Now that its retail partner Costco has moved on to different credit cards, AmEx is apparently looking for some new customers who are a little downmarket from their old ones. Like its pal Bluebird, the card is reloadable and can even accept direct deposits from your employer. It offers one extra thing as an incentive to go prepaid: cash-back rewards like a credit card. [More]

debit cards

Choosing The Wrong Prepaid Debit Card Can Cost You Up To $500/Year In Fees

While prepaid debit cards have long been criticized for having too many fees (and for being less than transparent about those fees), the impact of those fees will largely depend on how you use a particular prepaid card. Choosing one that’s ill-suited to your needs could cost you hundreds of dollars a year in fees that you didn’t need to spend. [More]

Chase Says It Will Replace All Debit Cards With Chip-Enabled Cards

After an earlier report that it would do so, JPMorgan Chase says it’ll be reissuing debit cards for all its customers, replacing the old magnetic strip cards with those containing microchips for increased security. [More]

Sally Beauty Looking Into “Unusual Activity” On Payment Cards At Some U.S. Stores

In what has become an unfortunately familiar experience, yet another retailer is announcing that it might’ve been the victim of a potential data breach: Sally Beauty confirms that it’s investigating “unusual activity” involving payment cards at some of its U.S. stores. This, a year after a breach that affected tens of thousands of customers. [More]

Student IDs That Double As Debit Cards Carry Significant Overdraft Fees

The cozy relationship between institutions of higher education and credit card issuers has come under increased scrutiny in recent years as consumer advocates and legislators have debated whether or not products like student IDs that double as credit or debit cards provide an actual benefit to students or if they’re just a way for schools and banks to rake in the big bucks. According to a new report from the Center for Responsible Lending, the excessive overdraft fees surrounding the use of the cards suggest the latter point. [More]

Meijer Offering $10 Coupon To Customers After Two Credit & Debit System Failures

Meijer is trying to win back customers with an apology and a $10 coupon, after customers were forced to either pay cash or abandon their shopping carts two days in a row last month. The retailer suffered two credit card system failures, two days in a row, that kept shoppers from paying for their goods with credit or debit cards. [More]

Supreme Court Refuses To Hear Retailers’ Complaints About Debit Card Swipe Fees

More than four years after the Dodd-Frank banking reforms directed the Federal Reserve to set a standard for swipe fees — the money charged to retailers by banks for each debit card transaction — the hotly debated issue appears to have hit a dead-end with the U.S. Supreme Court deciding this morning to not hear an appeal from retailers who contend the Fed set the fees too high. [More]

CFPB: College Credit Card Agreements On Decline; Debit, Prepaid Card Agreements Increase

Since Congress passed the Credit Card Accountability, Responsibility, and Disclosure (CARD) Act in 2009, the cozy relationship between credit card issuers and institutions has fractured. But while the number of agreements between the two entities has declined drastically, that doesn’t mean banking on campus has gotten any safer for students. [More]

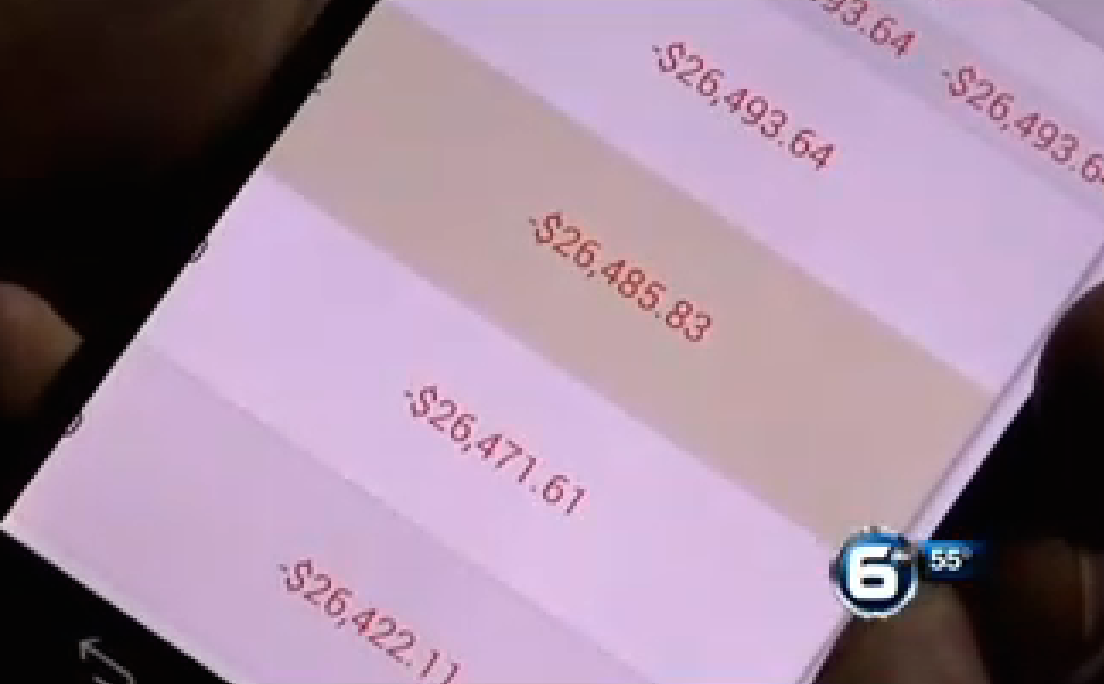

Restaurant Accidentally Overcharges Customers Anywhere From $8K To $99K

Some Knoxville, TN, residents are fuming mad at a local chain restaurant after seeing that their debit and credit cards have been charged 1,000 times what they should have been for their meals, leaving people in the red for anywhere from $8,000 to $99,000. [More]

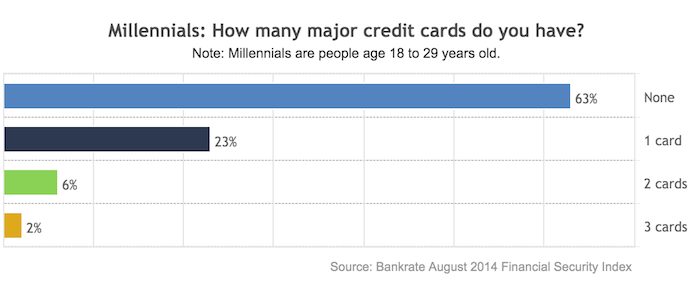

Nearly 2 Of 3 Millennials Don’t Have Credit Cards

Millennials — those Americans currently between 18 and 29 years of age — never really lived in a world without debit cards, when the only way to make a non-cash purchase was to use a credit card or hope the store accepted personal checks. So it may come as little surprise to some that nearly two-thirds of the consumers in this age group don’t have a single credit card to their names. [More]

Couple Accused Of Stealing $16K By Exploiting Debit Card With Magically Increasing Balance

To my knowledge, there has never been an established, official “opposite day,” whereby spending money on products you actually magically increase how much money you have, much less an “opposite bunch of months” where this happens. So when a couple using a debit card that made them richer with every purchase realized what was happening, the legal thing to do would’ve been to pipe up. [More]

P.F. Chang’s Security Breach Involved 33 Locations, Goes Back To As Early As October 2013

Consumers’ worried their credit card information was compromised during a security breach at P.F. Chang’s China Bistro earlier this summer now have more details. Investigators have determined that the breach affected customers’ credit card information at 33 restaurants and began as early as October 2013. [More]

10 Answers To Credit Card Questions We Get Asked All The Time

Credit cards come with a lot of fine print. But the scene isn’t just complicated for cardholders; it’s complicated for the retailers that accept them, too. What needs signing, and what doesn’t? When can a store ask for ID? Are they allowed to charge different prices for cash and credit? [More]

Suze Orman And Magic Johnson Prepaid Cards Come To An End

Lending their names to a reloadable prepaid debit card might be a hot way for celebrities to make money and take up permanent residence in their fans’ wallets, but they’re also widely criticized for their high fees and taking advantage of unsophisticated consumers. Now the cards promoted by two big names who really should have known better, Magic Johnson and Suze Orman, are shutting down. [More]

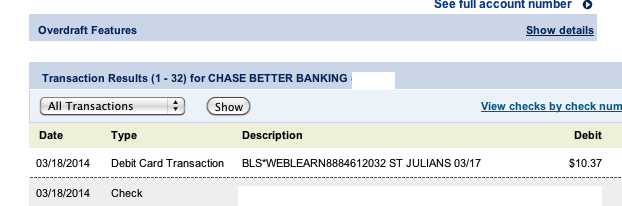

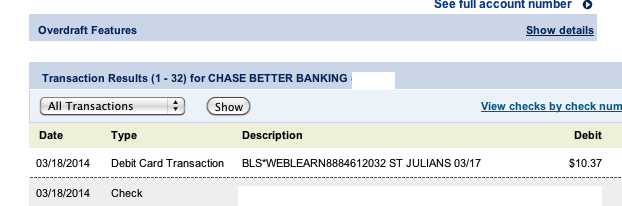

More Details Revealed On WEBLEARN Debit/Credit Card Scam

Last week, we told you how our banking sources had linked the recent rash of fraudulent debit and credit card charges from a mysterious company listed as WEBLEARN to the scammers behind a similar scheme that had dinged victims’ accounts for bogus $9.84 transactions during the holidays. Some further investigation by those better equipped to do so has turned up more on this link. [More]

Fraudulent WEBLEARN Debit/Credit Card Charges Possibly Linked To Earlier “$9.84” Scam

We recently told you about a rash of low-value fraudulent charges attributed to a mysterious company called “WEBLEARN” popping up on credit and debit card statements. Since then, we’ve heard from hundreds of people who’ve been hit with these charges and while we still don’t know where the scammers got the purloined card numbers, the identity of the scammers is now less of a mystery. [More]

Walmart Slaps Visa With $5B Lawsuit For Allegedly Fixing Card Swipe Fees

Thought retailers were done fighting credit card companies over those credit and debit card swipe fees? You thought wrong! Or not wrong, because no one can predict the future, but Walmart is steamed up and suing mad at Visa, alleging in a new lawsuit that the card company set ridiculously high card swipe fees. [More]

Appeals Court Resurrects Fed’s Debit Card Swipe Fee Limits

In a move that will please banks and annoy retailers, a federal appeals court has overruled a lower court decision on swipe fees — the amount banks charge retailers for each debit card transaction — and revived the previous controversial standards put in place by the Federal Reserve in 2011. [More]