Once again, as part of its ongoing efforts to crack down on unscrupulous debt collectors, the Federal Trade Commission has accused a North Carolina company of running a “phantom” debt collection scheme that went after people for money that they did not actually owe. [More]

deceptive practices

Payday Loan, Check Cashing Operation Trained Employees To “Never Tell Customer The Fee”

All American Check Cashing collects approximately $1 million in check-cashing fees each year. But according to federal regulators, the company, which also provides payday loans, obtains those fees through deceptive means, including refusing to tell customers what they will be charged and lying to prevent consumers from backing out of transactions. [More]

“Buy Here, Pay Here” Dealer To Return $700K To Consumers Over Deceptive Lending Practices

Federal regulators continued their crackdown on not-so-upfront “buy-here, pay-here” auto dealers today, ordering a Colorado-based dealer to pay nearly $1 million in restitution and fines for operating an abusive financing scheme. [More]

Two Payday Lenders Agree To Pay $4.4M In Fines, Release Borrowers From $68M In Loans, Fees

Federal regulators continued an ongoing crackdown on deceptive payday loan players by reaching a multimillion-dollar agreement with two lenders to settle accusations they illegally charged consumers with undisclosed and inflated fees. [More]

The Country’s Two Largest Debt Buyers Must Refund Consumers $61M Over Illegal Collection Practices

Encore Capital Group and Portfolio Recovery Associates are two of the biggest names in the debt-buying game, and according to federal regulators they have often used deceptive and harmful tactics to collect their newly acquired debts. Now, as a result of these actions, the companies must refund consumers $61 million and pay $18 million in penalties. [More]

Corinthian Colleges Fined $30M Over Falsified Job Placement Rates At Heald College

The Department of Education continued its crackdown on deceptive for-profit college practices Tuesday by levying a $30 million fine against embattled Corinthian Colleges Inc. – operator of Everest University, Heald College and WyoTech – over the use of misstated and inaccurate job placement rates to recruit students. [More]

FTC Temporarily Halts Deceptive Practices Of Mortgage Relief Operation

The Federal Trade Commission continued its crackdown of deceptive mortgage relief companies this week as a federal court granted the agency’s request to temporarily halt a Los Angeles-based company that charged consumers excessive upfront fees for services they never performed. [More]

FTC Helps Stop Debt Collection Operations Attempting To Solicit Allegedly Fake Payday Loan Debts

There are few things more disruptive and frustrating than receiving a phone call demanding you pay a debt. Those feeling are amplified a thousand times when you don’t actually owe a debt. Yet, that was the case for consumers contacted by a Georgia-based company that was recently shut down at the request of the Federal Trade Commission. [More]

Houston-Based Debt Collection Company Agrees To Stop Deceiving Consumers

Deceiving consumers is a trademark for some debt collection agencies. Shady collectors have been known to lie about debts, misrepresent themselves as officers of the law, threaten lawsuits, and in the case of a Houston company, charged by the Federal Trade Commission, bully people into paying unnecessary fees. [More]

Man Sues GameStop For Deceptive Used Game Sales

A California man is suing GameStop because he bought a used game that lacked a valid code he needed to download contest promised on the cover of the box, IGN reports. [More]

Ticketmaster Pays $50,000 Fine, Closes More Than 100 Deceptive Site

Ticketmaster will pay a $50,000 fine and shutter more than 100 deceptive brokerage sites as part of a wide-reaching agreement with Illinois Attorney General Lisa Madigan. Madigan’s office accused Ticketmaster’s always shady subsidy, TicketsNow, of creating sites that masqueraded as local venues selling tickets at face value. The settlement also requires TicketsNow to wait until after Ticketmaster puts non-sporting events on sale before hawking tickets at outrageously inflated prices.

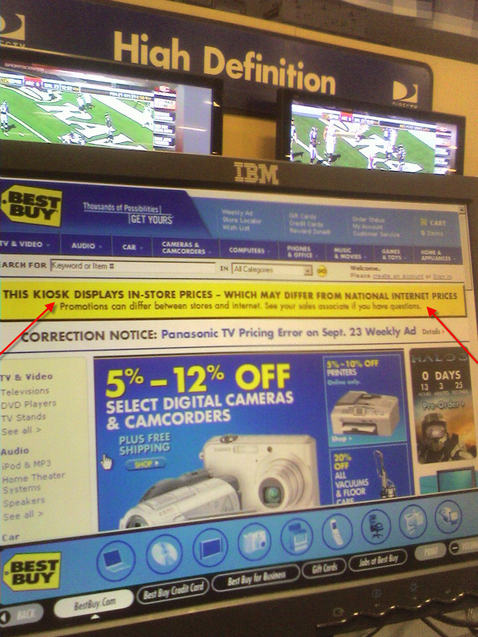

United, US Airways Bill Higher Baggage Fee As A Way To Save. Huh?

United and US Airways will soon charge an extra $5 to check bags at the airport, charging $20 for the first bag and $30 for the second. Since it will still cost $15 and $25 respectively to pay for checked bags online, United thinks they can herald the chance to “prepay & save!,” while US Airways boasts that they now have a “lower fee online!”

NY Attorney General: 25% Of Gas Stations "Engage In Deceptive Practices"

New York’s Attorney General, Andrew Cuomo, is warning consumers after an undercover investigation found that 25% of gas stations are engaging in “deceptive practices, including wrongfully surcharging credit card customers.” The AG says that under New York state law, retailers are not allowed to impose surcharges for using a credit card.

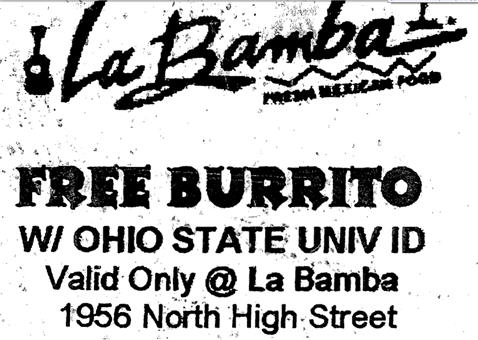

Ohio Attorney General Sues Credit Card Marketers Over Ohio State "Free Burrito" Event

Ohio Attorney General, Mark Dunn, is suing Citibank-affiliated credit card marketers for violating Ohio’s consumer protection laws during a “Free Burrito” event at Ohio State University.