Paul opted not to sign up for Chase’s overdraft fee trap–oh wait, they call it “protection”–but Chase happily ignored this fact and approved a transaction anyway, which led to a $34 overdraft fee that they refuse to reverse. The loophole they’re using to get around Paul’s opt-out is that the vendor was someone he’d authorized in the past, and therefore this new transaction isn’t protected from the bank’s “protection” fee. [More]

fine print

Hobby Lobby's Return Policy: We Don't Have To Take Back Anything

Michael says the first bullet point on the Return Policy plaque at his local Hobby Lobby (and also online) reads, “If for any reason you need to return merchandise purchased at Hobby Lobby, please return the product with the original sales receipt within 60 days of purchase.” That sounds great–you can shop with confidence that they’ll handle returns without too much trouble–but the reality is that the store can and will refuse any return, with or without a receipt, if someone there thinks it might lose them money in the short term. [More]

Developers Spiking Homeowner Contracts With Hidden Resale Fee Covenants

Last April, Techdirt pointed out that a financial firm in Texas was trying to attach “private transfer fees” to homes, so that developers would get a little bit of each sale as it passed among owners in the years to come. It sounded crazy then–imagine having to pay royalties on clothes or furniture whenever you resold them–but the firm is aggressively expanding its plan and has signed up more than 5,000 developers across the country, reports the New York Times. If you buy a new house in the next decade, look for a “resale fee” covenant hidden in a separate document that might not be included in your closing papers or even require a signature. [More]

Be Sure To Confirm Age Requirements Before Buying Airline Tickets For Kids

A man in California ended up fighting with Expedia over compensation after his kids, ages 12 and 16, were left stranded overnight in a Virginia airport, because the airline wouldn’t let them board the connecting flight without being accompanied by someone 18 or older. The man told Expedia the kids’ ages before buying the tickets but the company’s system didn’t send up any red flags, so he thought the trip would be fine. [More]

Acai Berry Company Temporarily Shut Down By FTC Over Billing Practices

Last summer, Central Coast Nutraceuticals settled a deceptive practices charge from Arizona’s Attorney General by promising to pay $1.4 million in fines. Now the company, which peddles acai berry and colon cleansing products, has been forced to temporarily stop selling or marketing its wonder products completely under an injunction obtained yesterday by the FTC. [More]

Sprint Totally Has The Hots For Me

Relationships get awkward when one party drops the “L” word too quickly. Such is the situation in which Jeremy found himself when he dug through his Sprint contract. [More]

Netflix: We Can Murder Your Account With No Notice At Our Whim

It’s amazing what we agree to every day when we scroll through infinite screens of dense legalese to click the box that said we’ve read and agree to abide by the terms of service on various sites. Brandon discovered that Neftlix users have all consented for the company to stop its endless supply of movie and TV shows for any reason whatsoever. [More]

Does "One Coupon Per Customer" Apply To Couples Making Individual Purchases?

Liz is wondering what’s going on at her local Hobby Lobby. She’s a professional doll maker and she buys a lot of supplies from the craft store chain every month. So far, she and her husband have been able to use the company’s in-store coupons for separate purchases even if they stand together in line at the register, but it looks like her Hobby Lobby may be cracking down on that. Should it? [More]

Groupon Shows How To Properly Explain TOS Changes

Groupon is a daily deal sort of website, but the reason it’s on Consumerist today is because of how well it communicated some recent changes to its Terms of Service agreement. Consumerist reader Pureboy sent in a copy of the email he recently received where the website explained the changes in plain English, with examples. [More]

Chase Charges $5 To Use Non-Chase ATMs Outside The U.S.?

Chase says this about using non-Chase ATMs: “$2 each for any non-Chase ATM withdrawal, balance inquiry or transfer. $3 per ATM withdrawal outside the U.S.” You might think that means it costs $2 in the U.S., and $3 outside. You’d be wrong. [More]

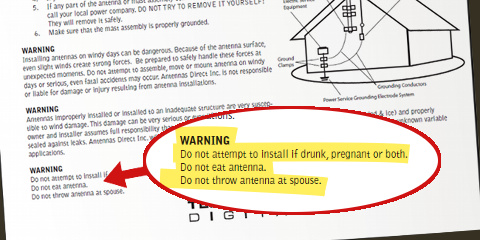

These Antenna Installation Instructions Are Surprisingly Specific

I am typing this post with a digital TV antenna stuck in my ear, and all because nobody told me that this wasn’t the right way to install it. Ow! Apparently Antennas Direct of Missouri knows that there are people like me out there, because they’ve included some very specific warnings on their installation instructions (PDF). (Thanks to Billy!) [More]

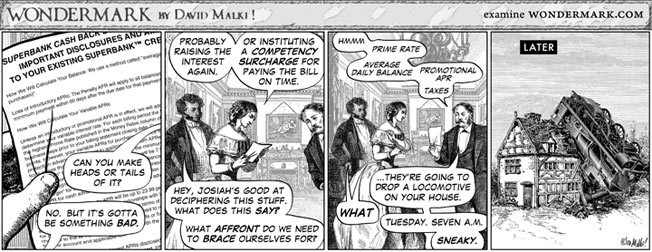

If I Read The Fine Print I Would Still Have A House

Credit card companies stuffed all the crazy they could into their contracts in advance of the CARD act taking effect. This time they might have taken it too far, even for banks. Shoulda read that boilerplate!

#599; The Boilerplate Clause [WonderMark] (Thanks to MercuryPDX!)

Access America's "Comprehensive Trip Protector" Insurance Isn't Comprehensive, So Enjoy Your Overnight Layover

Mark Smith just got suckered into buying travel insurance that turned out to be worthless to him. There was a huge hole in the middle of the coverage, which meant he and his two kids were stuck overnight in Denver on his own dime. Luckily the policy only cost $40, but that’s $40 that now belongs to Access America in exchange for providing a useless service. [More]

Citibank Freaks Out Customers With Weird 7-Day Rule On Withdrawals, But It's Not As Devious As It Looks

Some Citibank customers recently received notice that the bank reserved the right to require 7 days written notice before authorizing a withdrawal on checking accounts. (It’s also on page 23 of Citi’s Client Manual [PDF].) As you can imagine, this freaked some people out. A Citibank rep quickly moved to clarify the rule, and he pointed out that it’s actually required by federal law for certain types of accounts, and it’s not unique to Citibank, and they don’t intend to enforce it. [More]

FiOS: Lock In A $20 Per Month Price Increase With A Two Year Contract! Huh?

Our buddies over at the CR Money Blog noticed something odd about a new offer from Verizon. You can get FiOS for $89.00 for a year! Sounds good, until you realize that the prices goes up after 12 months– but the contract doesn’t end for another year. [More]

Without Proof Of Purchase, Your Warranty Options May Be Limited

Rob’s digital photo frame stopped working a few days ago, so he contacted Kodak to see whether they could help him. He writes that he knew it was at least one month out of warranty because the warranty is for one year, and he’d been given it as a gift a year ago on Christmas. Still, he was hoping Kodak would cut him a deal or do some sort of above-and-beyond thing.

Instead, he found out that as far as Kodak was concerned, it had been out of warranty for over two years

Watch Out For These Tricks After The CARD Act Kicks In Next Month

The credit card reform bill will go into effect at the end of February, but that doesn’t mean you should stop paying attention to what your credit card company does with your account. There are lots and lots of loopholes, notes WalletPop. For example, your card issuer can still raise rates on future purchases any time and for any reason. In addition, there’s no limit to the number of fees that can be invented and applied to your account. The only way to make sure you don’t get screwed by a profit-hungry card issuer is to read every single thing that’s mailed to you, and closely review your statement for evidence of any changes that you may have missed. [More]

This Citibank Balance Transfer Offer Sure Sounds Dangerous

RP was just offered a transfer on his Citi card by a Citibank CSR, but the CSR was kind of vague on the details of the offer and could only repeat the benefits. RP looked online while the CSR pitched the offer, and found that there’s quite a big catch in the fine print–after six months, the interest rate jumps from 3.99% to 29.99%. [More]