Americans get to face another three years at higher risk of having our payment card numbers scooped up by criminals while we fuel up our cars. The major credit card networks, Visa and Mastercard, have given gas stations an extension, pushing the deadline for them to install payment terminals with chip (EMV) readers back to October 2020. [More]

emv

Can A Cashier Make Me Read My 3-Digit Credit Card Code In Front Of Other Shoppers?

Your credit card has a 16-digit number on the front, plus an expiration date, and another three-digit code on the back. We all know in a vague way that the code on the back (also known as the “CVC” or “CVV”) has something to do with making transactions safer or reducing fraud, but other than that we don’t give it much thought — and while we might expect to have to share that number when shopping online, we certainly don’t expect to be asked to read it out loud when making an in-person purchase at a crowded coffee shop. [More]

Retailers Frustrated About Chip Card Terminals They Can’t Turn On, Liability For Fraud

A grocery store chain in Florida made headlines last week for filing a lawsuit against a consortium of credit card issuers for delaying their certification to process payments on the EMV (chip card) payment network. They aren’t alone, though: many other medium-size chains and other businesses have had their certification delayed, which is costing them thousands or tens of thousands of dollars now that they’re liable for fraudulent transactions. [More]

Retailers Have Chip-Enabled Card Readers, Aren’t Actually Turning Them On

If you’ve received a shiny new chip-enabled card from your bank or credit card company in recent months, then you’ve probably been through this at least once. You see that a store has the slot for your card, so you assume that the store actually accepts them. Silly shopper! The terminal tells you to swipe the magnetic stripe instead. [More]

Slow Rollout Of Chip-And-PIN Credit Cards May Keep Lines Moving This Holiday Season

October 1 was supposed to be the deadline for U.S. retailers to update their payment systems to accept new chip-enabled credit cards, but a number of stores haven’t finished making this change, and most consumers still have boring ol’ no-chip cards. The good news is that this foot-dragging on everyone’s part may have the effect of not slowing down checkout lines this holiday shopping season. [More]

Credit Card Processors Aren’t Buying Netflix’s EMV Shift Excuse

When Netflix announced its quarterly results this week, they had an explanation for why their new subscriber number fell short of their projections. The shift to smart-chip (or EMV) payment cards means that the service lost some subscribers while customers received new card numbers and forgot to change them over. That’s a good story, but people in the banking business have some issues with it. [More]

Netflix Thinks You’re Letting Your Subscription Lapse When Your New EMV Payment Card Arrives

You are, presumably, a financially responsible adult, or aspire to become one. Yet it’s easy for even the most financially responsible grown-up to forget to change everything over when you receive a new credit or debit card. As banks are supposed to replace all of our cards for the EMV changeover, our forgetting to update the cards on our Netflix accounts is actually affecting the company’s profits. No, really. [More]

Target To Be First Major Credit Card Issuer To Require PINs For Chip-Enabled Cards

While many banks and other financial institutions issuing credit cards have shifted from magnetic-strip cards to the more secure EMV smart cards, most of those companies have opted to let their customers continue signing for purchases rather than memorizing a PIN. That apparently isn’t the case for Target, which is poised to become the first major credit card issuer to convert to cards that require a PIN. [More]

The Chip-And-PIN Credit Card Era Starts Today. What You Need To Know

Over the past few months, you may have noticed more retailers adorning their checkout stands with shiny new credit card readers. While those systems still have an area along the side where you swipe your card’s magnetic strip, they also have a smaller slot (typically) on the front where you simply jam gently insert your card. This is all part of the country’s shift toward more secure, but far from perfect, chip-enabled cards that kicks into high-gear today. [More]

Most Small Business Owners Aren’t Ready For Chip-And-PIN Credit Cards

Following a string of high-profile data breaches last year, Visa and MasterCard handed down a requirement that all merchants transition to the more secure chip-enabled credit card payment system by October of this year. While several major retailers have already made or are in the process of making the switch, a new report finds that many small business owners don’t even know about the deadline – or the potentially costly consequence of not meeting it. [More]

American Credit Cards Are Most Popular In The World For Hacks, Fraud (Because Our Tech Stinks)

If it feels like we hear a whole lot of stories about retail data breaches here in the U.S., well, that’s because we do. Americans are super duper popular targets for card hacks and fraud, and it’s for one simple reason: our credit card security is bad and should feel bad. [More]

Banks Aren’t Really Going To Replace Everyone’s Credit Cards This Year

Hey, remember how the major credit card companies were going to replace all of our magnetic stripe credit cards sometime this year with computer chip cards sometime this year? You know, like what the rest of the world uses? That isn’t happening. We’ll get our computer-chip cards, sure, and some retailers might be able to read them. However, banks might take until 2017 or so to replace all of our cards. [More]

Visa, MasterCard Working On Security Improvements To Make Data Breaches Suck Less

The data breaches, major and minor, that we’ve seen over the past few years aren’t going anywhere. Payment system and database hacks are, for now, basically inevitable. And that’s why Visa and MasterCard have both announced plans to expand their security features for online shopping. [More]

Bogus Credit Card Charges Look Like They Were Made With Chip-Enabled Cards

As banks begin rolling out new credit cards embedded with microchips intended to help prevent fraudulent use, some financial institutions are reportedly seeing a spike in bogus transaction charges that appear to be coming from these newer cards, even though chip-enabled cards have yet to be sent out. [More]

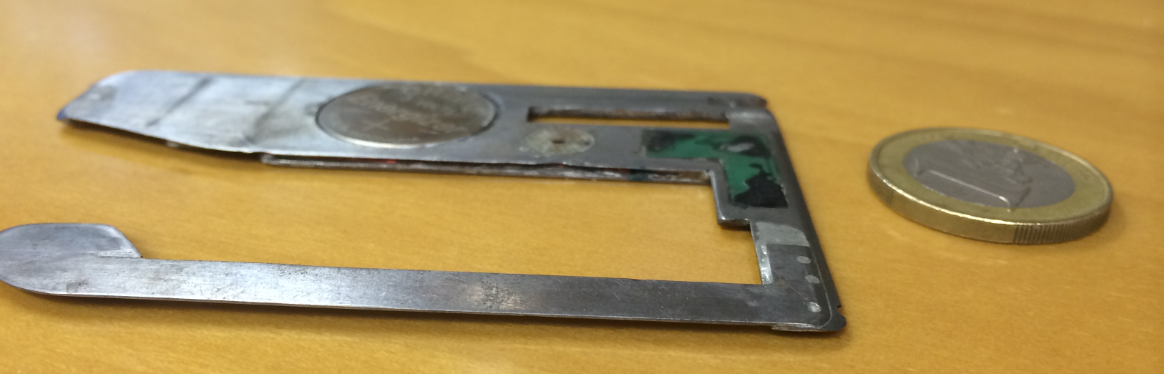

Here’s Another Near-Invisible Card Skimmer Found On A European ATM

On the right of this photo is a 1-euro coin, which is more or less the size of a U.S. dollar coin. On the left is a super-thin skimmer recovered from the card-reader slot of an ATM in Europe. Powered by a watch battery, it was only found when the ATM displayed a “fatal error” message and a technician came by to figure out what was wrong. [More]

Your New Credit Card Is Already Waiting Inside This Secret Facility

Sure, credit card issuers, including Target, aim to get us all using chip-and-PIN (EMV) credit and debit cards sometime next year. They will make our transactions more secure, and maybe we’ll be less likely to get our digits stolen in a catastrophic data breach. Here’s one question that you may not have thought to ask, though: where do these cards actually come from? [More]

Massive Data Breaches Could Lead To Americans Finally Getting Smarter Credit Cards

The Senate Judiciary Committee heard testimony today from Target’s chief financial officer about the massive data breach that hit the company during the holiday shopping season last year. [More]