It’s been 11 months since Michael’s brother PS4 failed, months he’s spent trying to get Sony to fix what should have been covered by the gaming console’s one-year warranty. But because there was no proof of his efforts to have the PlayStation 4 repaired under warranty, prompting Sony to basically shrug and wipe its hands of the situation, Michael had to take another route to victory. [More]

credit cards

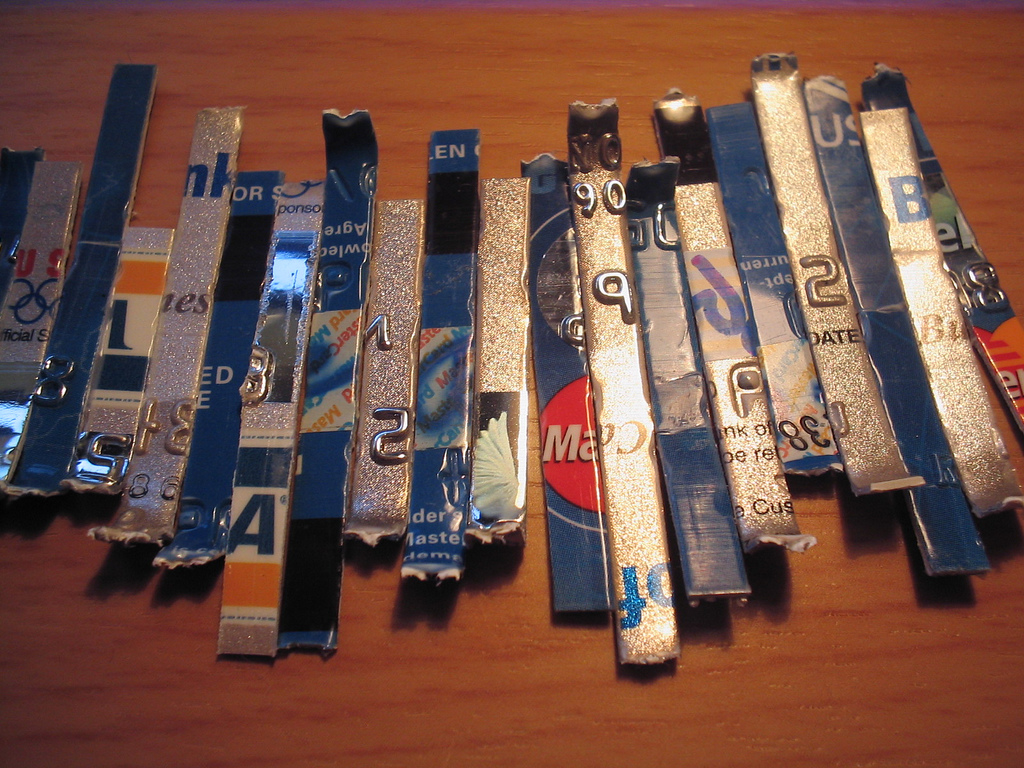

The Chip-And-PIN Credit Card Era Starts Today. What You Need To Know

Over the past few months, you may have noticed more retailers adorning their checkout stands with shiny new credit card readers. While those systems still have an area along the side where you swipe your card’s magnetic strip, they also have a smaller slot (typically) on the front where you simply jam gently insert your card. This is all part of the country’s shift toward more secure, but far from perfect, chip-enabled cards that kicks into high-gear today. [More]

Trump Hotel Breach Likely The Result Of Malware, May Have Lasted More Than A Year

Three months after the Trump Organization confirmed that several of its hotels’ credit card systems had been breached, the company is releasing additional details on the hack that appears to have started with a computer virus and went undetected for more than a year. [More]

Jewel-Osco: Payment System Outage Could’ve Caused Multiple Charges On Customers’ Cards

If you shopped at Jewel-Osco recently and used your credit or debit card to pay, you might want to check your accounts and make sure you weren’t charged multiple times for one transaction: the grocery chain confirmed on Monday that its payment system suffered a glitch that could’ve caused some customers to be overcharged for their purchases. [More]

Discover Card Program Rewards Students Who Get Good Grades. Is That Legal?

Not so long ago, many college campuses regularly played host to credit card company shills, giving away T-shirts and pizzas to students in exchange for filling out account applications. Then the Credit Card Accountability Responsibility and Disclosure (CARD) Act of 2009 put an end to most of these practices, leading card issuers to devise new ways to market directly to the under-21 crowd. [More]

Target Agrees To Pay Visa $67M Over 2013 Data Breach

It’s hard to believe that it’s been nearly two years since cybercriminals breached Target’s in-store payment network and stole credit card data for millions of customers during the year’s busiest shopping season. Credit card issuers went after the retailer because they had to pay for the huge number of replacement cards that were issued to affected customers. Now it looks like Target and Visa have reached an accord that will put $67 million back in those card issuers’ hands. [More]

Auto Loan Debt Tops $1 Trillion For First Time; All Consumer Debt Nearing $12 Trillion

Now that the Great Recession has gone from “is it really over?” to “remember when?” more Americans are buying cars, pushing auto loan debt beyond the $1 trillion mark for the first time in U.S. history. [More]

Square Trying To Help Small Businesses Meet October Deadline For New Chip & PIN Credit Cards

A survey released last week by Wells Fargo found that a majority of small business owners aren’t prepared for the October deadline to switch from traditional swipe-and-sign credit card transactions to the supposedly more secure chip-and-PIN card system. Now, one mobile payment company says it wants to take some of the burden off the shoulders of these companies by offering to pay for any charges incurred from a breach — as long as the business owner has ordered its new card reader. [More]

Most Small Business Owners Aren’t Ready For Chip-And-PIN Credit Cards

Following a string of high-profile data breaches last year, Visa and MasterCard handed down a requirement that all merchants transition to the more secure chip-enabled credit card payment system by October of this year. While several major retailers have already made or are in the process of making the switch, a new report finds that many small business owners don’t even know about the deadline – or the potentially costly consequence of not meeting it. [More]

Which Cities Have The Highest/Lowest Credit Card Debt Burden?

The average amount of credit card debt varies quite a bit from city to city, as does the ability of consumers to pay down that debt in a timely manner. A new study claims to show that the cities with the least amount of credit card debt burden aren’t necessarily the cities with the least amount of debt. [More]

Payment Information From Zoo Gift Shops Breached, May Include Names And CVVs

Have you bought a cuddly stuffed animal or another souvenir recently during a visit to the zoo? If so, keep an eye on your credit card statements. According to reports from financial institutions and an announcement from one affected zoo, a company that manages zoo gift shops recently had its systems breached. [More]

Regulator Issues “Guiding Principles” For Making Real-Time Payments Safe, Secure

If you buy something with a debit/credit card or an online check, there can be a delay of hours or days before the other party gets those funds. Advances in technology are allowing payment platforms to cut that down to mere seconds, which could help consumers by preventing banks from re-ordering multiple transactions to maximize overdrafts. But as non-cash payments inch closer to real-time transactions, federal regulators want to ensure that companies are following certain best practices to make things safe and consumer-friendly as possible. [More]

American Express Automatically Switched Me To Paperless Statements; Is That Legal?

From paying bills online to reading an e-book, advancements in technology have changed just about every aspect of consumers’ lives that used to be printed on paper. But what if you prefer getting your credit card statement in the mail and then find out that you’ve been changed over paperless statements without being asked? [More]

Chase Credit Card Settlement Halts Collections On 528,000 Accounts

Earlier today, we told you of reports that JPMorgan Chase had agreed to pay at least $125 million to close the books on state and federal investigations into its credit card collections practices. Now that the details of the deal have been made public, we know exactly how much the bank will pay and how many credit card accounts are affected. [More]

![JPMorgan Chase To Pay $136M To Close Credit Card Debt Collection Probes [UPDATED]](../../../../consumermediallc.files.wordpress.com/2014/09/chasecard.png)

JPMorgan Chase To Pay $136M To Close Credit Card Debt Collection Probes [UPDATED]

UPDATE: The Consumer Financial Protection Bureau has released the details of the settlement, which put the total value at $136 million, $106 million of which will go to the 47 states (and Washington, D.C.) involved in the investigations. [More]

Regulators Shut Down Debt Relief Operation That Took Millions From Consumers

The Florida Attorney General’s Office and the Federal Trade Commission make a pretty effective pair when it comes to putting an end to companies and operations taking advantage of consumers. Just a day after the regulator and state’s attorney general teamed up to sue a company behind medical alert robocalls, the two entities announced they shut down a debt relief scheme that took million from consumers with credit card debt. [More]

Could You Soon Be Making Purchases By Scanning Your Face? That’s The Plan At MasterCard

Who has time to memorize the special code or password when you could just scan your face to approve an online purchase? While using facial recognition as confirmation you’re, well, you, might seem a little far-fetched, it could be a reality this fall according to MasterCard. [More]

Credit Card Data Breach Confirmed At Trump Hotels

Hotel properties owned by Donald Trump’s Trump Organization are the latest consumer-facing businesses to become the subject of a cybercrime, with the company acknowledging that a data breach has occurred at locations run by the Trump Hotel Collection. [More]