There are many things missing from Aldi that American shoppers expect to find in grocery stores. They don’t have free plastic bags, for example, or candy at the checkout, or items containing added MSG or hydrogenated oils. Another familiar missing item was credit cards: cash, debit cards, SNAP, and EBT cards were accepted, but not credit cards with their higher fees. As of today, though, that changes nationwide. [More]

credit cards

Costco Credit Cards Will Officially Switch To Citi, Visa In June

For more than a year now, Costco has been preparing to take its store-branded credit card business in a new direction. Specifically, it’s transferring its credit card network from long-time partner American Express to Citigroup and Visa. After hitting a few snags in the road, the shopping club now plans to make things official in June. [More]

Retailers Have Chip-Enabled Card Readers, Aren’t Actually Turning Them On

If you’ve received a shiny new chip-enabled card from your bank or credit card company in recent months, then you’ve probably been through this at least once. You see that a store has the slot for your card, so you assume that the store actually accepts them. Silly shopper! The terminal tells you to swipe the magnetic stripe instead. [More]

Sam’s Club To Accept Visa Credit Cards As Of February 1

Shoppers at Sam’s Club will no longer need to ensure that they have the correct credit card on hand or that they’ve brought cash: as of February 1, 2016, the warehouse club will begin accepting Visa credit cards in its stores, finally making all four credit card networks accepted in its stores. [More]

Safeway Says No Payment Data Stolen From California Stores, Only Colorado

There’s potential good news out of Safeway: while the company confirmed that they found skimmers in credit card payment terminals in two states, a spokesperson says that the baddies didn’t harvest any customer data from the stores in California. Instead, the grocer found them back in September while inspecting terminals. While it’s good news that customers didn’t walk up to an ATM only to find their bank accounts drained, it’s still worrisome that someone was able to install the skimmers in the first place. [More]

Colleges Warned About Making Secret Deals With Credit Card Companies

In spite of rules intended to crack down on the once-rampant mis-marketing of credit cards to college students, some schools have not been fully transparent about lucrative agreements they’ve made with card companies, and could face federal penalties. [More]

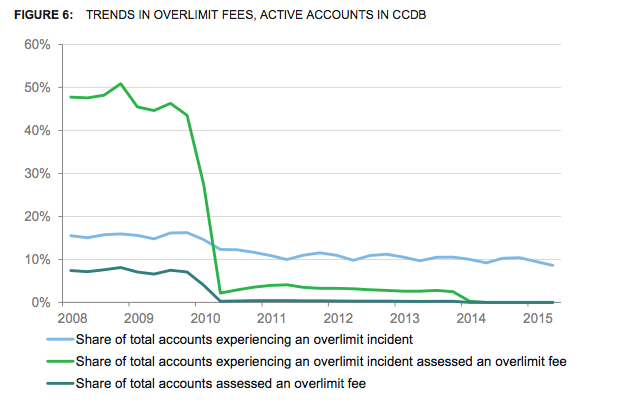

Report: Credit Card Reforms Saved Consumers $16B In Six Years

In 2009, lawmakers passed a massive set of reforms for the credit card industry – known as the Credit Card Accountability Responsibility and Disclosure Act (CARD Act) — aimed at protecting consumers though transparency, fairness, accountability and better access to an array of financial products. A new report from the agency tasked with enforcing these rules, finds that nearly six years after implementation, consumers have saved nearly $16 billion in fees. [More]

San Francisco Sues American Express, Alleging Illegal Restraints On Merchants

Earlier this year, a federal court ruled that American Express violated antitrust laws — resulting in higher costs for consumers — by forbidding retailers that accept AmEx from encouraging customers to use competing cards like those from Visa, MasterCard, and Discover. Now, the city of San Francisco is suing the credit card company to get back billions of dollars for merchants in California. [More]

States Ask Banks, Credit Card Companies To Hurry Up With The Chip & PIN Cards Already

The deadline has come and gone for most retailers to install new microchip-scanning credit card readers in stores, but many stores are still waiting to introduce the devices because a lot of banks and credit card issuers have yet to issue the more secure cards to customers. In the hope of resolving this stalemate, attorneys general for eight states and the District of Columbia have called on the nation’s biggest banks and card networks to start pressing the new plastic ASAP. [More]

Slow Rollout Of Chip-And-PIN Credit Cards May Keep Lines Moving This Holiday Season

October 1 was supposed to be the deadline for U.S. retailers to update their payment systems to accept new chip-enabled credit cards, but a number of stores haven’t finished making this change, and most consumers still have boring ol’ no-chip cards. The good news is that this foot-dragging on everyone’s part may have the effect of not slowing down checkout lines this holiday shopping season. [More]

JPMorgan To Pay $100M To Settle Unlawful Debt-Collection Allegations In California

Four months after JPMorgan Chase agreed to pay at least $136 million to close the books on state and federal investigations into its credit card collections practices, the company reached a $100 million settlement putting an end to a similar investigation in California. [More]

Reminder: Deferred Interest Credit Cards Aren’t All They’re Cracked Up To Be

Each year, consumers marking items off their holiday shopping lists are tempted by retailers’ store-branded credit cards and the offers of “0% interest for 12 months” or “special financing.” And this year – although it’s only October – is no different. [More]

Home Depot Customer Sues For $250K Over $28 Late Fee

Earlier this year, Home Depot charged an Oregon customer a $28 late fee for allegedly missing a payment on his store line of credit. The subsequent dispute over that fee resulted in more fees, a 100-point drop in the customer’s credit score and now a $250,000 lawsuit against the retailer. [More]

Credit Card Processors Aren’t Buying Netflix’s EMV Shift Excuse

When Netflix announced its quarterly results this week, they had an explanation for why their new subscriber number fell short of their projections. The shift to smart-chip (or EMV) payment cards means that the service lost some subscribers while customers received new card numbers and forgot to change them over. That’s a good story, but people in the banking business have some issues with it. [More]

Store-Branded Credit Cards Charge Upwards Of 29% Interest

It can be so incredibly tempting: You’re at the cashier (or about to check out online) with a substantial purchase and you’re presented with the offer to save money now if you just apply for a store-branded credit card. But if you don’t pay off that balance right away, you could be looking at interest rates nearly double the national average. [More]

Netflix Thinks You’re Letting Your Subscription Lapse When Your New EMV Payment Card Arrives

You are, presumably, a financially responsible adult, or aspire to become one. Yet it’s easy for even the most financially responsible grown-up to forget to change everything over when you receive a new credit or debit card. As banks are supposed to replace all of our cards for the EMV changeover, our forgetting to update the cards on our Netflix accounts is actually affecting the company’s profits. No, really. [More]

Target To Be First Major Credit Card Issuer To Require PINs For Chip-Enabled Cards

While many banks and other financial institutions issuing credit cards have shifted from magnetic-strip cards to the more secure EMV smart cards, most of those companies have opted to let their customers continue signing for purchases rather than memorizing a PIN. That apparently isn’t the case for Target, which is poised to become the first major credit card issuer to convert to cards that require a PIN. [More]

CFPB To Consider Rules That Would Revoke Banks’ “License To Steal”

The lengthy, often complicated terms of use for more than half of all credit cards — and nearly half of all federally insured bank deposits — include clauses that force customers into arbitration, taking away their right to sue these companies in a court of law and usually blocking them from joining together in a class action. Critics argue that these forced-arbitration clauses allow banks and other businesses to break the law with impunity. Heeding the call of lawmakers and consumer advocates, the federal Consumer Financial Protection Bureau has decided to consider rules that would ban this practice among financial institutions. [More]