Last fall, Jay’s mother died after a heart procedure. We’re very sorry for his loss, but also very sorry that her death meant that he has to deal with Bank of America. Before the procedure, she added him to her accounts as a signatory, not realizing that doing so didn’t give him access to her safe-deposit box. Going through probate in order to get the documents he needs to access the box will cost more than $1,000. What’s inside? No one knows. Certainly not Jay, even though he’s the executor of his mom’s estate and her only heir. It could be a copy of her will, or it could be stacks of gold bullion. [More]

death

I Can’t Believe My Friend Is Dead, And Neither Can T-Mobile

Tanya’s sister Tina died in a motorcycle accident this past summer. It’s hard enough to deal with the untimely death of a young person, but Tina’s emergency care after the accident left huge medical bills for her estate to take care of. And there’s one irritating thing left that her family can’t make go away: T-Mobile won’t close her mobile phone account, even after receiving the death certificate. [More]

Tuna Cannery Worker Cooked To Death In Massive Steam Oven

The family of a 62-year-old employee of Bumble Bee Foods wants people to remember how hard he worked to support his family and the pride he took in his lawn, and not the tragic and horrible way that he died on the job. That’s completely understandable, but it’s hard to ignore the man’s death, an industrial nightmare. [More]

Man Wins Bug-Eating Contest To Get Free Snake, Then Collapses And Dies

How far would you go to get something for free? A Florida reptile store held a contest where entrants had to eat roaches and worms. The champion bug-gobbler would receive a free–totally free–pet python. Remarkably, more than one person entered this contest. Tragically, the winner, a 32-year old man, vomited and collapsed after the contest, later dying in an area hospital. [More]

We’re All Gonna Die, Might As Well Make Some Money Off It

Imagine that you, your spouse, or a beloved relative is terminally ill. A man approaches you and asks whether your family would be interested in a little proposition. Your relative would need to provide their name, Social Security number, and a signature or two. In return, they would receive a few thousand dollars. Sounds like an identity theft scheme, doesn’t it? Only it was all perfectly legal. No families were swindled, no fake credit cards were opened. The lawyer behind this scheme was taking advantage of a loophole in the rules of a specific type of life insurance product, variable annuities. Investors used a system intended to protect a large nest egg for future generations to profit without having to die. [More]

After 2 Fatal Megabus Accidents In A Week, Illinois Governor Wishes Feds Cared

Megabus is not having a very good week. The company settled a wrongful death lawsuit, agreeing to pay $5.1 million to the family of a man hit and killed by a Megabus in a downtown Chicago crosswalk in 2010. The day before the settlement was announced, another Megabus hit and killed another elderly pedestrian in a crosswalk just a few blocks away from where the 2010 accident occurred. Last week, a bus leaving Chicago hit an overpass, killing one passenger and injuring dozens more. Oh, and a Charlotte-bound bus caught fire in Georgia this week, too. The National Transportation Safety Board declined to investigate this week’s incidents, and Governor Pat Quinn isn’t happy about that. [More]

Why Private Student Loans Are A Dangerous Game

Co-signing a younger relative’s private student loans doesn’t seem like such a reckless idea. After all, it’s an investment in their education and careers, they’ll certainly be able to pay it all back once they’re educated, and they’re going to outlive you, anyway. That’s not always the case, and the risks can be substantial. Jessica’s best friend had her grandfather, now 80 years old, co-sign her private loans with Citibank. After her sudden and shocking death, now he’s on the hook for $70,000. [More]

Key Finally Decides Not To Make Family Pay Dead Student's College Loans

When a person dies and their estate is settled, any remaining debt dies with them, including student loans. But there’s an exception: if a parent or other responsible grown-up co-signs a loan and the borrower dies a tragic young death, that co-signer is on the hook for the entire amount of the loan. That’s how co-signing works, after all. But after a Rutgers student died in 2006 after two years in a coma, most of his lenders (credit cards and student loans) deferred, then forgave his debts. Key Bank was the holdout, since the student’s father had co-signed his college loans at Key. Since 2006, the family has paid $20,000 of the $50,000 balance. It took an awful lot of negative publicity, but Key says that they will forgive the debt, and might not even put future families in the same terrible situation. [More]

Wells Fargo Does CD Paperwork For Wrong State; It's Your Problem

Earlier this year, Ken’s father passed away. He had been investing in certificates of deposit for decades, and had set up each CD with one of his sons as beneficiary, so that accessing or re-investing the money would be simple…or as simple as any transaction with a megabank ever is. Out of all of the CDs, the only problem was one at Wells Fargo. Since the beneficiary information was missing from their computer systems, they needed the original receipt from when the account was opened. Ken’s dad was originally issued the wrong type of receipt for the state he lived in, so there was no proof that Ken was the beneficiary for the account. Now he needs a court order to get to the account. [More]

Toys 'R' Us Must Pay $20.6 Million In 2006 Pool Slide Death

We enjoy mocking Banzai and their tendency to put wildly inaccurate photographs of their products on the boxes. But another wild inaccuracy led to tragedy in Massachusetts in 2006, when a 29-year-old mother went headfirst down an inflatable waterslide that collapsed. She broke her neck and later died as a result of the injuries. The jury deliberated for less than an hour before awarding her survivors $20.6 million–and they weren’t even allowed to hear about the other person allegedly paralyzed by a similar injury while using the same product. [More]

Close Up Loved One's Accounts After They Pass Away

If the responsibility has fallen on your shoulders to close up the accounts and cancel the contracts of a loved one who passed away, it can be a painful, slow, and confusing process. Here are 9 tips to make it go smoother. [More]

DirecTV Sees Your Father's Death As Sales Opportunity

Carl’s father had DirecTV service at the time that he passed away, and Carl called them up to cancel the account while settling the estate. The satellite provider chose to see his father’s death as a retention opportunity, using emotional appeals to try to get Carl to take over his father’s service at his own home. Carl was not pleased. [More]

Boy Dies In Roller Coaster Fall

A 3-year-old Chicago-area boy died after he fell off an indoor amusement park roller coaster. [More]

Things To Put In Your "I'm Dead" Folder"

Besides the usual will, investment account information, and the truth about your secret crime-fighting identity, one thing you’ll want to put in your “When I’m Dead” folder is contact information for key helpers and vendors, writes Karin Price Mueller over at Second Act. This is info for people like your accountant, attorneys, financial advisers, gardeners and home security folk. It will really help out who is managing your affairs after you’ve passed. [More]

What Should I Know To Provide For My Family After I Die?

While everyone should have their financial and legal affairs in order in case of sudden and untimely death, reader Charlie has to worry about this much too early in his life. He’s been told that he has only a few years to live, and wants to begin planning now to make his passing easier on his family and to provide for them. [More]

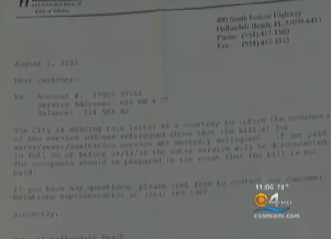

Too Bad Your Dad Died: Now Give Us $363

Melissa’s father passed away at the end of January. She’s just now settling his estate, and most companies she has dealt with have been accommodating and understanding. The exception? Verizon Wireless, which told Melissa that it was her fault she hadn’t been able to contact them until they sent a collection notice. She owes–or, rather, her father’s estate owes–$362.80 that she doesn’t have on hand. They’re making a sad and difficult time even worse. [More]

AT&T Demands UVerse Upgrade To Remove Dead Father's Name From Account

It can be very useful to be grandfathered into an old plan that isn’t available anymore. What one Reddit poster and his mother have discovered, though, is that it creates some problems. Like when someone dies, and AT&T insists that they can’t make any changes to your DSL and landline account unless you upgrade to UVerse. [More]