So the latest solution to the problem of these toxic assets on the banks’ books is a “public-private partnership” between the government and the private sector…yawn what is he going on about, I wish I had a pancake…oh wait! Here’s Paddy Hirsch from marketplace drawing stick figures on a whiteboard and explaining it all. Now we’re talking.

explainers

Why AIG Gave Your Money To Other Banks

There’s been a big stink about how AIG has given a bunch of taxpayer money to other banks. Why why why, demand the American people. Well, it’s not like they enjoy shoveling money out the door, wait, scratch that, but anyway, the real reason is because of something called “collateral calls.” Marketplace’s Paddy Hirsch explains the situation with the help of his friends Mr. Magic Marker and Mrs. White Board in this video.

What Do Deal Site Acronyms Like "YMMV" And "AC" Mean?

If you’re new to hunting for deals online, you’ll start seeing all these funky acronyms used as shorthand. Here’s some of the most common ones and what they mean:

Hot Cartoon Makes Understanding Credit Crisis Simple And Fun

This a freakin’ awesome cartoon that explains how the credit crisis began, played out, and exploded in our face. I know you’ve seen and heard a million of these by now, but this one is highly visually engaging and entertaining, enough so I could see it being used in the classroom and kids not getting (too) bored. Graphic designer Jonathan Jarvis. Especially good is how it explains leverage.

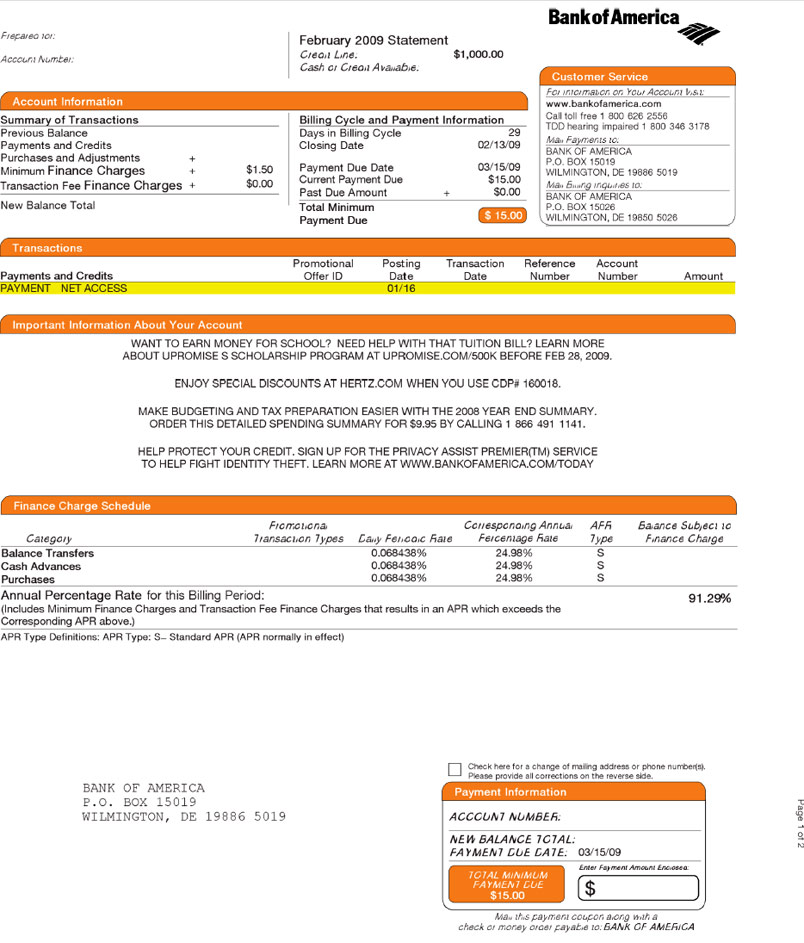

Your APR Is Now 91.29% – Yours Truly, Bank Of America

David’s effective APR on his Bank of America credit card is now 91.29%. It’s not a typo or a scam, it’s math.

What Is Mark To Market?

One buzzphrase going around about the financial crisis is “mark to market.” Some think banks are being overly punished by being forced to “mark to market” the investments they own, or price them according to current market value. As you can probably figure out, those assets have plummeted. Marketplace’s Paddy Hirsch explains with his trusty whiteboard and stick figures what “mark to market” means, and what it means for the economy.

Bankruptcy Is A Last Resort

Bankruptcy is not a get out of jail free card for your debts, it’s a nuclear weapon. If you use it, expect to be considered credit unworthy for a decade.

Video: Oil Speculators To Blame For Record Gas Prices After All

If you thought oil speculators as the reason behind the historic gas prices spikes of this summer was debunked, think again. From ’07 to when the price of oil collapsed, supply increased and demand dropped. According to basic economic theory, this should’ve meant the price went down. But all of a sudden an influx of capital, an infusion that brought the total at play from $13 billion to $300 billion, brought to market by large investment bankers, exploiting de-regulation and trading in black box private exchanges made possible by Enron, drove the price of oil from $69 to almost $150. A new 60 Minutes report explores the issue. Video inside.

Your Credit Card Costs Consumers ~$50,000,000,000 Per Year

Not all money is created equal. It costs retailers extra in fees when you use a credit card, a costs that gets passed right back to you in the form of higher prices, and how much that is depends on which credit card you use. To see how much more expensive your credit card is making life, enter the first 6 digits of your credit card over at truecostofcredit.com, a mashup developed by reader Sean Harper and his friend. This is the bank identification number and cannot be used to steal your credit card, so don’t worry. If you rather not do that, you can also see the results for an AMEX, a debit card, Mastercard rewards card, or a Visa rewards card. Of the project, Sean writes:

HELOC Cuts, The Hows And Whys

Did your Home Equity Line of Credit (HELOC) suddenly trail off in the forest recently? Here’s some straight-talk on why, and what, if anything, you can do about it. [Examiner.com] (Photo: Getty)

What The Hell Is Leveraging?

Leverage leverage leverage. Everyone’s talking about it, but what does it mean?

Video: How Credit Cards Become Bonds

We’ve heard lots about how mortgages get turned into tradeable securities, but they’re not the only thing. No no no, there was far too much Chinese money not able to earn anything on T-bonds for us to let them lie. Credit cards can become asset-backed bonds too. Marketplace’s Paddy Hirsch is back with his whiteboard and dry-erase markers to explain how it works. Video inside.

Why Was Gas So Expensive?

Did you know that gas price gouging almost never occurs as prices rise? Rather, it’s most often when dealers keep prices artificially high even as their costs fall. As gas costs were near $5 a gallon until falling and oil companies earn around $100 billion each year, it’s a good time to question what really goes into the price of gas. The numbers on the gas station sign hide a complex set of transactions. Before gas can power your car, it must be discovered as crude oil, traverse three markets, and be refined from crude into gas. Inside, we’ll explain the three markets, walk you through the role of refineries, and show how oil companies use creative tactics to manipulate gas prices…

What Are "Collateralized Debt Obligations?" Watch These Champagne Glasses.

There’s a lot of funky financial terms getting thrown as we try to explain how the money meltdown started in the first place, and one of the funkiest is a CDO or “collateralized debt obligation.” Luckily, Paddy Hirsch from Marketplace is here to explain it using just champagne glasses, a whiteboard, and a sexy British accent..

Blame The Subprime Meltdown On The Repeal Of Glass-Steagall

A lot of blame has sloshed around for the sub-prime meltdown, from greedy borrowers to greedy mortgage brokers to Alan Greenspan, but if you want the real culprit, it was the repeal of the Glass-Stegall Act. On November 12, 1999, the champagne must have been shooting from the walls at Citigroup, which had worked behind the scenes for over 30 years to get the act overturned. After recovering from their hangover, they and their banking buddies went on a sub-prime lending orgy. But what was Glass-Steagall and how did it use to protect us?

Stimulus Checks Will Not Cut Into Your Rebate

False reports have circulated that the stimulus checks are an advance on your tax rebate and were going to cut into your tax rebate. That’s not the whole story. Yes, it’s an advance, but it’s an advance on an additional credit Congress passed for your 2008 earned income. It’s too late to do that for 2007, seeing as it’s already over. “So the government is making me borrow from myself?!?!?” No. Congress is giving your 2009 self a $600 credit, and is sending that $600 back in time by one year.

What Is Minimum Advertised Price?

Minimum Advertised Price is an agreement between suppliers and retailers stipulating the lowest price an item is allowed to be advertised at. If you’ve ever tried to shop around and keep nosing up against the same number, you may have just discovered that good’s MAP. This is why sometimes you see signs that say “price too low to advertise!” Or why when shopping online, sometimes the price doesn’t show up until further in the transaction process. Retailers can incur sizable fines and/or penalties from their suppliers for violating MAP contracts.