../../../..//2009/01/19/the-credit-card-regulations-that/

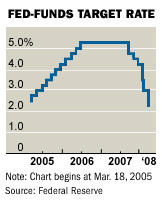

The credit card regulations that the Fed enacted last month won’t take effect until summer of 2010, so Congresswoman Carolyn Maloney is reintroducing the Credit Cardholders’ Bill of Rights, which offers the same reforms but would come into effect 90 days after the president signs it.