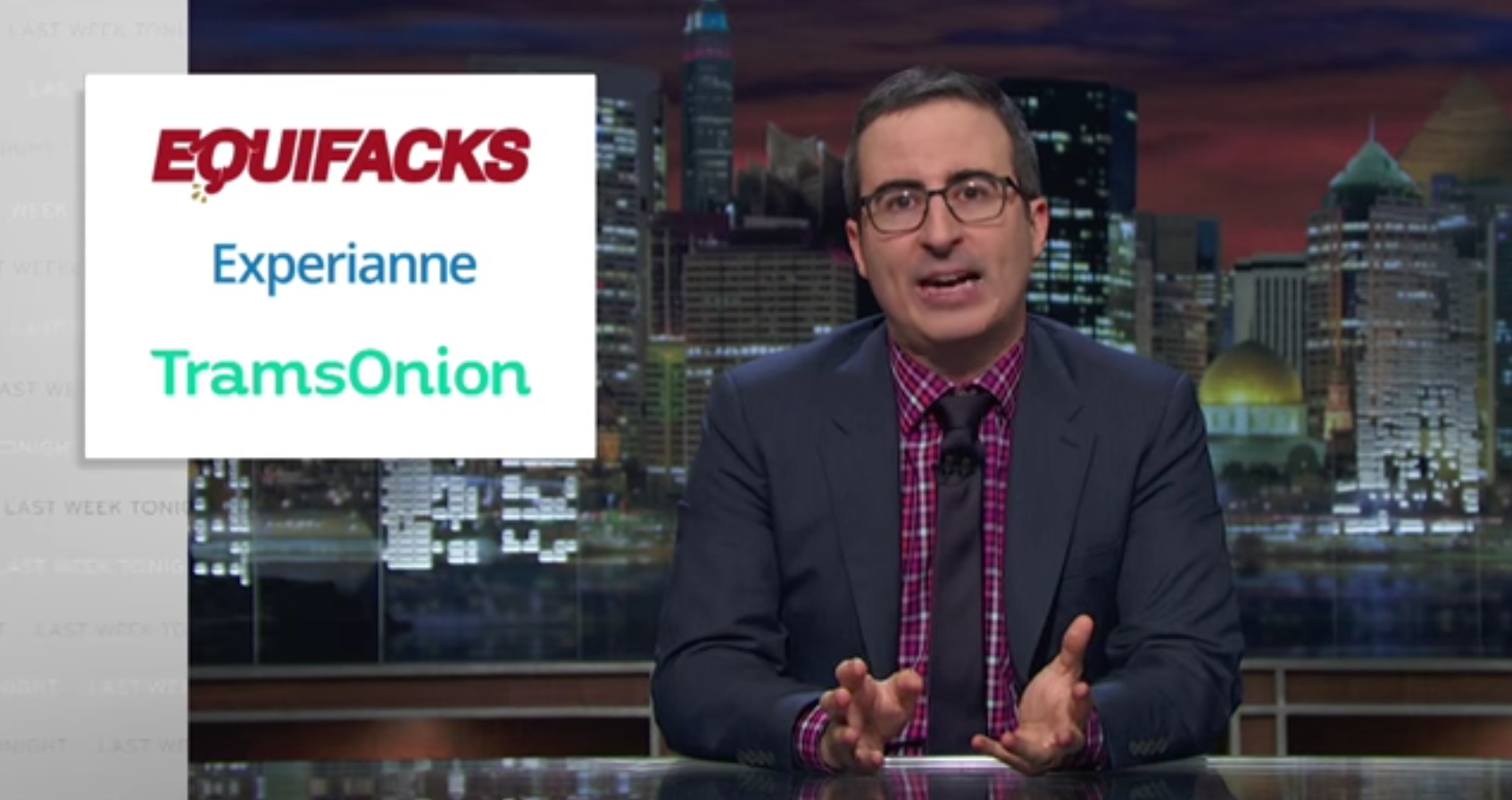

UPDATE: Experian tells Consumerist that its authentication processes go farther than previously identified steps. The company regularly reviews its security practices and adjusts as needed.

Placing a credit freeze on your accounts following a hack or issue with identity theft is only effective if the credit reporting agency you’re working with doesn’t give ne’er-do-wells the ability to unfreeze the accounts by providing the same information that any good ID thief already knows about you. This is a lesson some victims of Equifax’s recent data breach are learning after freezing their accounts with fellow credit reporting agency Experian. [More]