As you may have heard, more than a few people around the country have been out and about in recent weeks in protest of — well, in protest of a lot of things. But what many of these people (and many of us who are sitting in our homes) share in common is that they’re fed up with the super-sized banks and are looking for alternatives. This appears to have led a growing number of people to the front door of their local credit unions. [More]

credit unions

November Fifth Is Bank Transfer Day

Remember, remember, the fifth of November, because that’s when “Bank Transfer Day” is happening. By that date, all participants will have closed their big retail bank accounts and put their money in a local non-profit credit union or local or regional community bank. [More]

Non-Credit Union Alternatives To Banks With Monthly Debit Card Fees

While often the default response online to people looking for something other than a big retail bank to stash their cash is to shout, “Credit union! Credit union!”, they’re not the only game in town. [More]

Credit Union Decides To Clear Out Foreclosed Home Five Days Early

An Oregon woman who had recently moved out of her foreclosed home had been told by her credit union that she had until this Friday to clear her remaining property out of the home. But that didn’t stop the lender from sending out a moving company this past weekend to take her stuff away anyway. [More]

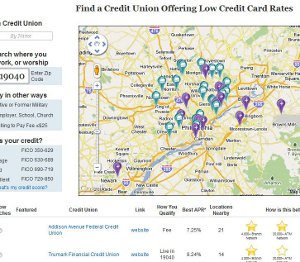

New Search Tool Helps You Find Credit Unions With Decent Credit Cards

As many of the bigger banks have reacted to credit card regulation by nickel-and-diming their customers, a number of people have begun looking to not-for-profit credit unions as a lower-cost alternative. Unfortunately, since most unions don’t advertise and there often isn’t one on every corner, they can be difficult to locate. But a new search tool from the folks at Nerd Wallet can help point you in the right direction. [More]

How Can I Fix My Capital One Data Entry Error?

Devin moved his banking to a local credit union. Hooray! The problem is that he accidentally gave his credit card company the wrong bank account number when he switched banks. He didn’t find out about the mixup until after his due date had already passed. He wonders: is there anything he can do to avoid the late fees and interest hikes sure to follow? [More]

How To Find A Good Local Bank

So you’re tired of banking at one of the big, faceless national chains and want to keep your money local? You can try one of the recent sites devoted to the local bank movement, like anewwayforward.org or moveyourmoney.info, or you can follow this Kiplinger columnist’s lead and do it yourself with a little online research. [More]

That Mysterious $230,000 Deposited In Your Bank Account Is Probably Not Yours

If you checked your bank account balance to see a mysterious $230,000 deposit, what would you do? If your answer is “contact the bank and make sure the money goes back to its rightful owner,” you are correct. If you said “buy a Camaro and a new wardrobe, check into a hotel, and brag about your windfall to a police officer,” you are incorrect. Unfortunately, an Alaska fisherman chose that second option, and now he’s in jail. [More]

Credit Unions Ask Customers To Leave

Credit unions might be attractive alternatives to big commercial banks, but they’re not crisis-proof. OregonLive says about a fifth of the nation’s credit unions are having financial troubles right now. To get in better financial health, they’re introducing fees for services that have long been free, and even asking members to move their deposits to other institutions. [More]

VIDEO: Should I Go Credit Union Or Bank?

Sick of interest rate hikes, new hidden fees, and their credit lines cut, more consumers are trying their local credit union a shot. This CBS video takes a look at a credit union in Michigan who bought back their credit card program that they had sold to large bank after members started complaining. [More]

Magical USAA Check-Depositing Smartphone App Now Available For Android

Do you envy iPhone users’ ability to deposit checks in their USAA accounts by snapping a picture and using a fancy secure app? Now, check-zapping abilities have been granted to phones using Google’s Android mobile operating system. [More]

Break Up With Your Bad Big Bank This Valentine's Day

You know what, it’s just not working out. I’m sorry, giant bank, but it’s time for both of us to move on. This Valentine’s Day, it’s time break up with your big bank, and this website will help snip the ties that bind. [More]

Overdraft Fees Up 35% In Past Two Years

As a nation, we pay more each year in overdraft fees than we do for books, cereal, or fresh vegetables, says the Center for Responsible Lending (CRL)—and considering how outrageously expensive cereal is, they must be talking about a huge sum. They are: “Banks and credit unions collected nearly $24 billion in overdraft fees last year, an increase of 35 percent from just two years earlier.”

USAA: Opt-Out Of Mandatory Binding Arbitration By Closing Your Account

The “credit union on steroids” has gone to mandatory binding arbitration for all disputes, removing customers’ ability to successfully sue them if things go wrong. Previously, USAA had arbitration as an option, but allowed members to opt out. Now, if you want to opt out of arbitration, you’ll have to close your accounts.

Credit Unions Dive Into The Student Loan Market

Private loans are the worst type of student debt, but the best place to get them may be your local credit union. Like most credit union products, their loans are usually a better deal with more favorable terms than similar loans from bigger banks.

Study Of Credit Unions Indicates CARD Act Will Benefit Consumers

Two Harvard doctoral students in economics compared how credit unions and banks operated their credit card divisions, and concluded that the recent CARD act “is likely to bring about moderate, and even positive, changes,” as banks begin to emulate parts of the fairer business model of credit unions. Specifically, they say, all the doom and gloom from the banking industry about how consumers will get shafted by the new rules is mostly fearmongering.

Disney Credit Union Sends Debit Card That Is Already Expired

Poor Ruben just wants his Disney Credit Union card to work, but there appears to be no hope — unless he can stand to listen to an hour of the Main Street Electrical Parade Theme while on hold. If you’re not familiar with this particular composition, let us assure you that it is the kind of music used in interrogations to extract confessions.

Update: USAA Posts Notice On Website Regarding Technical Issues

Last week we raised the ire of plenty of USAA fans by posting a story about a woman’s IRA that went missing for nearly a day. We were as surprised as many of you that she’d received such poor customer service from the first CSR she spoke with, considering USAA’s usually stellar reputation. But the next day someone from USAA contacted Travis and his wife to find out what went wrong. Here’s Travis’ update.