In a rare instance of criminal charges being brought against executives at one of the world’s largest car companies, federal authorities have indicted six Volkswagen employees involved in the decade-long “Dieselgate” scandal and cover-up. [More]

doj

Former Pharma Execs Face Felony Charges For Generic Drug Price-Fixing

Federal prosecutors have charged both the former CEO and president of a New Jersey pharmaceutical company with illegally conspiring to fix prices on generic drugs, marking the first time the Justice Department’s Antitrust Division has prosecuted a case involving generic medications, and could be the first domino in a series of charges still to come against others. [More]

Former Pharma Execs Accused Of Boosting Fentanyl Sales By Bribing Doctors With Sham Speaking Engagements

Fentanyl is an incredibly potent opioid painkiller; it acts quickly and powerfully, but doesn’t last as long as others, meaning its medical application is limited. So if you’re a drug company trying to boost sales of your new fentanyl spray, how do you sell more of a product that very few people have a real need for? You could bribe doctors with paid “speaking engagements,” take them out and show them the “best nights of their life,” all so they write prescriptions for patients who probably shouldn’t be getting your drug. [More]

GNC Agrees To Improve Efforts To Keep Illegal Dietary Supplements Out Of Its Stores

When you buy a dietary supplement, you never know quite what you’re getting, because supplement manufacturers don’t have to prove to the Food and Drug Administration that their products work — or are even safe — before putting them on the market. GNC, the world’s largest dietary supplement retailer, has now agreed to try to ramp up efforts to ensure that the products it sells are safe and legal. [More]

Feds Give Up Trying To Hold Bank Of America Accountable For Countrywide’s “Hustle” Mortgage Scam

A nasty four-year legal battle between the Justice Department and Bank of America over a massive mortgage-related scam run by Countrywide Financial has come to a whimpering conclusion, with the DOJ opting to not appeal its most recent defeat in the case. [More]

JPMorgan Chase To Pay $264M To Settle Corruption Allegations For Hiring Friends, Family Of Government Officials

Over a period of seven years, JPMorgan Chase hired or gave internships to around 200 individuals, not because they were the best people for their positions (they often weren’t), but at the request of foreign government officials and clients. That practice, alleged U.S. regulators, was a violation of federal law. Now Chase has agreed to pay a total of more than $264 million to settle these allegations of nepotism-gone-too-far. [More]

DOJ Sues DirecTV Over Blackout Of SportsNet LA

The Justice Department has filed a lawsuit against DirecTV, alleging that the nation’s largest satellite TV provider illegally shared non-public information with other pay-TV companies about their negotiations to carry SportsNet LA, the only cable channel in Los Angeles to air most Dodgers games. [More]

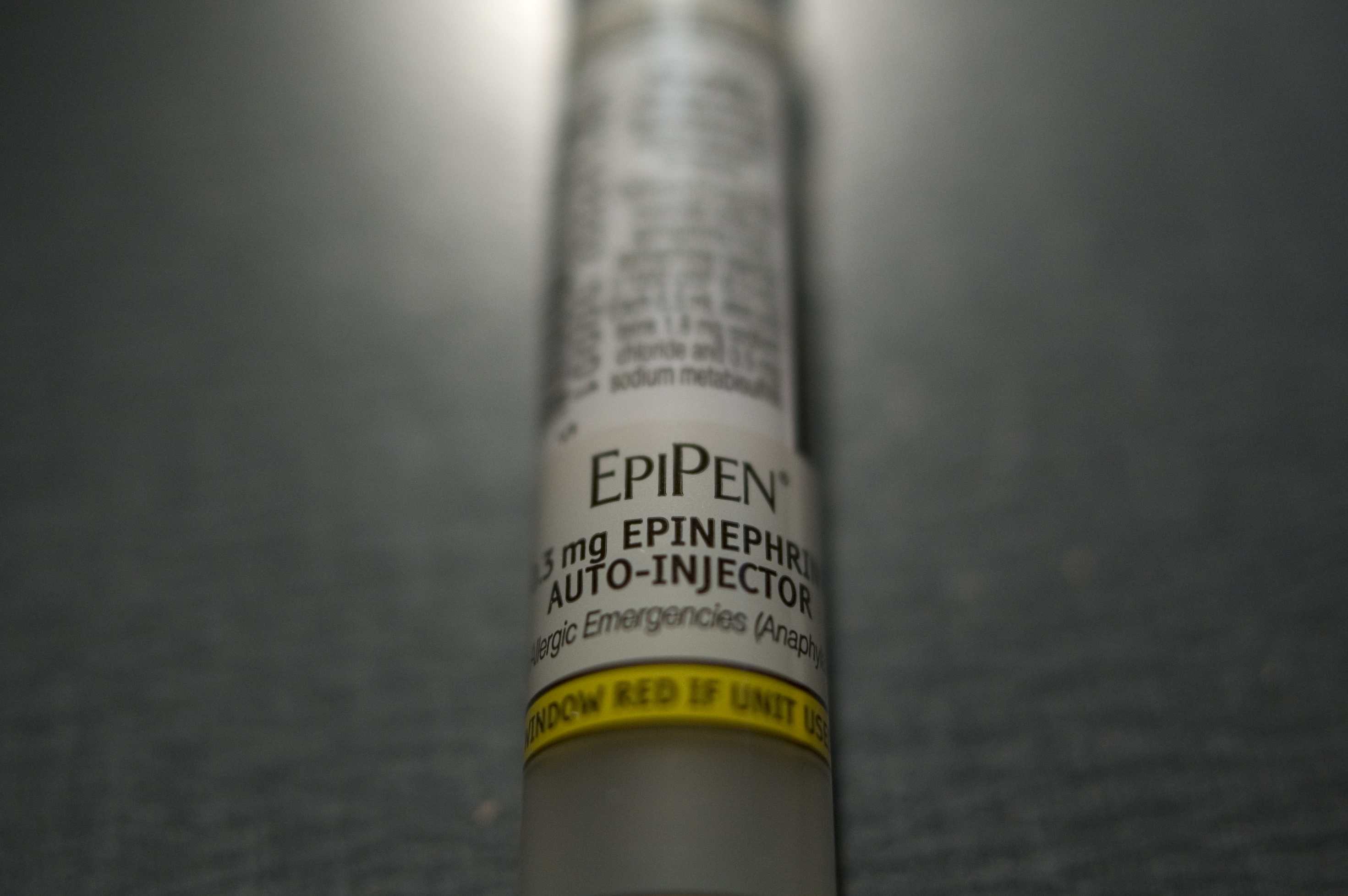

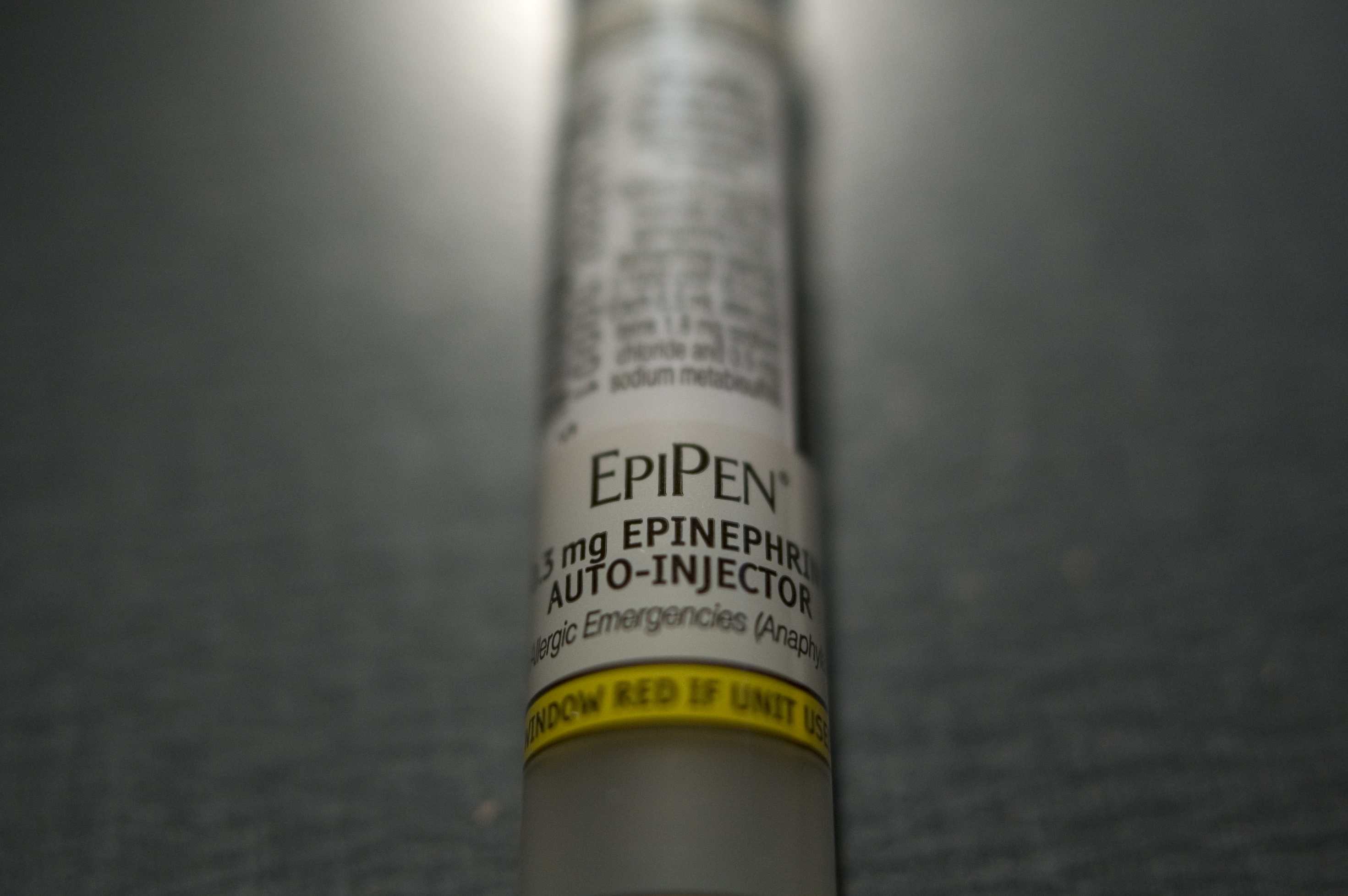

Sen. Elizabeth Warren: $465M Mylan EpiPen Settlement Is “Shamefully Weak… Shockingly Soft”

Earlier this month, drugmaker Mylan disclosed a $465 million settlement with the U.S. Department of Justice over allegations that the company had defrauded the Medicaid system by mis-categorizing its high-priced EpiPen allergy treatment. The DOJ has still yet to confirm this settlement or provide any details, and critics of the deal say it looks like Mylan is getting off easy. [More]

DOJ, States To Sue Moody’s Credit Rating Agency For Role In Mortgage Meltdown

What drove the mortgage bubble in the years leading up to the 2008 financial crisis wasn’t just ill-prepared home-buyers signing on to subprime, adjusted-rate mortgages they couldn’t afford, or the lenders who effectively gave up on underwriting these loans so as to bundle and resell as many of them as possible. There were also credit rating agencies that gave these mortgage-backed bonds the seal of approval, even when they were worthless. [More]

Mylan To Pay $465M To Settle EpiPen Medicaid Pricing Scandal; Critics Call Deal “Inadequate”

Amid recent revelations that EpiPen maker Mylan has been overcharging U.S. taxpayers for potentially hundreds of millions of dollars since at least 2011, the drug company says it has agreed to pay $465 million to close the book on a federal investigation into its Medicaid pricing — all without admitting any liability. [More]

14 Senators Agree: DOJ Needs To Investigate, Prosecute Wells Fargo Executives

Thousands of Wells Fargo employees were let go after federal and state regulators exposed the long-running fake account fiasco, and the civil lawsuits and congressional investigations into the matter are beginning to pile up. Now a coalition of 14 senators are asking the Department of Justice to launch a criminal investigation in the hope of ferreting out individuals at Wells Fargo who may have encouraged or turned a blind eye to this fraud. [More]

Senators Ask DOJ To Investigate Mylan Over Possible EpiPen Medicaid Fraud

EpiPen maker Mylan might have thought that dealing with the public shaming of a congressional hearing would be the low point of its ongoing price-hike scandal, but lawmakers continue to scrutinize the drug company and are now calling for a federal investigation into the possibility that Mylan was deliberately mis-categorizing the emergency allergy medication in order to reap bigger payments from Medicaid. [More]

Owner Of Online Colored Contact Lens Store Pleads Guilty To Importing & Selling Counterfeit Lenses

Importing and selling counterfeit goods is against the law, so is selling imported contact lenses — even purely cosmetic ones — that haven’t been authorized by the FDA for stateside distribution. The Las Vegas owner of a website specializing in colored contact lenses has pleaded guilty to all of the above. [More]

Apple, Amazon, Google, Twitter, Dozens More Voice Support For Microsoft Lawsuit Against Justice Dept.

In April, Microsoft sued the U.S. Department of Justice, arguing that its “customers have a right to know when the government obtains a warrant to read their emails,” and that “Microsoft has a right to tell them.” While Microsoft might be the only plaintiff in this case, dozens of tech biggies, media companies, privacy advocates, and others have let the court know that they stand behind Microsoft. [More]

Justice Department To Phase Out Use Of Private Prisons

Around 15% of the nearly 200,000 inmates in federal custody are housed in privately operated prisons that have come under fire for allegations of poor treatment of prisoners and less stringent security measures — all at a yearly price tag to taxpayers of $639 million. Today, Deputy Attorney General Sally Yates announced plans to phase out the Justice Department’s use of private facilities over the coming years. [More]

Appeals Court Tells DOJ To Stop Spending Money Prosecuting Medical Marijuana (For Now)

People frequently refer to “legal” medical marijuana in the dozens of states that have approved at least some medicinal use of the drug but as the Drug Enforcement Agency recently made quite clear, the federal government still considers marijuana a Schedule I controlled substance with no proven legitimate medical applications. However, yesterday a federal appeals court reminded the Department of Justice that the law currently limits the government’s ability to prosecute medical marijuana cases in states where it’s allowed. [More]