If you’re a fan of those pink and white frosted Circus Animal cookies from Mother’s, either stock up or start priming your nostalgia, because this week the company closed its doors abruptly. They’ve cited the expected reasons—the rising cost of raw materials, and an inability to borrow in the frozen credit market.

financing

Toyota: Bad Economy, Bad Car Sales, Cheap Financing

Toyota, long resistant to the sort of interest-free financing deals that their domestic counterparts survive on, is offering 0% interest financing on 11 of their vehicles, including Corolla and Camry, the Tundra full-size pickup truck, Matrix; RAV4, Highlander, FJ Cruiser, 4Runner and Sequoia SUVs; Sienna minivan; and Tacoma pickup truck.

How Hard Is It To Get A Car Loan These Days?

Having trouble getting a car loan? You’re not alone. “Gas at $4 a gallon changed the type of vehicles people buy. The credit crunch, however, has changed their ability to buy,” says a car dealer. Higher interest rates, higher down payments, fewer loans, and high aversion to dings on your credit report, this Kicking Tires post has more from the front lines about banks’ new level of pickiness when it comes to putting you in your next jalopy.

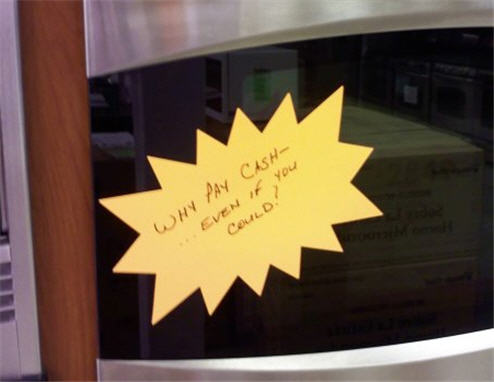

Home Depot Asks: "Why Pay Cash Even If You Could?"

Reader Dan thought we’d be interested in this sign he spotted in his local Home Depot. It reads: “Why pay cash even if you could?”

Not Good: Fannie Mae Loses $2.3 Billion

Fannie Mae is the nation’s largest mortgage finance company and it’s just not doing too well, says the AP. Increasing losses from foreclosures are wiping out Fannie’s revenue.

UPDATE: Consumer Takes Sleazy Prius Salesman To Court

23 months after we first posted her story, Angela Weigold writes in with the latest update about a Prius salesmen who left multiple harassing phone messages daily, calling Anela a “whore” and put her phone number on online escort websites.

Help! Sears Is Charging Me Interest On A "0% For 24 Months" Deal And They Won't Stop!

Reader Mike asks:

../../../..//2008/06/25/in-an-effort-to-spur/

In an effort to spur sales, General Motors is offering no-interest, six-year loans on new vehicle purchases through June 30th. Unfortunately, only the slow-selling models (i.e., not very fuel efficient) are included in the sale. Oh, also they’re raising prices on 2009 models. [New York Times]

Hospitals To Patients: "How About You Put That Liposuction On Your Credit Card?"

A Consumer Reports study finds that medical professionals are pushing high-interest lines of credit and financing options on patients. Credit agencies are even partnering with hospitals to offer branded credit cards so patients can finance elective cosmetic surgeries like liposuction and hair removal.

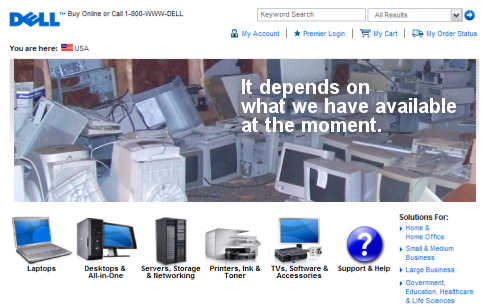

Dell Reduces Instant Discount By $200 Somewhere Between Shopping Cart And Order Confirmation

Before we get to the typical bad-company shenanigans—in this case, Dell’s $599 discount mysteriously shrank to $400 between when he placed it in his shopping cart and when he reached the confirmation screen—we want to share this bit of ridiculousness. Dell’s CSR Vanessa gives us the scoop on Dell’s sophisticated order fulfillment system:

Citibank Will Apply Your "No Interest Financing" Payments Anyway It Wants

Reader D has a Worst Company In America-themed success story. D writes:

The information on your website helped me get an error corrected with how Sears/Citibank credited my Sears credit card payments. Since you have Sears and Citibank going against each other today in your “worst company” tournament, I thought you might like to hear my story.

Auto Loan Crash? Lots Are Overflowing With Repossessions

So many vehicles are being snatched from owners who stop making payments that some repo operators and auto auctioneers say lots are overflowing.

The Downside To Alternate Payment Systems

If you use services like Bill Me Later, eBillme, or Pay Payl’s Pay Later—payment options designed to let you pay online without using a credit card—you should be aware of the risks as well as benefits that come with them, writes SmartMoney. The most important thing to consider: as far as FICO is concerned, you’re applying for a line of credit (with the potential for high interest rates) when you pay with one of these systems, and your credit score may drop accordingly.

Will Car Loans Be The Next Credit Meltdown?

Gone are the days of the three-year car loan. The length of the average automobile loan hit five years, four months in October, up more than six months from 2002, according to the Federal Reserve. And nearly 45% of loans written today are for longer than six years. Even some staid lenders owned by the carmakers, such as Toyota Financial Services and Ford Credit, are offering seven-year financing. And a few credit unions, particularly in the West, are tinkering with the eight-year note.

Avoid In-Store "Finance Traps" When Buying An HDTV

Several retailers are offering special deals on expensive HDTVs this season—things like no payments until x date or zero percent financing—but PC World cautions that they’re not always the bargains they appear to be. Their advice: “Cash is always best. If you need a special promotion to buy an HDTV, you can’t afford it.”

Is Wall Street Killing America?

Wall Street’s relentless drive for short-term profit is ruining corporate America and the consumer experience, according to John Bogle, founder of the Vanguard Group. The overseer of one of the world’s largest mutual funds appeared on Bill Moyers Journal to discuss a New York Times investigation that revealed substandard care at nursing homes owned by investment firms. According to Bogle, the trend is not contained, and has dire long-term consequences:

The financial sector of our economy is the largest profit-making sector in America. Our financial services companies make more money than our energy companies — no mean profitable business in this day and age. Plus, our healthcare companies. They make almost twice as much as our technology companies, twice as much as our manufacturing companies. We’ve become a financial economy which has overwhelmed the productive economy to the detriment of investors and the detriment ultimately of our society.