In a lawsuit seeking to block the merger of health insurance companies Aetna and Humana, the U.S. Department of Justice cited decreased competition on state individual health insurance exchanges as one reason why the merger shouldn’t happen. [More]

doj

Justice Dept. Sues United Airlines For Denying Benefits To Air Force Reservist On Military Leave

The Uniformed Services Employment and Reemployment Rights Act (USERRA) provides that anyone who takes leave from their current job to serve in the armed forces is entitled to the same general benefits as an employee on non-military leave. However, the U.S. Department of Justice says that United Airlines violated this law by refusing sick day benefits to an Air Force reservist while he was away on military leave. [More]

Fiat Chrysler Subject Of Federal Fraud Investigation, Claims Report

The Justice Department is reportedly looking under the hood at Fiat Chrysler, investigating the automaker for possible violations of securities laws. [More]

Prosecutors: FedEx “Should Be Treated Just Like Any Other Drug Courier”

Two years after federal prosecutors charged FedEx with being criminally complicit in the transporting of illegal drugs from online pharmacies, the case is finally going to trial. In this morning’s opening statements, lawyers for the Justice Department urged the court to not be swayed by the famous brand name on the side of the planes. [More]

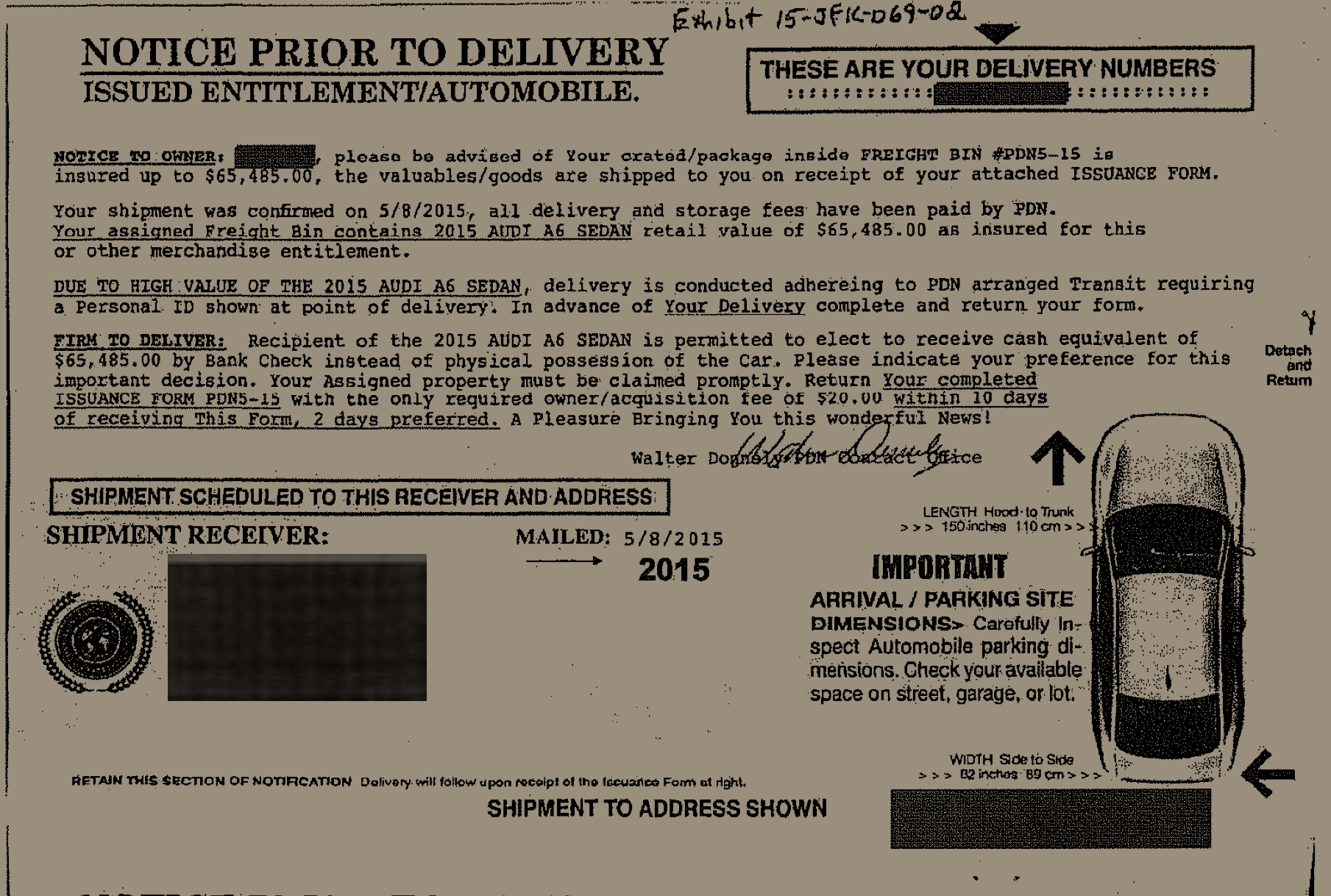

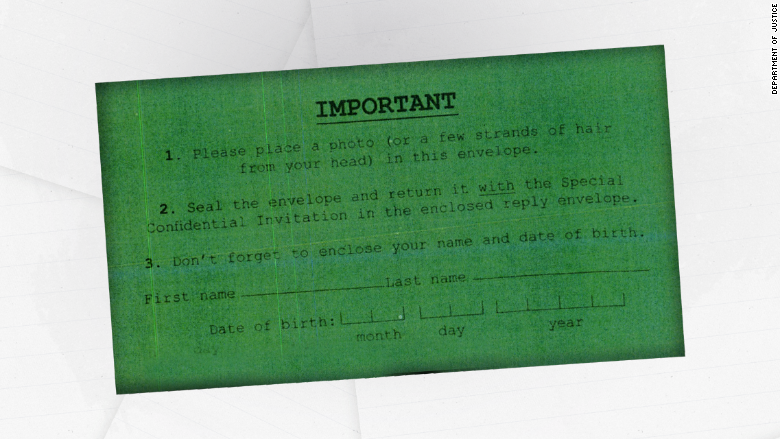

U.S. & Dutch Authorities Shut Down International Scam That Bilked Millions From Elderly

Simultaneous legal actions by both the U.S. Department of Justice and Dutch authorities seek to shut down an alleged mail fraud scheme that tricked elderly Americans into paying tens of millions of dollars with the false promise of winning valuable prizes in return. [More]

Bill Requiring Security Backdoors On Phones & Other Devices Appears To Be DOA

Last month, Senators Diane Feinstein of California and Richard Burr of North Carolina were set to bring forth legislation that would end the debate on whether companies like Apple should help law enforcement unlock users’ devices, by requiring them to do so. In spite of the bipartisan, high-level sponsorship and the spotlight of the disputes between Apple and the Justice Department, it looks like this controversial legislation may never even be formally introduced. [More]

DOJ: Concerns About Expanded Government Hacking Much Ado About Nothing

Earlier today, a bipartisan group of senators introduced legislation intended to combat new rules that some critics believe gives expanded hacking authority to federal law enforcement agencies. In response, the Justice Department claims that this bill isn’t necessary to protect consumers’ privacy. [More]

Feds Shut Down Psychic Scammers Who Tricked Victims Out Of $180 Million

We first wrote about the “Maria Duval psychic mailer” scheme, which used supposedly personalized mass mailings to trick people into paying money for Duval’s otherworldly insights, more than six years ago, and the internet is full of complaints from people who lost thousands of dollars to Duval and her related businesses. Today, the U.S. Department of Justice announced a settlement that permanently bars Duval and others from continuing to bilk consumers out of their money with false promises of psychic guidance. [More]

Court Rejects Twitter’s Transparency Lawsuit Against Justice Dept.

Twitter has hit a substantial roadblock in its nearly two-year legal battle against restrictions on what it can reveal to users about requests for data from federal law enforcement agencies. Yesterday, a U.S. District Court dismissed a substantial chunk of Twitter’s case, though the social media platform will be given an opportunity to try again. [More]

Dole Found Listeria In Salad Processing Plant As Far Back As 2014, Kept Shipping Veggies

Is it a crime for a company or its representatives to keep on shipping food products that may be dangerous to the public if they know that the items may be contaminated? Dole’s Springfield, OH processing plant has started shipping salad again, but new evidence shows that the company kept shipping lettuce even as it was aware of Listeria contamination in the building as far back as 2014. [More]

Why Won’t The FBI Tell Apple How It Unlocked iPhone?

A month ago, the FBI dropped its legal effort to compel Apple to unlock a dead terrorist’s iPhone after a third party provided the agency with a way to bypass the device’s encryption. While the federal law enforcer is okay with using what it learned to aid other criminal investigations, it doesn’t look like the FBI is jumping at the chance to let Apple in on the secret. [More]

5 Things You Should Know About The Approved Merger Of Time Warner Cable & Charter

Earlier today — almost exactly a year after rejecting the merger of Time Warner Cable and Comcast — both the FCC and the Justice Department gave their blessing to the marriage of TWC and Charter. But what does that really mean for the millions of consumers who will be affected by the merger? [More]

The End Is Just The Beginning In The Apple Vs. DOJ Legal Battle Over Encryption

As you may have heard, on Friday afternoon the U.S. Department of Justice backed off its efforts to compel Apple to aid in unlocking a criminal suspect’s iPhone — for the second time in only a few weeks. While some have heralded this as a significant victory for Apple (or at least as a loss for the government), it’s really just a tiny, unresolved spat in what looks to become a protracted legal battle for both sides. [More]

Did U.S. Use Secret Court To Force Tech Companies To Weaken Encryption?

Legislators in D.C. are currently considering a law that would compel tech companies to have weak device and software encryption so that law enforcement can snoop when necessary, while federal prosecutors have repeatedly used a 227-year-old law to try to force Apple and Google to work around existing security on their products. A new lawsuit seeks to find out if the government has also been using a highly secretive court to force tech companies to assist in breaking their own encryption. [More]

Apple: Why Should We Help Unlock iPhone Of Someone Who Has Already Pled Guilty?

With the U.S. Department of Justice still attempting to compel Apple to unlock the iPhone of a drug suspect, the tech giant is asking the court why this is so important when the former owner of that iPhone has already pled guilty. [More]

Microsoft Sues Justice Dept.; Wants To Be Able To Tell Users When Govt. Reads Their Files

Before the advent of cloud computing, law enforcement would often have to physically go into an office or home and seize computers and servers of criminal suspects and their cohorts — an obvious tip-off that an investigation is taking place. But now, with so much data living far from the devices used to access it, the government can seize that information without having to load up a van full of hardware, leaving the target of the investigation none the wiser. What’s more, the government can try to block cloud-computing companies from telling affected customers about these seizures, which Microsoft believes is a violation of the Constitution. [More]

DOJ Still Pushing Apple To Unlock Drug Suspect’s iPhone, In Spite Of Judge’s Ruling

In February, while a federal court in California was pondering whether or not to compel Apple’s assistance in unlocking a terrorist’s iPhone, a federal magistrate judge in New York ruled — in a drug-related case — that the government couldn’t force Apple to defeat its own encryption. In spite of that ruling, the Justice Department now tells the court that it is going ahead with its effort to require Apple’s help. [More]

Government Has Used 1789 Law To Compel Apple & Google To Unlock More Than 63 Smartphones

The high-profile legal standoff between Apple and the FBI recently came to an end when the government unlocked a terrorist’s iPhone without Apple’s assistance, but new data confirms that this single showdown is just one of dozens of cases where the federal government has successfully used a more than 225-year-old law to compel Apple or Google to aid authorities in bypassing smartphone security measures. [More]