Eleven years ago, West Virginia accused an insurance broker called Acordia of improperly pocketing millions of dollars in commissions. Acordia is now doing business under the Wells Fargo banner, and the big bank has agreed to pay $8 million to settle this decade-old lawsuit. [More]

fees

Costco Expected To Raise Membership Fees By 10% Sometime In The Next Year

The cost of a yearly Costco membership could be going up in the near future: according to analysts at UBS, the retailer is probably going to raise prices by 10% by late this year or early 2017. [More]

San Francisco Requiring Uber, Lyft Drivers To Get Business Licenses

Though you might think of Uber and Lyft drivers as employees of those ridesharing services, the companies maintain that drivers are independent contractors who simply use the Uber or Lyft platforms to connect with passengers. That now means that several thousand of these independent operators in San Francisco must each obtain a business license.

[More]

Which Airlines Charge A Fee To Buy Tickets Over The Phone Or At The Airport?

We used to live in a time when some of the only options for buying airfare were over the phone or in person at an airport ticket counter. Technology changed, and many airlines have added fees for those ticket-buying methods. While Delta Air Lines is now turning back the clock and will drop such fees, many of the other major players still tack on extra charges for those ticket-buying options. [More]

Unregulated Preparers, Lack Of Disclosures & Costly Financial Products Put Your Tax Refund At Risk

Each year during tax time millions of consumers put their financial future in the hands of strangers, trusting that these tax preparers — who are largely unregulated — know the rules, will get them the best possible result (hopefully a refund), and won’t sell them on a product that costs more than it’s worth. But in the world of complicated tax codes and credits, consumers continue to face a long list of risks, including untrained preparers, undisclosed fees, and dangerous refund anticipation products. [More]

U.S. Airlines Providing Travel Waivers To Some Passengers After Brussels Attack

In light of today’s attacks in Belgium, several U.S.-based airlines are waiving their typical rebooking penalties and fees for travelers flying from, to, or through Brussels and several other European cities. [More]

Spirit Airlines Drops Some Baggage Fees For Active Duty Military Personnel

Spirit Airlines has long been known as the airline that charges a fee for nearly everything: checked bags, carry-on bags, seat selection, and water, just to name a few. In a change of pace, the budget carrier recently announced it would no longer charge active duty military members fees on some of their bags. [More]

Court Delays Some FCC Efforts To Lower Costs For Prisoners’ Phone Calls

Last fall, a new FCC order sought to reduce the often sky-high prices that prisoners must pay for making phone calls. Those changes were to start kicking in over the coming weeks and months, but today a federal appeals court delayed some reforms while allowing others to move forward. [More]

Customer Claims Uber Driver Staged Vomit Scene To Collect Bogus $200 Cleaning Charge

If you own a car that you use to drive strangers around in, it’s a nasty, expensive surprise when one of your passengers vomits up their dinner/night on the town in your car. But one Uber customer says she was hit with a $200 fine for a phantom puking session that never happened while she and her friends were in the car. Instead, she claims the driver faked the whole thing just to collect the dough. [More]

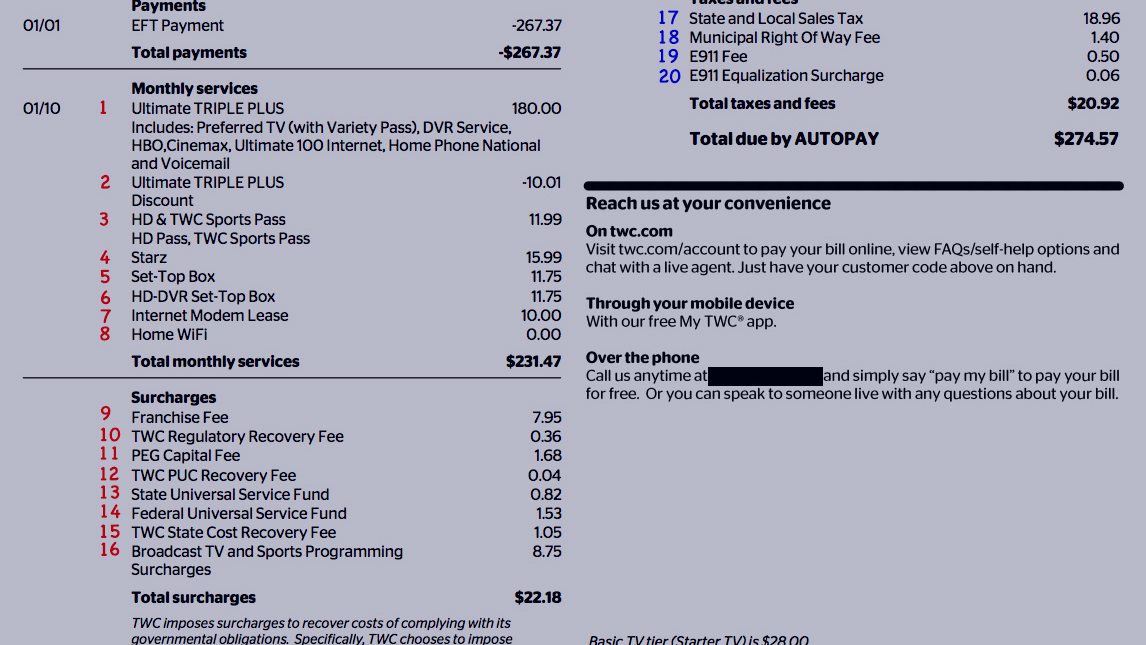

The Consumerist Guide To Understanding Your Time Warner Cable Bill

When you sign up for services — some combination of TV, broadband, and/or phone — from your cable company, you’re told you’ll pay something like $49 or $99 a month… and yet the price you actually pay can be 30-40% or more on top of that, thanks to a heap of sometimes confusing charges and fees. Which ones do you blame the government for, and which are made up by your cable company? One cable company at a time, we’re going to use real customers’ bills to break it down. We’ve already looked at Comcast. Up now: Time Warner Cable. [More]

Feds Order Debt Relief Schemes To Cease Misleading Use Of Government Logos

Even though it’s incredibly easy to slap a government agency’s logo on your website, that doesn’t make it okay. Just ask the two debt relief companies that have been ordered to stop using Department of Education logos to mislead student loan borrowers. [More]

Papa John’s Accused Of Taxing Delivery Fees In Illinois

Sometimes it’s just easier to have a piping hot pie delivered to your door, even if it means you have to pay a small fee for the convenience. But an Illinois man claims in a recently filed class-action seeking lawsuit that Papa John’s added a little extra to his bill in the form of an illegal delivery tax. [More]

The 3 Biggest Banks Extracted $6 Billion In ATM And Overdraft Fees From Us Last Year

Back in 1998, comedian Al Franken published a satirical novel where the fictional Al Franken ran a single-issue presidential campaign against ATM fees in 2000. A technical malfunction erased ATM deposits, making his single issue a crucial one, and Franken ended up in the White House. Today, he is a sitting U.S. senator, yet not involved in the 2016 presidential race where excessively high ATM fees are an actual issue being discussed. [More]

Two Payday Lenders Agree To Pay $4.4M In Fines, Release Borrowers From $68M In Loans, Fees

Federal regulators continued an ongoing crackdown on deceptive payday loan players by reaching a multimillion-dollar agreement with two lenders to settle accusations they illegally charged consumers with undisclosed and inflated fees. [More]

Hilton’s DoubleTree Hotel Now Offering Fee Packages For Extras Like WiFi, Drink Service

Just like airlines, hotels charge customers an array of fees for everything from WiFi access, minibar usage, premium coffee, and other little extras. Instead of surprising guests with these costs when they check in (or, even worse, when they go to pay their bill at checkout), one hotel company is experimenting with packages of add-ons that customers can select when they check in. [More]

United Airlines Expands Age Range For Children Flying Alone Who Are Required To Use $150 Service

If you’ve got a tween who’s preparing to fly alone on United Airlines, you might end up paying a fee you weren’t prepared for: United Airlines has quietly expanded the age range of children who have to use a $150 service when flying without an accompanying adult, raising it from an upper limit of age 12 to age 15. [More]

Taco Bell Refunds Customer After App Billing Disaster Causes $210 of Overdraft Fees

Diners may choose to use the mobile app from their favorite fast food joint for a number of reasons: to easily customize their meal, to ensure they don’t have to wait in long lines to order, or to get in and out of the joint in a flash. One thing these customers likely don’t count on is having the charges for a month’s worth of app orders cleared on the same day, resulting in an overdrawn bank account through no fault of their own. [More]