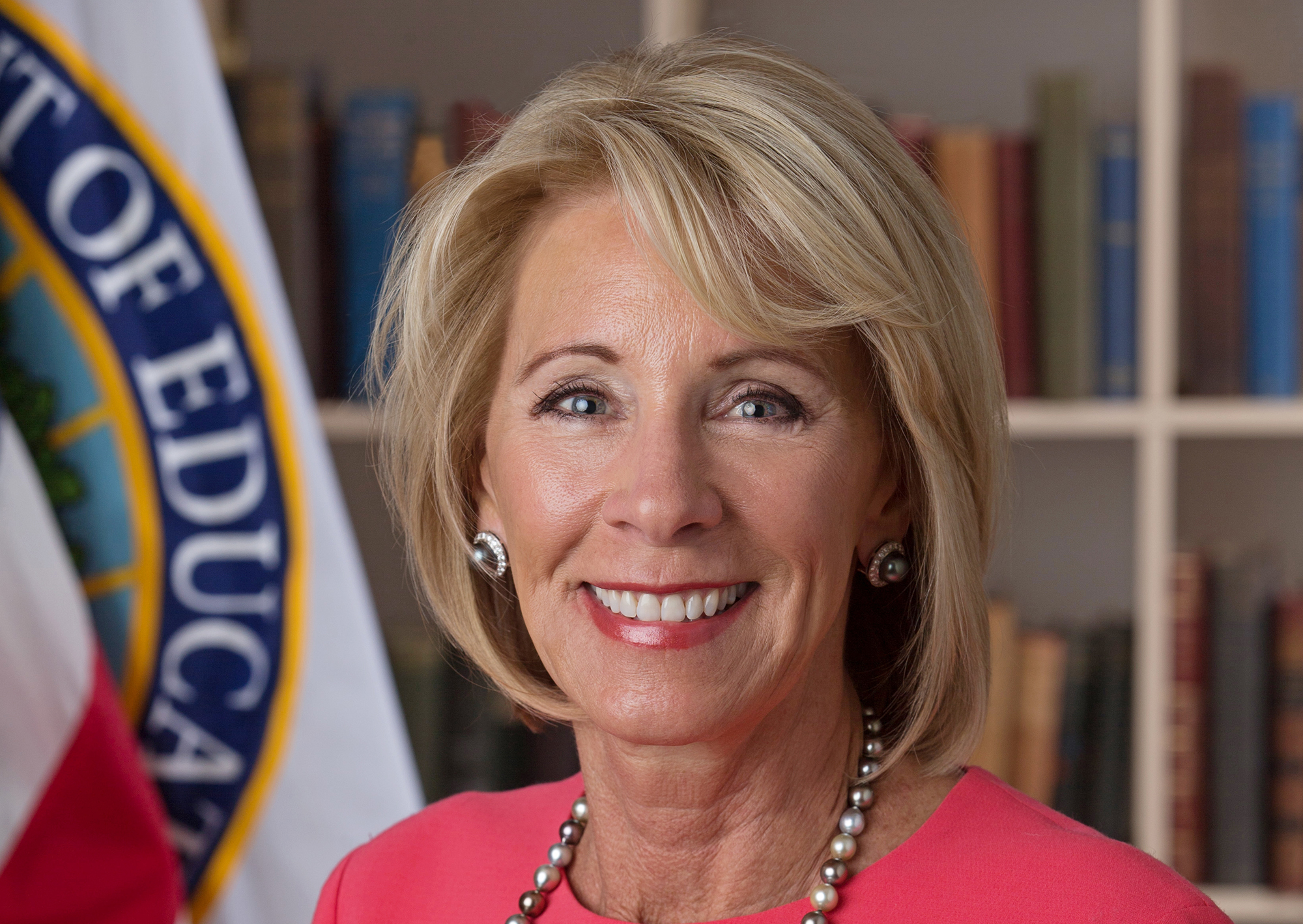

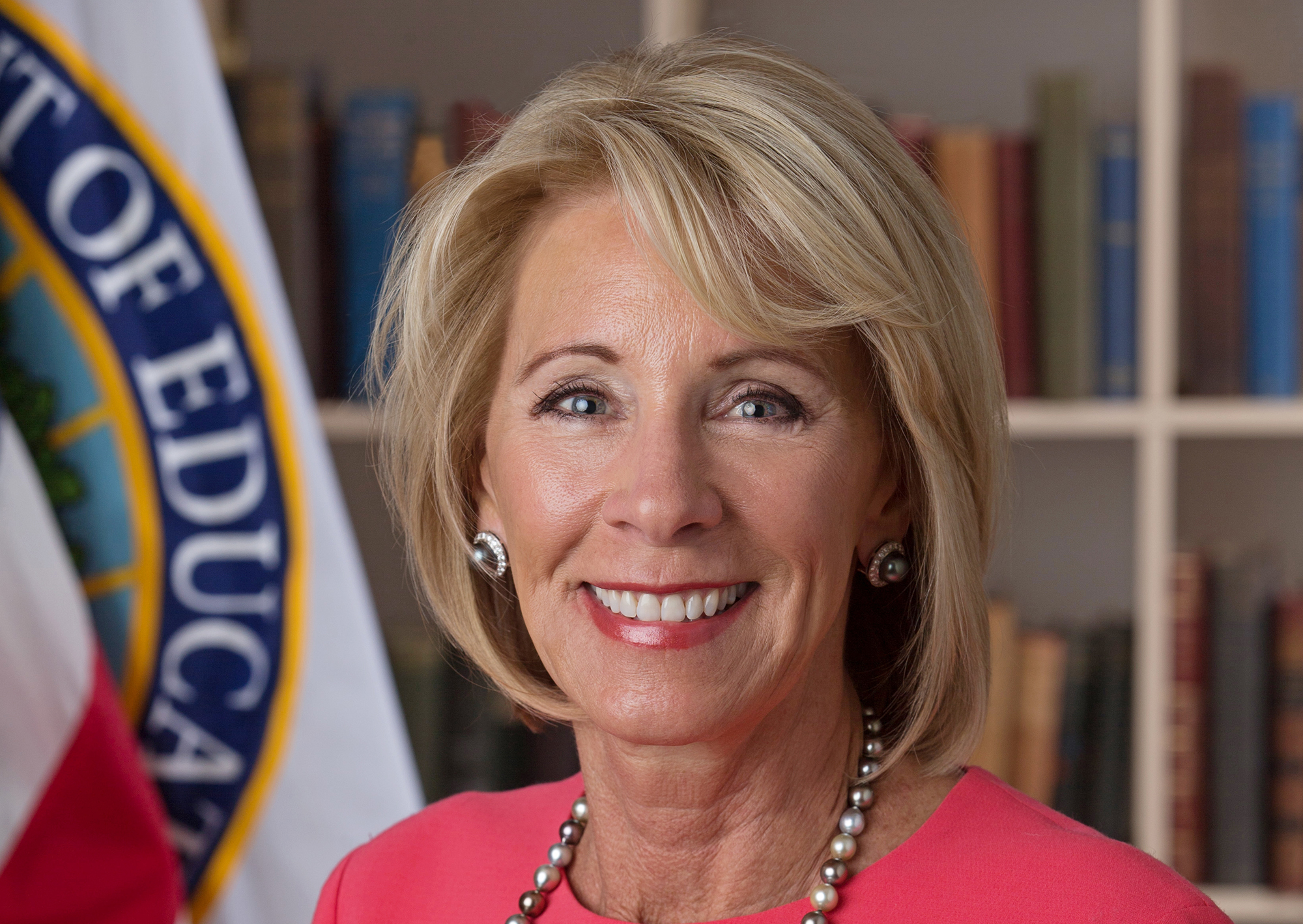

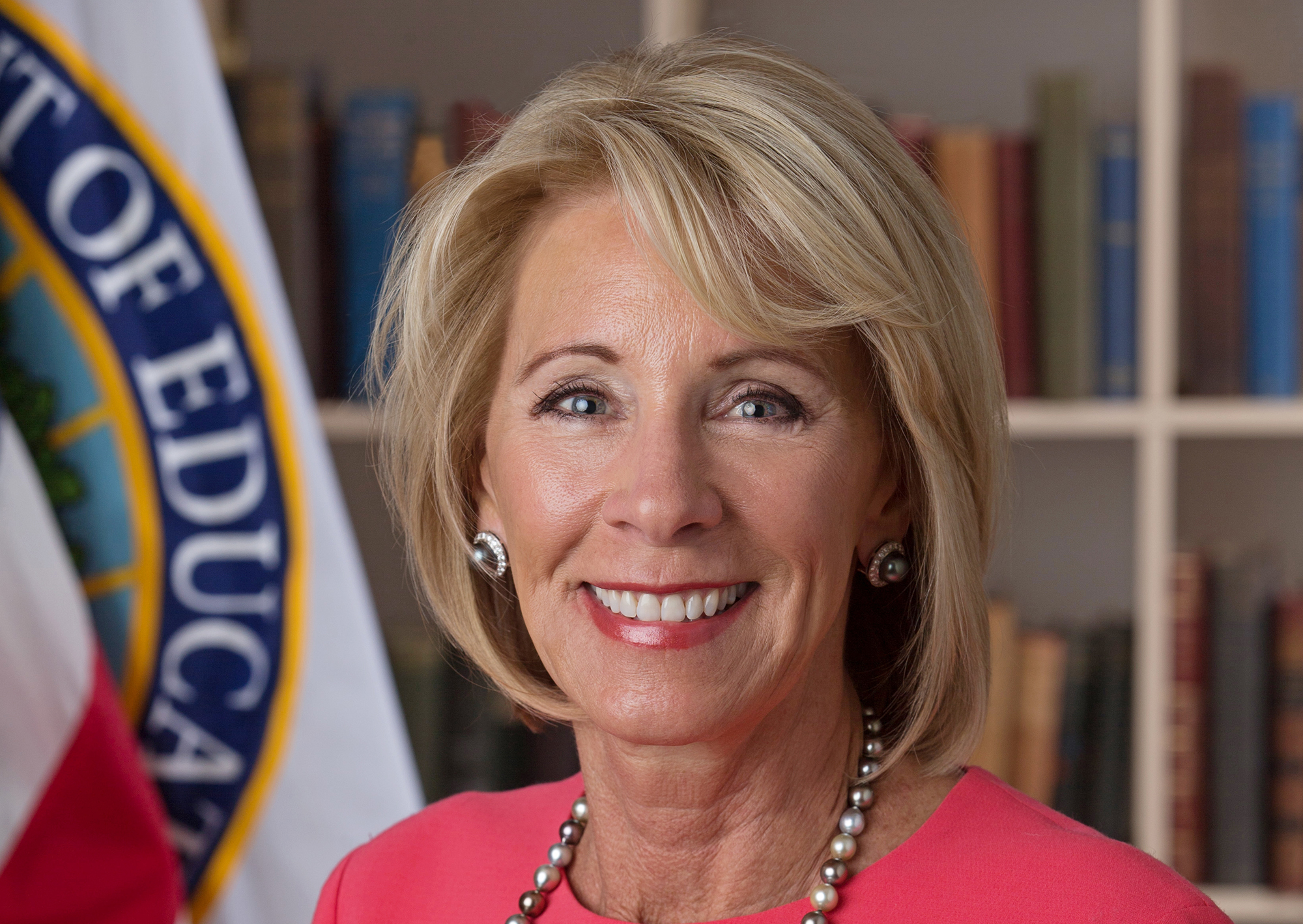

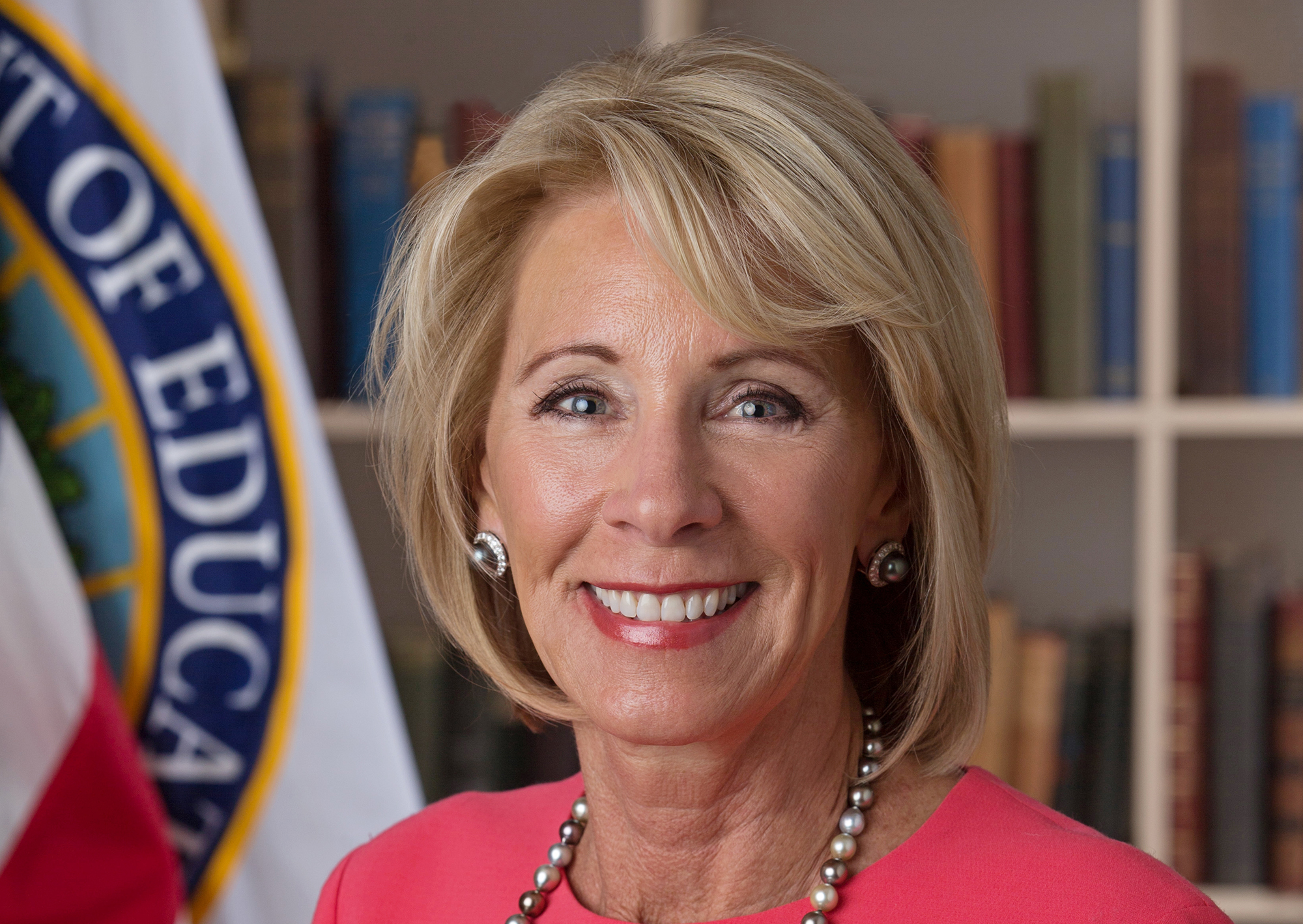

Education Secretary and champion of for-profit colleges Betsy DeVos is once again siding with this controversial industry and against students who were defrauded by schools that tricked them into paying top dollar for a bottom-dollar education. [More]

department of education

Borrowers In Student Loan Forgiveness Program Shocked To Learn Loans Won’t Be Forgiven

This month is the first in which student loan borrowers enrolled in the Department of Education’s Public Service Loan Forgiveness program were expecting to see their student loan tab cleared. But that’s not happening for some borrowers after learning they were never actually enrolled in the programs, despite assurances from the companies servicing their debts. [More]

25 States Urge Betsy DeVos To Not Let Student Loan Companies Sidestep The Law

Since Betsy DeVos took over as Secretary, the Department of Education has been — to put it mildly — generous to the student loan industry. Through DeVos, the Trump administration has stopped cooperating with federal financial regulators to rein in unscrupulous loan servicers, and announced its plan to put all federal student loan accounts into the hands of a single company. But several states are letting it be known that they will not go easy on student lenders and servicers, even if they ask nicely. [More]

Betsy DeVos Delays Student Loan ‘Borrower Defense’ Rule Until At Least 2019

Despite the pleas — and legal actions — of lawmakers, consumer advocates, and students, Secretary of Education Betsy DeVos quietly announced Friday that the Department of Education will further delay, by nearly two years, rules intended to prevent students at unscrupulous schools from being left with nothing but debt if their college collapses. [More]

States Accuse Betsy DeVos Of Failing To Protect Students From Sketchy For-Profit Schools

Education Secretary Betsy DeVos has made no effort to hide her support for the for-profit education industry, going so far as to hit “reset” on rules intended to protect students from schools that provide minimal education at a maximum cost. Now, a coalition of 18 state attorneys general are suing DeVos and the Dept. of Education, alleging they failed to hold these schools accountable. [More]

Bank-Backed Congressman Praises Betsy DeVos For Cutting Ties With Consumer Protection Agency

Congressman Jeb Hensarling of Texas, whose campaign has received more than $8 million from the financial sector since 2010, has long endeavored to undercut the Consumer Financial Protection Bureau, an agency that regulates many of the businesses that keep Hensarling’s election campaigns flush with contributions. So it’s of little surprise that the lawmaker is thrilled at Education Secretary Betsy DeVos’ recent decision to stop working with the CFPB on student loans — even though the Bureau has returned hundreds of millions of dollars to screwed-over student borrowers. [More]

Student Loan Defaults Increase For First Time In Five Years; 8.5M Borrowers Now In Default

For the first time in half a decade, the rate of education loan defaults among recent college students has risen, highlighting the struggle many recent graduates face when it comes to paying their educational debts. [More]

States Ask Betsy DeVos To Not Drop Protections For Student Loan Borrowers

Earlier this month, Secretary of Education Betsy DeVos declared that the Department of Education would no longer work with the federal Consumer Financial Protection Bureau to root out bad players in the student loan servicing arena. While the CFPB fired back, accusing DeVos of misunderstanding just what the Bureau does, a coalition of state attorneys general are now joining the choir, claiming the decision to end the agencies’ agreements undermine protections for student borrowers. [More]

Disgraced College Accreditor Asks Betsy DeVos For Second Chance

Last year, the Department of Education revoked federal recognition for the accrediting body that ignored red flags at failed for-profit educator Corinthian Colleges and allowed billions in federal aid dollars to schools under investigation. Now, Accrediting Council for Independent Colleges and Schools is back, asking new Education Secretary Betsy DeVos for another chance. [More]

CFPB Asks Education Secretary DeVos To Not Give Up On Protections For Student Loan Borrowers

A week after Secretary of Education Betsy DeVos essentially broke up with the Consumer Financial Protection Bureau, ending the agencies’ agreements to work together to root out bad players in the student loans servicing arena, the CFPB is firing back, accusing DeVos of misunderstanding just what the Bureau does. [More]

Betsy DeVos Refuses To Work With Consumer Protection Agency On Student Loans

The Department of Education will no longer work with the federal Consumer Financial Protection Bureau to root out bad players in the student loan servicing arena. That’s according to Education Secretary Betsy DeVos, who recently notified the CFPB that her department is ending years of formal cooperation combating student loan fraud. [More]

Education Dept. Hires Exec From Scandalized For-Profit School To Run Enforcement Division

Dedicated and effective government employees can come from many prior walks of life, it’s true; the path through any career can be winding and complex. But choosing someone with major ties to a for-profit college that engaged in questionable behaviors to head up a division tasked with investigating for-profit colleges that engage in questionable behaviors seems like a bad sign. [More]

Education Secretary Betsy DeVos Will Allow For-Profit Schools To Continue Offering Programs That Don’t Meet Standards

Earlier this year, Education Secretary Betsy DeVos revealed plans to “reset” the Gainful Employment rule meant to hold for-profit colleges more accountable for the education they provide students. Today, she continued tearing apart the rule, announcing the intention to allow colleges to continue enrolling students in programs that run afoul of the regulation. [More]

Dept. Of Education Hasn’t Approved A Loan Forgiveness Claim In Six Months

When Education Secretary Betsy DeVos hit “reset” on revamped Borrower Defense rules that aim to ensure students at troubled schools weren’t left with nothing but debt if their college collapsed, she noted that students who had already submitted claims for loan forgiveness wouldn’t be affected. But that doesn’t appear to be the case, as the Dept. hasn’t approved a single application in nearly six months. [More]

From Forbearance To Garnishments: 5 Things We Learned About Student Loan Debt Collection

Student loans are big business, both for private lenders and the federal government. And with $1.4 trillion dollars in education debt outstanding, it should come as no surprise that these companies and the government would want to recoup these costs. However, that often comes at a cost to borrowers, from those who have fallen on hard times, to those failing to receive proper notice and options from servicers, or those who believe they were defrauded by the educators who promised them a better life. [More]

Education Dept. Civil Rights Chief Sorry For Saying 90% Of College Rape Claims Are Result Of Bad Breakups

As Education Secretary Betsy DeVos moves forward with her plan to review the federal government’s policy regarding sexual assault and harassment on college campuses, the acting head of the Department’s Civil Rights division is now apologizing for making an unsubstantiated and unsourced claim that nine in ten of these assault allegations are baseless and can be tied back to nothing more than too much drinking and bad breakups. [More]

States Say Education Secretary Betsy DeVos Broke Law By Delaying Protections For Student Loan Borrowers

Following Education Secretary Betsy DeVos’ decision to “reset” new regulations put in place to protect students at for-profit colleges, two separate lawsuits now accuse the Secretary of breaking federal law by running roughshod over the regulatory process when she delayed the so-called Borrower Defense rule, which would have made it easier for defrauded students to get out from under their student loan burdens. [More]

Betsy DeVos To Put $1.3 Trillion Student Aid Office In Hands Of Exec From For-Profit Student Loan Company

The top official at the federal Office of Financial Aid recently resigned after butting heads with new Education Secretary Betsy DeVos and her plan to make sweeping changes to federal student loan programs. Now DeVos has announced a replacement who is more likely to follow her lead: Dr. A. Wayne Johnson, the CEO of a private, for-profit student loan company. [More]