The Fair Debt Collection Practices Act prohibits debt collectors from a number of annoying and aggressive practices, like calling late at night to hassle folks about their debt or publicly outing people as debtors. However, this morning — in Justice Neil Gorsuch’s first opinion — the U.S. Supreme Court ruled that this law doesn’t apply to banks that purchase defaulted loans with the intention of collecting on them. [More]

FDCPA

Supreme Court: Protections Against Debt Collectors Don’t Apply To Banks That Purchase Defaulted Loans

Feds Go After “Massive, Illegal” Debt-Collection Operation

A large, nationwide debt-collection operation that allegedly brought in tens of millions of dollars through illegal means — like impersonating law-enforcement officers, or threatening arrest for non-payment — is the target of a joint legal action by the Consumer Financial Protection Bureau and the New York state attorney general. [More]

Debt Collector Gets Out Of Lawsuit… By Buying The Lawsuit Out From Under The Plaintiff

When you sue a debt collector for allegedly violating federal law, that collector can’t just go behind your back, buy the debt on the cheap at auction and get the whole case dismissed, can it? That tactic worked for one collection agency and, depending on how a federal appeals court rules, it could lead to many other debt collectors buying their way out of legal trouble. [More]

New Rules Would Require Debt Collectors Have Proof You Actually Owe Money

One of the most common complaints about debt collectors is that they harass people over debts that are either no longer owed, or weren’t owed in the first place. Federal regulators are now proposing rules that — among other protections — would cut down on these annoying, bogus collections actions by requiring that debt collectors have some sort of evidence that the person they are calling actually owes money. [More]

Supreme Court OKs Private Debt Collectors’ Use Of Prosecutors’ Letterhead To Make People Pay

What’s more likely to get you to pay a questionable debt: A notice from some debt collection company you’ve never heard of, or a letter from your state’s attorney general about that same debt? Some states allow certain private, for-profit debt collectors to use prosecutors’ letterhead in correspondence with consumers about debts, even though the American Bar Association looks down on the practice. This morning, the U.S. Supreme Court chimed in on the debate, unanimously giving its SCOTUS seal of approval, at least when it’s done with the state’s approval. [More]

Even Scofflaws With $270K In Debt Have The Right To Not Be Cyberstalked By Collectors

We recently told you about the woman who admitted she indeed owed Kohl’s $20, but sued the retailer for being over-eager about collecting on the debt. But does a debt collector have more leeway to be a pest when the debt is 13,500 times that amount? [More]

5 Sample Letters That Get Debt Collectors Out Of Your Face

Calls from debt collectors can make your life miserable when you’re already pretty miserable from being in so much debt. It’s even worse when you already paid the debt, or it wasn’t yours to begin with–what should you do next? That’s why sample letters can be a good starting point, or you can just send them as is. [More]

Debt Collector Can't Harass Through Facebook Friends, Court Rules

In a precedent-setting case, a court has ruled that a debt collector can’t continue to contact a debtor’s friends and family on Facebook about her car payments, reports the Orlando Sentinel. The debt collector had already emailed, texted her, and called her at home and work, according tot he lawsuit, 23 times in one day. [More]

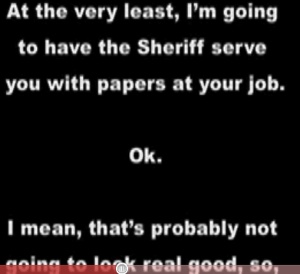

Zombie Debt Collector Threatens To Send Sheriff To Man's Work

“I’ll go through any lengths I have to in order to embarrass you,” says one of the many debt collector chicks who keep calling this guy up at work, trying to get him to pay for a credit card debt from 1998 that he doesn’t remember and for which they refuse to provide verification. [More]

Supreme Court Makes It Easier To Sue Debt Collectors

Last week, the Supreme Court ruled that debt collectors can’t use a “bona fide error” defense to avoid being sued for misinterpreting the Fair Debt Collections Practices Act (FDCPA). In other words, if a debt collection agency makes a demand that’s in violation of the Act, it can’t say it didn’t know any better. Well, it can, but you can go right ahead and sue. [More]

Make Debt Collectors Give You Money By Suing Them

This may not work for everyone, but it worked for Jeff. He tells Consumerist that after he filed Chapter 13 bankruptcy, Sallie Mae representatives continued to call him, which is sort of illegal. So his bankruptcy attorney sued them. And won a $4,000 settlement. [More]

Debt Collectors Will Stop Calling If You Sue Them

“Litigant Alert” from WebRecon promises to help debt collection companies ferret out “overly-litigious debtors” with “a history of suing collection agencies.” It’s basically a Do Not Call list of troublemakers who had the nerve to fight aggressive collection practices with the law. Debt collectors are apparently willing to pay $1,595 to figure out who they should leave alone.

Debunking The Debt Collectors' Spin Doctors

The nation’s economic woes make debt collection a topic du jour, but while there are some good bits mixed into the Washington Post’s article, “When Debt Collectors Disrupt Dinner,” it probably should have been titled “What Debt Collectors Would Like You To Say And Do When They Call About The Credit Card.” Read it with a shaker of salt. Read on for the good, the bad, and the lazy reporting, plus what you should actually to protect and exercise your rights as a debtor…

Debt Collectors Incessantly Harass Dead Son's Parents

Debt collectors are illegally harassing Vincent’s parents for debt their son owes. Vincent died last year at 27 from a sudden heart attack during a softball game. “I’m afraid to pick up the phone in my own home,” said Roco Crimeni, father. “That’s the hard part, to tell them my son is dead. How many times do I have to repeat it?”

Is Volkswagen Violating The Fair Debt Collection Practices Act?

Tim’s neighbor received a call from VW Credit asking her to walk across the street and leave a note on her neighbors’ front door and VW Bug asking them to call back their creditor. Calls like these are known as block parties, and they are a direct violation of the Fair Debt Collection Practices Act.

How To Protect Yourself Against Aggressive Debt Collectors

Millions of Americans are in debt, so it stands to reason that there are over 6,500 collection agencies in the U.S.. Most of these agencies operate under the law but a growing number of them do not. According to statistics from the Better Business Bureau, complaints filed against debt collectors rose 27% in 2007. Even if you legitimately owe the debt, you should know there are laws that protect you against harassment and the unfair practices often employed by these rogue debt collectors. CNN Money discusses the Fair Debt Collection Practices Act and laws which protect the consumer. Details, inside… [More]

Consumers Reported 69,204 Fair Debt Collection Practices Act Violations. FTC Responds With One (1) Lawsuit

Consumers have filed over 69,000 complaints against scummy debt collectors for violating the Fair Debt Collection Practices Act, prompting the FTC to rush to our collective defense by taking action against three debt collectors who showed a “culture of harassing the debtors from which they collect.” Two debt collectors settled and one went to court. Still, when you receive over 69,000 complaints—and these are from the people who know to complain to the FTC—it’s reasonable to assume that more than three collectors encourage a culture of harassment. More harrowing revelations from the FTC’s annual report to Congress, after the jump.