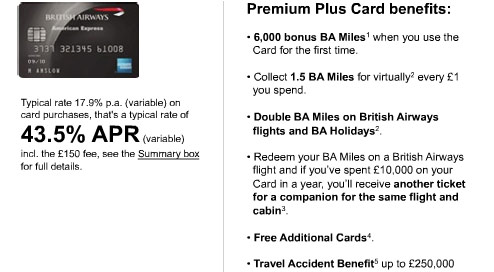

Perhaps this British Airways American Express Premium Plus Card’s interest rate is in “metric” APR, but if not, no matter what side of the pond you’re on on, or road you drive on, you must agree that a 43.5% variable interest rate is bollocks. Who cares how many bonus miles you get, they’re just going to get devalued anyway.

credit cards

Is This $0.10 Credit/Debit Surcharge On Gasoline Allowed?

Reader Brian wants to know how to tell a “surcharge” applied to a credit/debt card transaction vs a convenience charge?

Reader Refuses To Give Driver's License With Credit Card Purchase

Reader Brandon is obviously familiar with number 3 in the 10 Things You Might Not Know About Your Credit Card post, holding firm in the face of a retailer who wanted Brandon to give his driver’s license when he bought something with a credit card:

10 Credit Card Company Tricks To Beware

Are you smarter than a credit card company? They’ve got billions riding on their belief that you’re not. Check out these 10 methods, via the Americans for Fairness in Lending, credit card companies use to make extra money off you that you may not even be aware of, knowledge that could save you hundreds in extra fees.

10 Things You Might Not Know About Your Credit Card

You might think that everyone knows that you have to sign your credit card in order for it to be valid — after all — there’s a panel on the back that says “Not Valid Unless Signed,” but you’d be shocked at the number of angry emails we get from people who have tried to use an unsigned credit card with “SEE ID” or “CHECK ID” written on it and were turned away when they refused to sign their card.

Shame Yourself Into Spending Less With A Hello Kitty Debit Card

Reader MervinGleasner has Hello Kitty to thank for his unique method of curbing personal spending. In a comment on our “Succeed Through Self-Undermining!” post, he writes:

A Debt Collector Offers You A Credit Card, What's Wrong With This Picture?

Like countless others, reader Ryan is in debt. His debt is to the tune of $1,364. He received an interesting offer from the debt collector who is offering “debt reduction” in the form of a pre-approved Visa card in which his $1,364 debt would be reduced to a $1,200 balance if he accepts the card. He would need only to to pay off the balance under the terms of the credit card to eliminate his debt. Ryan wisely wrote to us to ask if this is a good idea. Actually Ryan, it’s a really really really bad idea. His letter and our advice, inside…

Paramedic Steals Credit Cards From Patient, Goes On Shopping Spree At Target

A Cleveland paramedic was arrested last week after being caught on video using credit cards she had stolen from an 87-year-old patient, according to The Plain Dealer. Tiffany Forte, age 32, has been working for the Cleveland Emergency Medical Services for the last seven years. A police statement says she was seen on video surveillance at Target and Marshalls racking up $1000 worth of charges while wearing her EMS t-shirt. Details, inside…

Succeed Through Self-Undermining!

Our post on freezing your credit cards in a block of ice got me thinking. Anything that slows, stops, or impedes making transactions can be used as a technique for limiting your spending. Whatever it may be, cutting up your credit cards, locking up most of your money in an account it takes 3 days to transfer from, giving yourself an allowance, it will be a variation on a single principle: It’s easier to put a hard limit on the future then to make the right decision in the impulsive moment. Installing some kind of an automatic hiccup can help break you out of your desire-driven action and give you the breathing room to step back and make the right choice. So if you have trouble with overspending (or overeating or any kind of bad habit) and your sheer willpower is sometimes lacking, aka, you’re human, try brainstorming ways you can trip yourself up. The world is full of obstacles, it shouldn’t be too hard to find one.

Risk-Based Pricing Is A Myth

Credit card companies need to penalize bad behavior with outrageous fees to keep credit affordable for the rest of us, right? Yeah, not so much. Credit Slips blogger and Georgetown Law Professor Adam Levitin argues that risk-based pricing is a myth that credit card companies exploit to escape well-deserved government regulation.

Sears Cancels Your Account Of 44 Years Because Your Husband Died Ten Years Ago. What?

Meet Judy, Sears’ ideal customer. When Judy’s husband died ten years ago, Sears, like her other creditors, assured her that she could continue using her account. Since then, Judy has used her Sears card to buy a washer, dryer, and refrigerator. Yet when Judy recently tried to buy a $142 saw, Sears insisted on immediately closing her account because it was in her late-husband’s name.

How A Forgotten Blockbuster Video Caused A 2 1/2 Year Battle With Discover Card And Collection Agencies

“Universal Default” is when your credit card company adjusts the terms of your loan because you “defaulted” with another company. In reader P.’s case the “default” was a Blockbuster video that his friend forgot to return. Discover Card took this opportunity to double P.’s interest rate. When he tried to fight it by closing his account, it launched him into a 2 1/2 year legal battle with Discover, a collection agency, and now the credit bureaus.

This McDonald's Charges 25¢ To Use A Credit Or Debit Card, Violates Merchant Agreement

Reader Brandon sent us this picture of a McDonald’s violating its merchant agreement by charging a fee for using a credit or debit card. The text reads, “FEE ASSOCIATED WITH CREDIT/DEBIT CARD OF 25¢ WILL BE APPLIED TO CARD TOTAL.”

Bank Of America Treats Parking Meter Payments As Cash Advances, Charges $10 Fee

Reader Gary used his Bank of America credit card to pay $2 on a parking meter in Washington, DC. Bank of America treated it as a cash advance and slapped him with a $10 fee, as well as a higher APR. When Gary called to complain, he learned that it wasn’t an error: Bank of America has started treating payments to parking meters as cash advances and may even treat all payments to government entities as cash advances.

Citigroup May Reinstate Universal Default

Last year Citigroup pledged to abandon the customer-screwing policy of universal default, where an unrelated late payment or credit score change can trigger an interest rate increase on your Citibank card. They even used a marketing phrase to promote their promise: “a deal is a deal.” According to the New York Times, Citigroup is “quietly reconsidering its pledge” and may decide to reinstate universal default as early as this week.

Chase Shrinks Credit Due Dates Without Warning, Profiting Off Fees

Got a Chase credit card? Check your bill to see if the due date shrunk. For the past ten months, the due date on reader NDphoxylady’s four Chase credit card due date was the fifteenth. Then, without warning or notice, it became the tenth. NDphoxylady only noticed when she was charged a $39 late fee and a $20 finance charge. When she complained to Chase, they told her that simply changing the due date on the bill was adequate notice. Nu-uh

Use Your Credit Card At A Marriage Counselor, See Your Limit Get Reduced

The FTC claims that CompuCredit didn’t properly disclose that it monitored spending and cut credit lines if consumers used their cards at certain places. Among them: tire and retreading shops, massage parlors, bars, billiard halls, and marriage counseling offices. “What they didn’t say was that you could be punished for specific kinds of purchases.”