A group of former and current Corinthian College Inc. students refusing to pay their federal student loans in protest of the government’s support of the crumbling for-profit college chain now have the backing of several top political officeholders afternine attorneys general from across the U.S. sent a letter to the Department of Education asking it to forgive the students’ loan debts. [More]

federal student loans

Nine Attorneys General Join “Corinthian 15,” Urge DOE To Provide Student Loan Debt Relief For Wronged Borrowers

You Can’t Discharge Your Student Loans In Bankruptcy Because Of Panicked 1970s Legislation

Although bankruptcy should only be viewed as the last option for consumers drowning in a sea of debt, even this final-straw course of action won’t help Americans with getting out from under hefty student loans — but it wasn’t always this way. [More]

Legislation Would Require Private Student Loans Be Forgiven If Borrower Dies

Shortly after the death of their daughter, a New York couple’s grief was interrupted by a battle with an entity they never imagined: her private student loan lender. Inheriting a dead child’s student loan debt is a problem too many parents have had to face, and one that a new piece of legislation aims to eliminate. [More]

Student Aid Bill Of Rights Aims To Overhaul Federal Student Loan Repayment, Servicing Process

The way in which borrowers pay back their federal student loans – from checking the balance to filing complaints against servicers – is set to change with the signing of a presidential memorandum Tuesday. [More]

Senators Chastise Govt. For Making Money Off Struggling Student Loan Borrowers, Not Offering Enough Relief

For several years now the government has offered federal student loan forgiveness programs aimed at helping borrowers to avoid defaulting on their debts. While recent reports have shown that the popularity of the programs has exceeded expectations, a group of six senators say the Department of Education could do more given the billions of dollars in payments it receives from federal loans each year. [More]

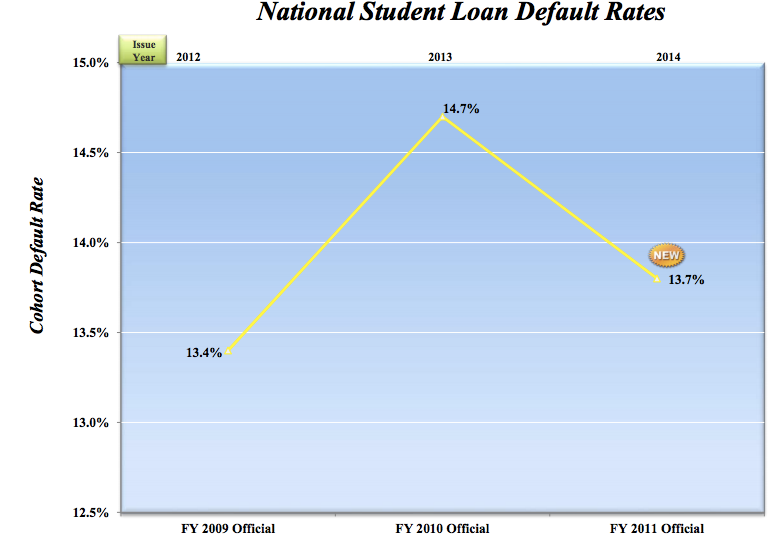

650,000 Student Loan Borrowers Who Began Repayment In 2011 Have Defaulted On Federal Loans

Maybe more consumer are realizing the long-lasting negative effects that can come from not repaying their student loans. Or maybe not. we don’t really know why, but we do know that the number of borrowers defaulting on some federal student loans is decreasing. [More]

Community Colleges That Don’t Offer Federal Loan Access Put Nearly 1 Million Students At Risk

Compared to private loans, federal student loans may be a preferred, and sometimes safer option, when it comes to financing one’s higher-eduction. But for a large section of American students those loans are out of reach because their schools simply don’t offer the option. [More]

Some Banks Reward Private Student Loan Borrowers With Refinancing Options

Recent college graduates face a number of barriers after getting their diplomas – finding a job, moving out on their own and paying back thousands of dollars in student loans. But now consumers struggling to pay back private student loans might find a bit of relief in new refinancing options from banks. [More]

Letter About 7-Cent Student Loan Bill Seems Like Efficient Use Of Government Resources

It was really thoughtful of the U.S. Department of Education’s Direct Loans program to let Puck know that his student loan payments, which he starts making in August, are too low to cover interest payments, and that some of that interest was about to be capitalized and become part of the loan’s total. It wasn’t all that thoughtful toward the environment or the program’s bottom line, though, because they printed and mailed a letter inviting him to use a forty-four cent stamp to pay off seven cents in accrued interest. [More]

Save On Federal Student Loans July 1

If you have a bunch of variable rate Federal student loans, July 1st could be your lucky day. July 1st is when the interest rates on Federal student loans changes, and one financial id expert is predicting they’re going to drop to “historic lows.” What this means is you will have an opportunity to consolidate your variable rate Federal student loans together at the new, lower, rate, and save yourself some cash. How much?

A Big-Ass List Of Student Loan Resources

It’s a tough economic climate to be graduating from school — and maybe an even tougher one for those of you trying to get financial aid. We’ve put together a list of some financial aid and student lending resources to help make things easier.