It’s been a week since credit reporting agency Equifax admitted it had lost sensitive personal data for 143 million American consumers — one of the worst data breaches yet. Now, the company says it knows how the intruders got in… and it’s through a bug that was first identified six months ago. [More]

equifax

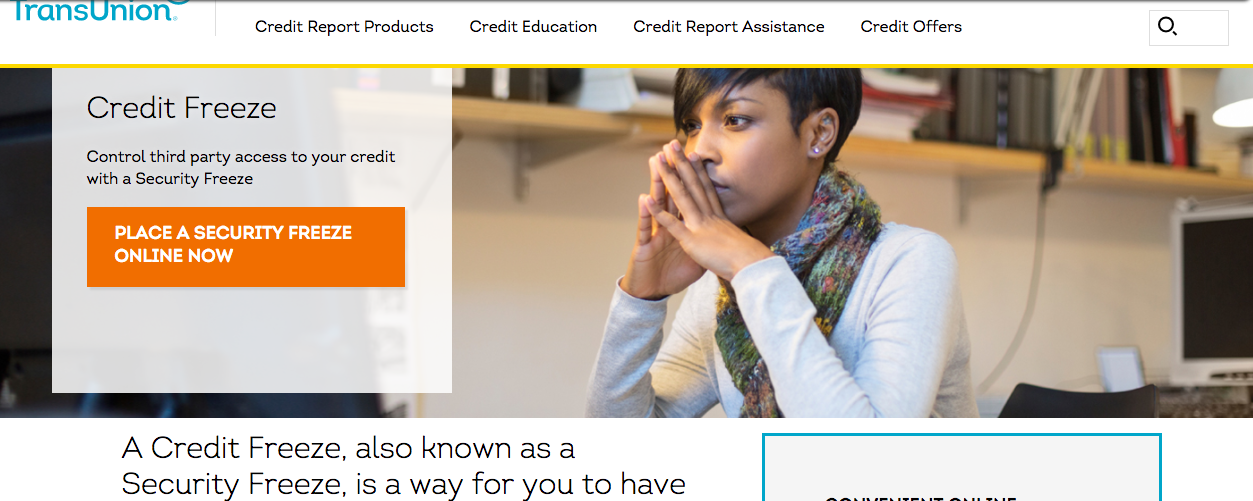

Did TransUnion Increase Cost Of Credit Monitoring In Wake Of Equifax Breach?

With more than 143 million consumers’ personal information now circulating on the dark web thanks to the massive Equifax data breach, there’s no doubt many of these victims are turning to the other two major credit bureaus — TransUnion and Experian — for credit freezes and monitoring services. But is one of these agencies cashing in on the Equifax hack by raising the price for its services? [More]

It’s Not Just The U.S. — Equifax Security Issues Causing Headaches Around The World

We already know that more than 143 million Americans’ personal identify information was compromised as part of Equinox’s two-month-long data breach. If you thought that was bad enough, it gets worse: The credit reporting agency’s lax data security may have affected tens of millions more consumers across the world. [More]

4 Things To Remember To Avoid Getting Scammed In Wake Of Equifax Breach

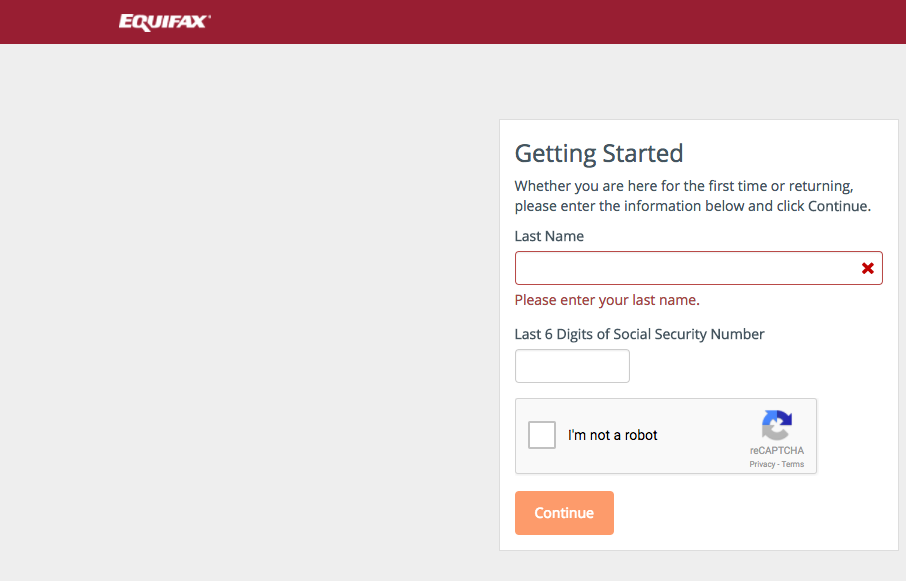

As everyone now knows, 143 million Americans had their personal data compromised during a two-month-long data breach at credit reporting agency Equifax earlier this year. Authorities are now reminding consumers to watch out for bad actors looking to profit from everyone’s worries about their newfound vulnerability. [More]

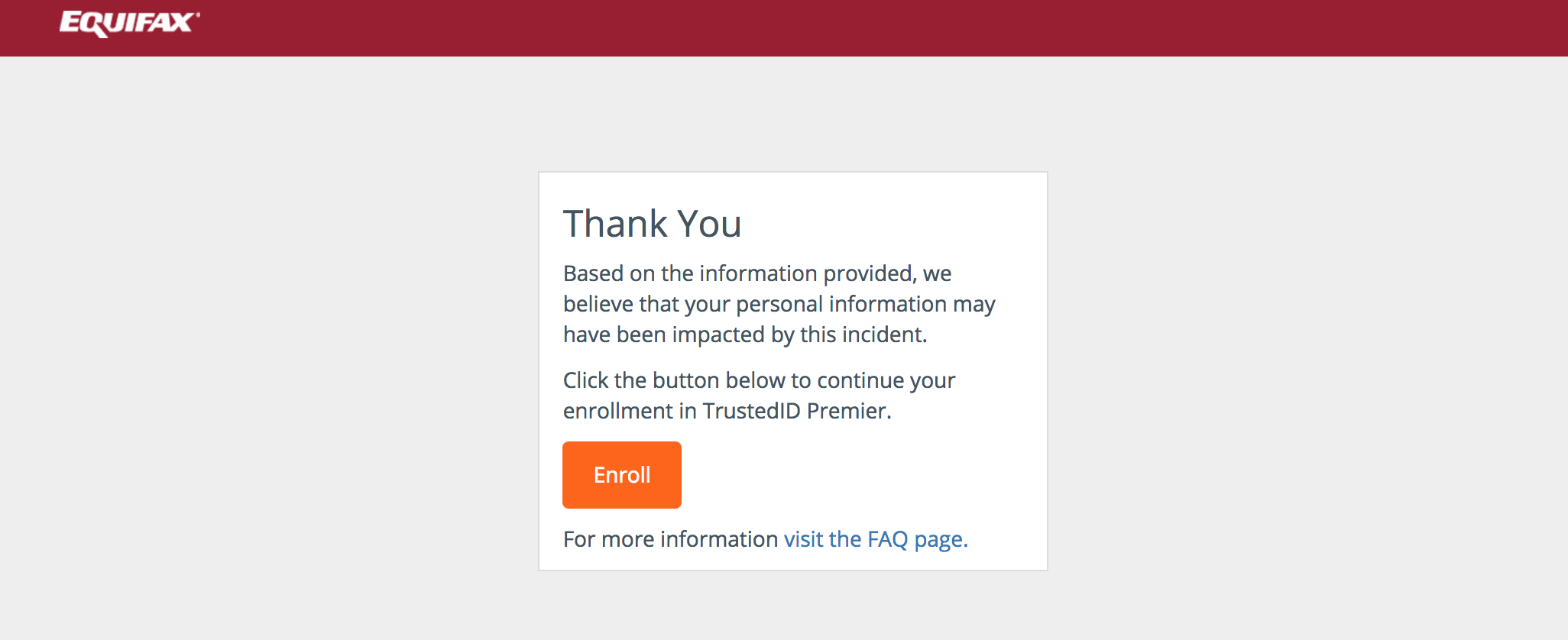

Equifax Drops Controversial Condition From Free Credit Monitoring Service

While the free credit monitoring service being offered by Equifax to the millions victims of its massive data breach leaves a lot to be desired, the company is remedying one of the more controversial aspects of the program — a condition that stripped consumers of their right to file a lawsuit in court. [More]

Don’t Take Equifax Up On Its Credit Monitoring Offer

As anyone able to tear themselves away from hurricane bulletins last week knows, credit reporting bureau Equifax shared the news that the personal information of 143 million Americans was compromised earlier this year. Yet while plenty of companies, including Equifax itself, are happy to give or sell you credit monitoring services after such a massive breach, that doesn’t mean you should take them up on it. [More]

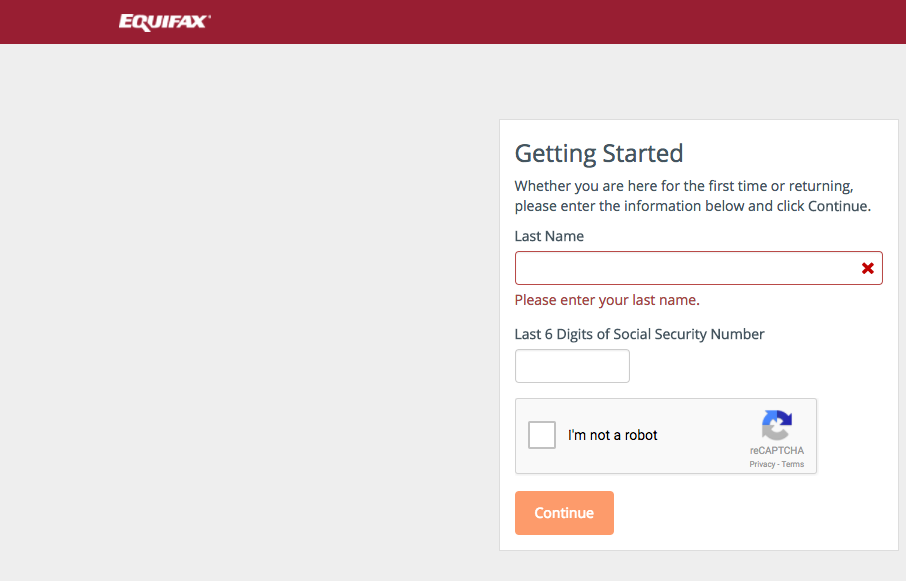

Equifax Already Being Sued Over Massive Breach; Company Criticized For Amateurish Response To Theft

Within hours of Equifax — one of the nation’s three major credit bureaus — confirming that the records of some 143 million people had been compromised in a data breach, the company now faces a lawsuit accusing it of failing to protect its stockpile of sensitive consumer information. Meanwhile, some critics are saying that Equifax’s response to the breach may be causing more harm than good. [More]

Equifax Announces Data Breach Affecting 143 Million Customers

Credit reporting agencies have access to basically all of our most sensitive financial information, and we pretty much all have our records collected and collated by them whether we want to or not. So that makes it a particularly big problem when one of the big three credit agencies in the country has to announce a data breach affecting all its customers, because that basically means all of us… and this one is bad. [More]

Credit Reports Soon Won’t Include Some Tax Lien, Civil Judgment Data

Millions of consumers could soon see their FICO credit scores increase as the three credit reporting agencies — Equifax, Experian, and TransUnion — take another step to overhaul their systems by excluding certain negative information related to tax liens and civil judgments from credit reports. [More]

Equifax, TransUnion To Pay $23M For Misleading Consumers About Credit Monitoring

The nation’s three largest credit reporting agencies — TransUnion, Equifax, and Experian — not only collect consumers’ financial information to assist lenders in gauging whether or not someone is qualified for a loan, fit for a job, or can afford a place to live, they also provide people with credit-related products and resources that are meant to help them keep tabs on or improve their credit. But, according to federal regulators, Equifax and TransUnion haven’t been upfront about the costs and usefulness of these products, and now they’re on the hook for a total $23.1 million in fines and refunds. [More]

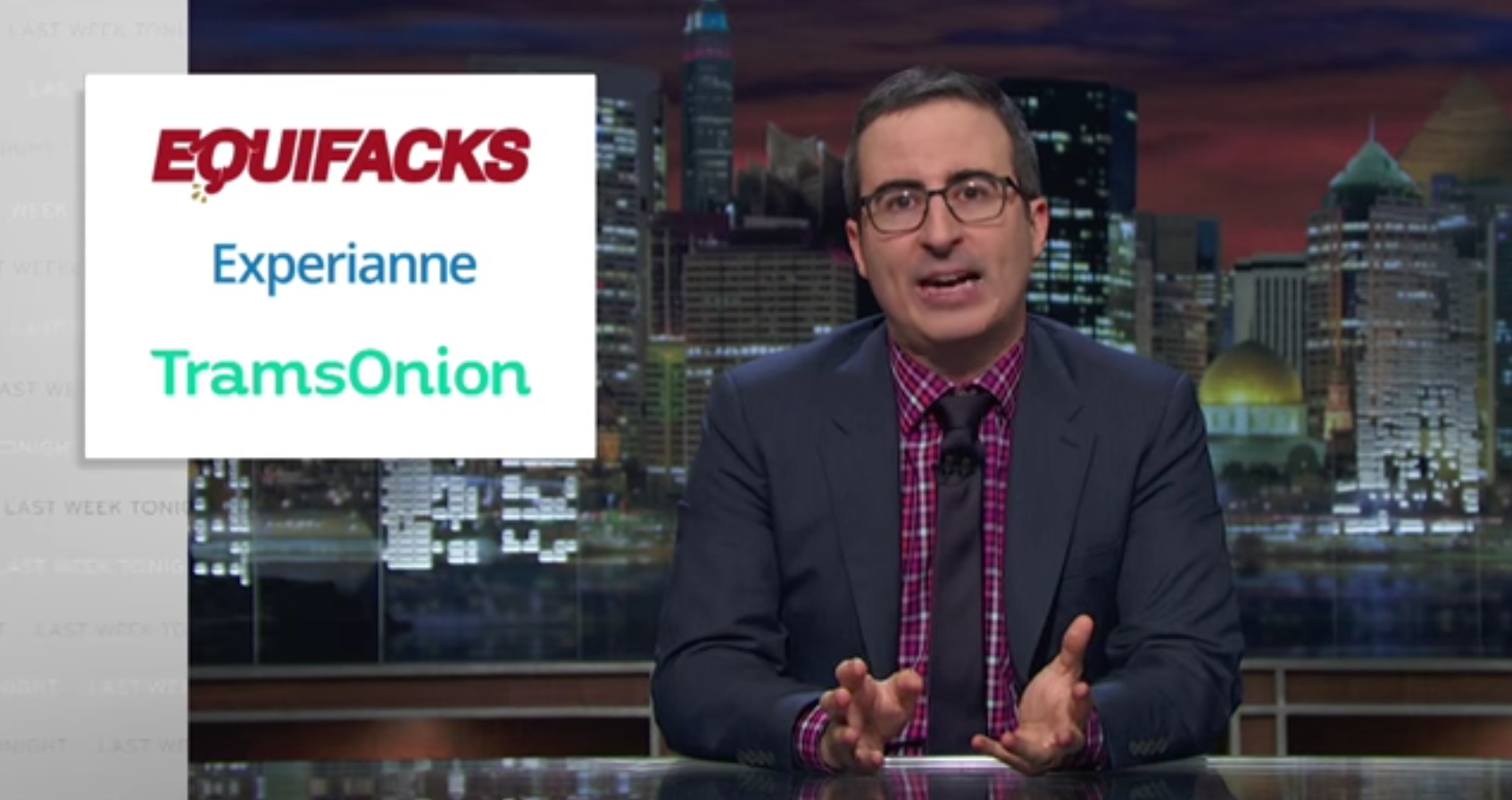

John Oliver Trolls Error-Prone Credit Bureaus With Horrible, Sound-Alike Companies

The three major credit reporting agencies — Equifax, Experian, and TransUnion — receive more complaints from consumers than most banks, primarily because these reports frequently contain errors and they make it incredibly difficult to resolve disputes. The credit industry seems to think its mistakes are within acceptable standards, but will they feel the same way when their brand names are facing similar odds for a disastrous mistake? [More]

Man Says He Can’t Access His Credit Report After Equifax Sent Him Personal Info For Dozens Of Strangers

Getting an unexpected surprise in the mail can be fun sometimes — a birthday gift from your grandma or some free electronics — but one Washington man was far from happy to find credit reports in his mailbox that were apparently intended for a bunch of strangers. Even worse, he says he can’t get access to his own report to make sure there aren’t unexpected debts attached to his credit history. [More]

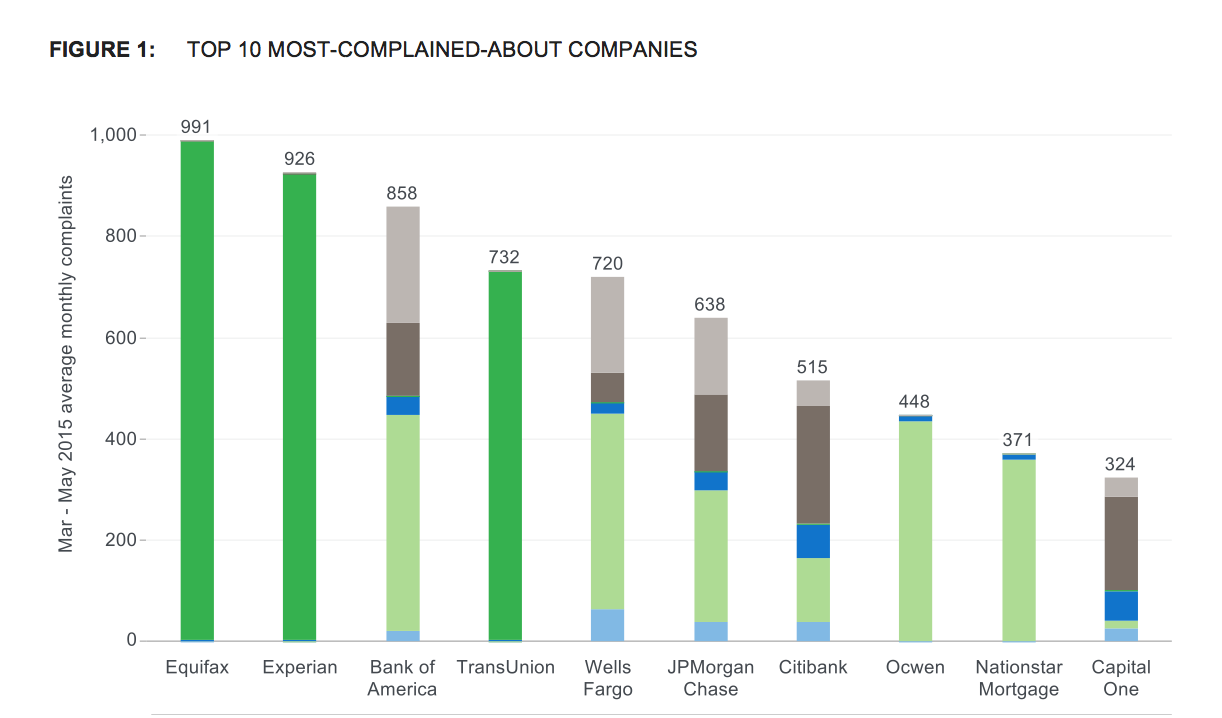

Credit Bureaus, Bank Of America, Wells Fargo Top List Of Most Complained-About Financial Companies

The Consumer Financial Protection Bureau has released its latest report on the various complaints the agency has received about banks, lenders, debt collectors, and other financial services. Amid a sudden increase in the number of complaints involving credit report errors, the country’s largest credit bureaus now dominate the top of the CFPB’s list of most complained-about companies. [More]

How Much Is A Company That Knows All About Your Financial Behavior Worth? Turns Out A Lot.

It’s no secret that consumer financial data is valuable: it determines if you get better rates on loans and allows lenders to predict the likelihood you’ll pay back debts. While we can’t necessarily put a price tag on that data (yet), we now know that one of the largest companies to collect that information is worth a bundle – 4 billion bundles, in fact. [More]

Senator Pushes For System To Notify Consumers ‘The Moment Access To Their Credit Is Requested’

It seems like every day, another retailer, service provider, or government agency falls victim to a data breach, and if a hacker uses that stolen info to open up a new line of credit in your name, you may not know until long after the fact. One lawmaker is hoping to curb identity theft by giving consumers a heads-up whenever their credit reports are accessed. [More]

Man Named God Reaches Settlement With Equifax, Finally Gets A Credit Score

You might recall a story from about a year back where a man with the first name “God” had a little dispute with credit-reporting agency Equifax, namely that the company wouldn’t recognize his moniker as legitimate. He’s now come out on top in his battle with Equifax, which has agreed he and his financial history do exist, and have granted him a shiny new credit score. [More]

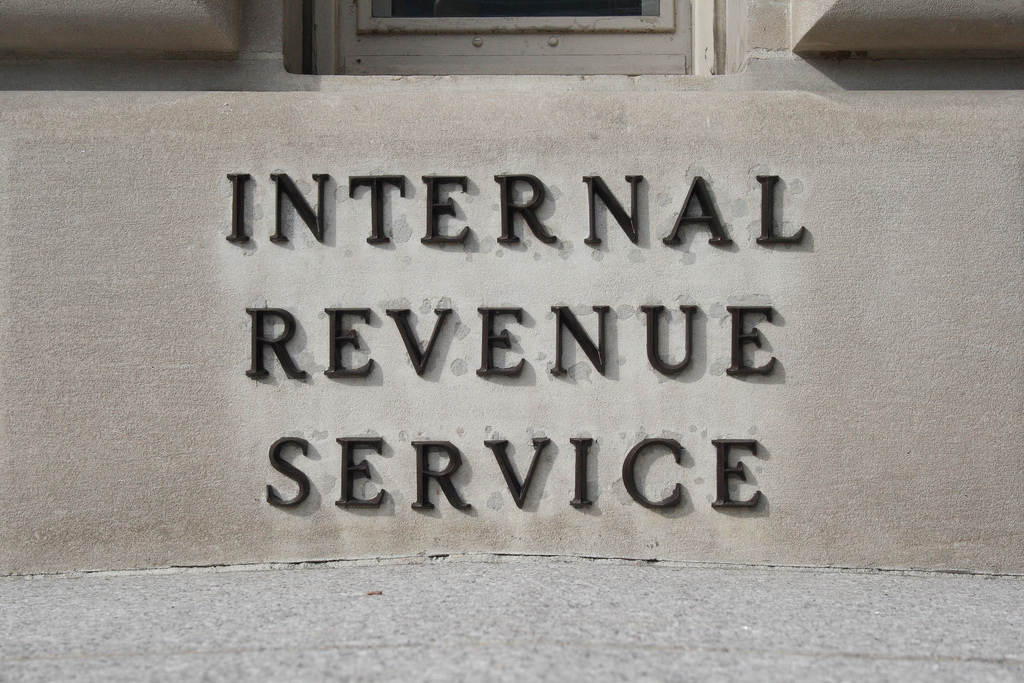

FBI Opening Investigation Into IRS Breach That Affected 100,000 Taxpayers

After the news yesterday that the Internal Revenue Service reportedly suspects Russian identity thieves were behind a breach that allowed thieves to access information for approximately 100,000 taxpayers, the Federal Bureau of Investigation says it’s now investigating the incident. [More]