right to a speedy and public trial” in criminal matters. And who needs that ancient Seventh Amendment and its fancy “right of trial by jury.” The U.S. Treasury Department has concluded that American consumers can not be trusted to thoughtfully exercise these Constitutional rights — at least not when doing so might be an annoyance to the financial services sector. [More]

Wells Fargo CEO: We Can Block Customers From Filing Lawsuits Because We Promise To Not Screw Up Again

Imagine a teenager who has been repeatedly caught sneaking out with their friends to get drunk and pilfer garden gnomes from the neighborhood. The teen’s parents ask “Why should we trust you anymore?” and the best answer the adolescent nincompoop can provide is, “Because I started cleaning my room and I’m gonna pass that Geometry quiz, I think.” Now, replace that teen with Wells Fargo, and you’ll basically have the scene from this morning’s Senate Banking Committee hearing. [More]

Supreme Court Allows For Rare Win In Customers’ Lawsuit Against Samsung

The Supreme Court has a long history of ruling against consumers when it involves a company’s attempt to strip its customers of their right to a day in court, but this week the nation’s highest court decided to not hear an appeal in a lawsuit involving Samsung, marking a rare instance in which SCOTUS came down on the consumers’ side in this issue. [More]

Wells Fargo CEO “Deeply Sorry” About That Time His Employees Opened Millions Of Fake Accounts In Customers’ Names

Tuesday morning, Wells Fargo CEO Tim “Apology Machine” Sloan will appear before the Senate Banking Committee to take some public tongue lashings for his bank’s fake account fiasco, which saw Wells employee opening up millions of bogus accounts in customers’ names in order to game the bank’s sales quota system. Sloan’s prepared remarks for this televised tomato-throwing include all manner of statements about how badly the bank behaved and how it’s darn-tootin’ not gonna let that happen again, but also don’t discuss one issue that will certainly be a hot-button topic among some senators in the room. [More]

Chamber Of Commerce Files Lawsuit To Stop American Consumers From Being Able To File Lawsuits

The U.S. Chamber of Commerce may sound like a government agency or a quaint organization of helpful business leaders, but it is, in fact, the single largest lobbying organization in the country, spending nearly $104 million last year alone on lobbying, about $40 million more than any other group. The Chamber also thinks the U.S. Constitution is mistaken, that the Sixth and Seventh Amendments don’t apply to consumers; that the mere fact you are a customer should strip you of your constitutional right to sue banks like Wells Fargo or credit bureaus like Equifax when they open millions of bogus accounts in customers’ names or fail to protect sensitive information for more than 100 million people.

And how does the Chamber of Commerce plan to stop the American people from being able to bring lawsuits? By doing the one thing it doesn’t want you to be able to do. [More]

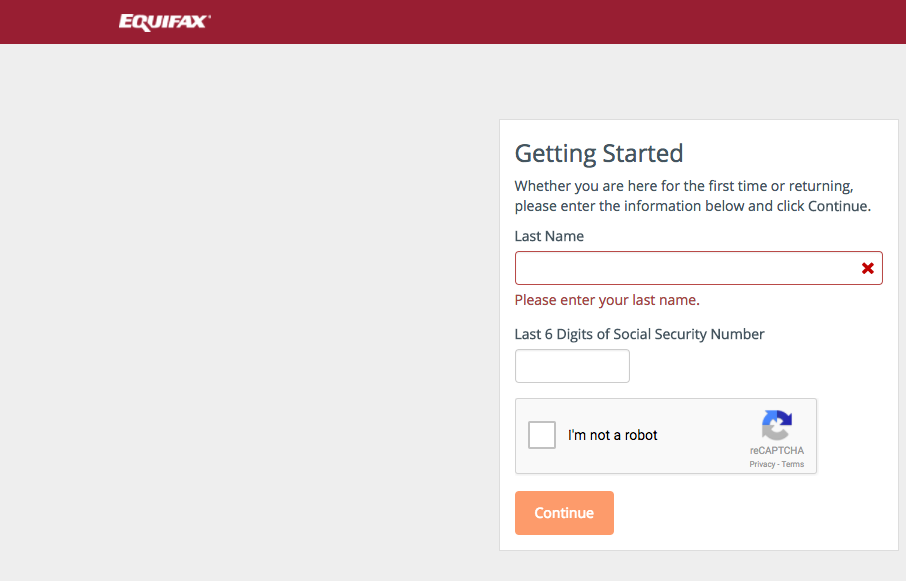

Equifax Drops Controversial Condition From Free Credit Monitoring Service

While the free credit monitoring service being offered by Equifax to the millions victims of its massive data breach leaves a lot to be desired, the company is remedying one of the more controversial aspects of the program — a condition that stripped consumers of their right to file a lawsuit in court. [More]

31 Senators Ask Trump Administration To Not Strip Nursing Home Residents, Families Of Their Legal Rights

Nursing homes and assisted living facilities in the U.S. have faced increasing criticism for shoddy care and bad business practices. At the same time, many of these facilities have begun using contractual language that explicitly prohibits residents or their loved ones from filing lawsuits when things go wrong. Now dozens of senators are calling on the Trump administration to rethink its decision to let this practice continue. [More]

House Votes To Strip Bank & Credit Card Customers Of Constitutional Right To A Day In Court

Because the Sixth and Seventh Amendments of the U.S. Constitution are apparently less important than making sure that banks, credit card companies, student loan companies, and other financial services be allowed to behave badly with impunity, the House of Representatives has voted to overturn a new federal regulation that would have helped American consumers hold these companies accountable through the legal system. [More]

Don’t Strip Consumers Of Their Right To A Day In Court, Say Advocates, Senators

Last week, bank-backed lawmakers revealed their plans to pass fast-track legislation that would undo the Consumer Financial Protection Bureau’s recently finalized rules that prevent banks and other financial institutions from stripping customers of their constitutional right to a day in court. Now, consumer advocates are urging the rejection of the legislation, expected to be voted on this week. [More]

Lawmakers Who Want To Hand ‘Get Out Of Jail Free’ Card To Banks Made Millions From Financial Sector Last Year

As expected, Republican lawmakers in both the House and Senate have introduced legislation that would overturn new rules intended to make sure that bank and credit card customers aren’t stripped of their right to file lawsuits in a court of law. Not surprisingly, many of the politicians pushing this pro-bank bill recently received significant financial support from the financial sector. [More]

GOP Moving Forward With Plan To Block New Legal Protections For Bank, Credit Card Customers

The Consumer Financial Protection Bureau recently finalized new rules that prevent banks and other financial institutions from stripping customers of their constitutional right to a day in court. As expected, bank-backed lawmakers in both the House and Senate are now planning to pass fast-track legislation that would undo these protections and make sure banks retain their “get out of jail free” card. [More]

CFPB’s Finalized Arbitration Rule Takes Away Banks’ ‘Get Out Of Jail Free Card’

Roughly 240 days from now, banks and other financial companies will no longer be allowed to prohibit customers from banding together in class-action lawsuits through the use of binding arbitration clauses, as the Consumer Financial Protection Bureau today released a long-awaited finalized rule on arbitration. [More]

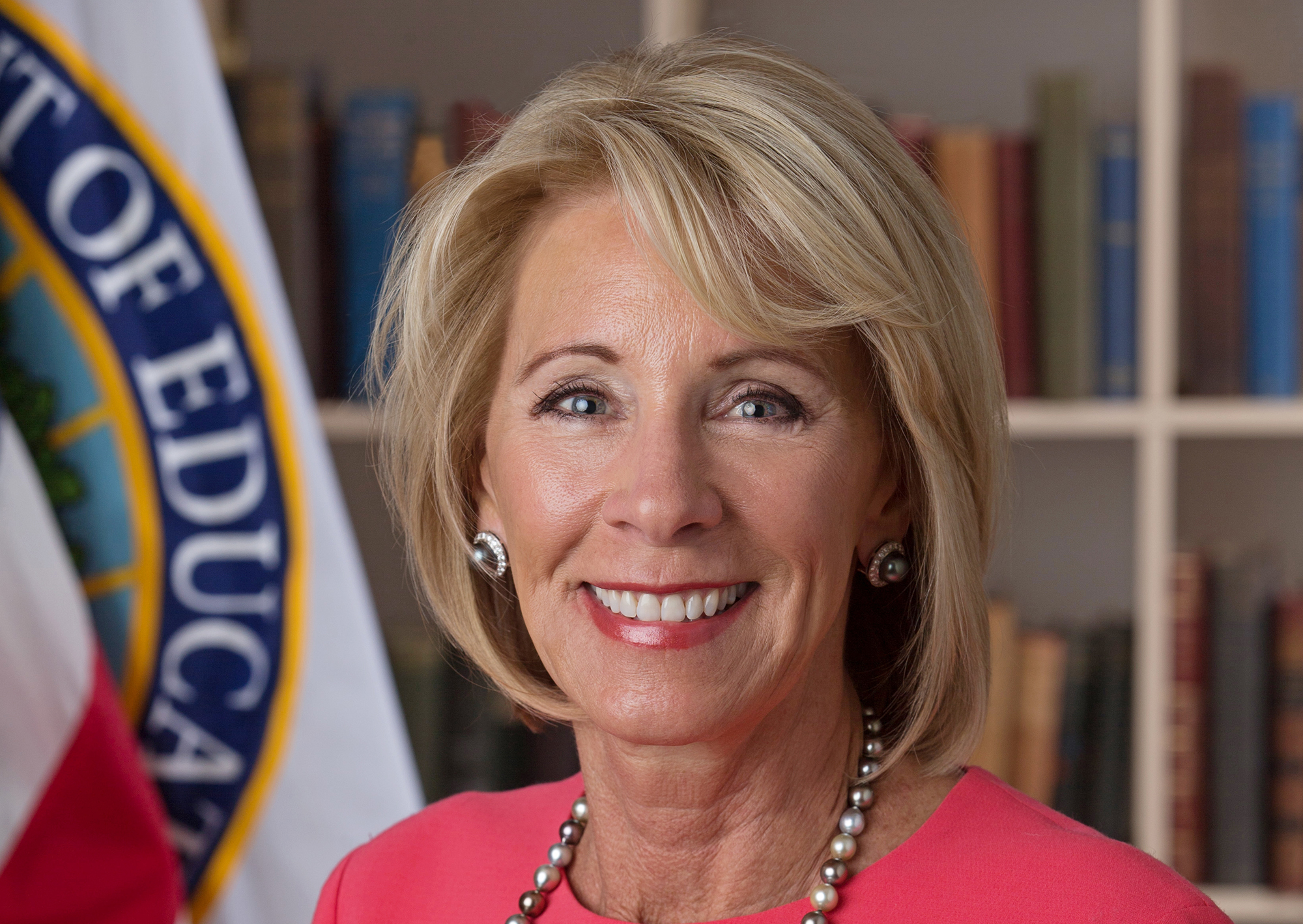

States Say Education Secretary Betsy DeVos Broke Law By Delaying Protections For Student Loan Borrowers

Following Education Secretary Betsy DeVos’ decision to “reset” new regulations put in place to protect students at for-profit colleges, two separate lawsuits now accuse the Secretary of breaking federal law by running roughshod over the regulatory process when she delayed the so-called Borrower Defense rule, which would have made it easier for defrauded students to get out from under their student loan burdens. [More]

Trump Administration Will Allow Nursing Homes To Strip Residents Of Legal Rights

The Trump administration has proposed revising a rule that hasn’t even gone into effect yet, with the goal of making sure that nursing home residents and their loved ones can not sue these long-term care facilities in the event that something horrible happens. [More]

Supreme Court Throws Out State Rule Protecting Nursing Home Residents From Having Rights Signed Away

A lot of people in nursing homes have adult children or other trusted people with authority to make financial, legal, and medical decisions on their behalf. However, can folks with power of attorney also sign away someone else’s right to have their day in court? According to the U.S. Supreme Court, yes. [More]

Judge Says Uber Can’t Use “Deficient” Sign-Up Process To Strip Users Of Their Right To Sue

Can Uber use some contractual language that users never actively acknowledge to force wronged customers out of the courtroom and break up class-action lawsuits? Currently, that depends on which federal judge you ask, with yet another court ruling that Uber may not be doing enough to tell users that they are giving up their right to a day in court. [More]

Wells Fargo Says It Will Pay $110 Million To Settle Fake Account Fiasco Class Action

Wells Fargo is currently facing — and trying to get out of — a dozen class action lawsuits involving a fake account fiasco that saw bank employees opening millions of bogus, unauthorized accounts in customers’ names. Now Wells says it has agreed to settle the oldest of those disputes, and that the settlement could close the books on the other complaints. [More]