Here’s a change of pace: After seemingly countless stories of mysterious debits and charges on consumer’s accounts, here’s a story of a man who found that his checking account suddenly included $917 he knew didn’t belong to him. [More]

fifth third bank

Fifth Third Bank Has 100 Million Reasons To Want To Keep Offering Payday-Like Loans

When the four banks still offering customers payday loan-like services announced they would discontinue their often under-fire products, they likely knew their bottom-line would take a hit. One of those institutions, First Third Bank announced this week that changes to its program resulted in the loss of millions of dollars in revenue, providing an example of why it can be difficult to persuade lenders to ditch the profit-making, but financially devastating programs. [More]

Fifth Third Bank Backtracks On Its Pledge To End Payday Loans

In early 2014, the four major banks still offering customers payday loan-like services announced they would discontinue their often under-fire programs by the end of the year. Apparently Fifth Third Bank has changed its mind, announcing plans to continue with a revised, supposedly less harmful version of the service for existing customers. But consumer groups say the revamped service doesn’t actually address the problems that led banks to discontinue programs in the first place. [More]

‘You’re Not Bankrupt? Our Bad’: Fifth Third Bank Accidentally Reports Customers As Bankrupt

How does go about accidentally being listed as bankrupt? Doesn’t seem possible, what with all the paperwork and such, right? Unless, of course, your bank takes the initiative and does it for you. And that’s just what happened for several Fifth Third Bank customers recently. [More]

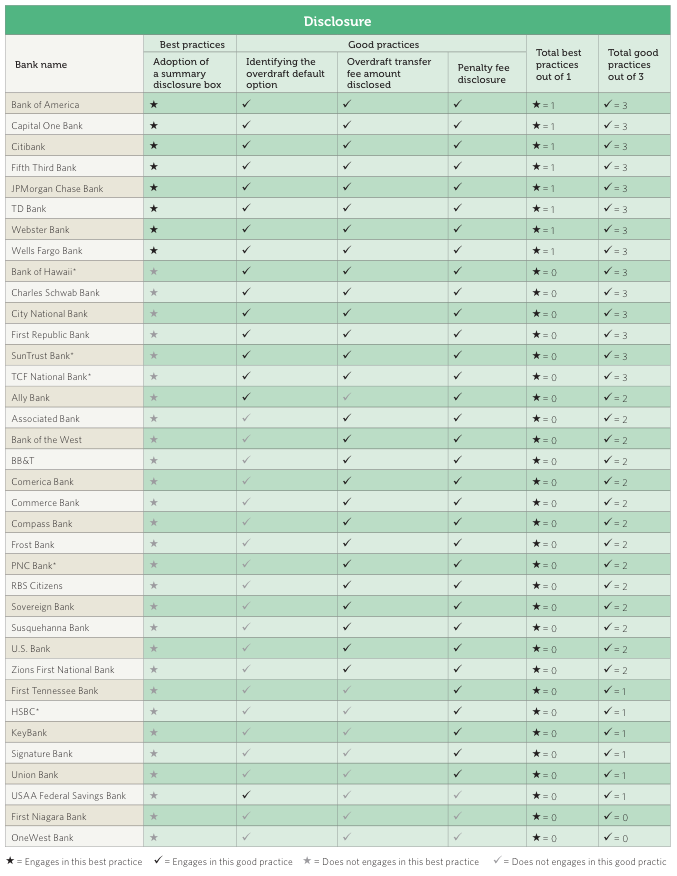

Consumer-Friendly Checking Account Practices Vary Wildly From Bank To Bank

Unless you’ve been hiding under a bed for the last six years, you probably know that the banking industry isn’t exactly beloved by many American consumers. As a reaction to public sentiment (and threats of regulation), a number of banks have begun phasing in some more consumer-friendly practices, but a new study shows these changes are not industry-wide and that several banks are still years behind. [More]

Senators Call For An End To Payday Lending By Banks

Four of the nation’s largest banks — Wells Fargo, Fifth Third Bank, U.S. Bank and Regions Bank — are involved in high-interest, short-term loans that may not always be called “payday” loans but might as well be. Thus, a group of five U.S. senators have asked regulators to put a stop to the practice altogether. [More]

Fifth Third Bank E-Mails Me Every Day. I'm Not A Customer

Ed gets a daily account alert e-mail from Fifth Third Bank. Keeping up-to-date on your accounts is important, but that seems a little excessive. …Oh. What’s that you say, Ed? You don’t even have an account with Fifth Third Bank? Your e-mail address is associated with someone else’s account and you don’t know how to fix it? [More]

Fifth Third Bank Says It Doesn't Actually Have Overdraft Notice Emails I Signed Up For

Consumerist reader Chris says he’s been a customer of Fifth Third bank for around two decades, as well as the rest of his family in the Midwest. Heck, his grandfather even worked there. But he says he’s now growing very disappointed with it, and a recent rash of overdraft fees isn’t helping that dissatisfaction. [More]

Don't Fall For The "Locked Debit Card" Text Alert Scam

With holiday shopping season heading into the home stretch, it’s prime time for ID thieves. Which is why some people might fall prey to scammers who text cell phone users with alerts that their debit cards have been locked. [More]

Fifth Third Is Jealous You're In A Committed Mortgage Relationship With Another Bank

It’s not all that interesting that Fifth Third Bank sent Jeff and his wife a letter encouraging them to refinance their mortgage: after all, they’re Fifth Third customers, but their mortgage is with another bank. What is interesting is that they just took out the mortgage a few months ago, and they went with another bank because Fifth Third turned them down. [More]

I Don't Want A Savings Account, Fifth Third: Please Stop Calling Me

Brad is a customer of Fifth Third Bank. He’s annoyed at the bank’s marketing practices. He tells Consumerist that when he transferred a large amount of money from his account with a credit union, Fifth Third decided that he clearly had too much money, and they wanted to help him open a savings account to remedy that situation. Well, that’s not what they said, but close enough. [More]