FICO score isn’t the only credit score game in town. That’s good news for people who have low scores thanks to being an immigrant, divorcee, or don’t have the means to acquire the credit in the first place. It’s one of those quirks of the system. To get credit, you have to have a credit history. To get a credit history, you need to be able to get credit. Thusly, some people find themselves a bit stuck. To meet the needs of these these “thin credit file borrowers”, some alternatives to the standard FICO score are out there. Let’s look at three.

credit bureaus

What's The Point Of Credit Repair Companies? (Not Much)

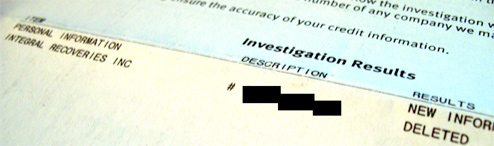

If you have bad credit and have been thinking about working with a credit repair firm, think again. Credit repair services aren’t doing anything that you can’t otherwise do for yourself. They review your credit history, lodge disputes, follow up, rinse and repeat. The appeal of a credit repair service is that they spend all that time resolving issues so that you don’t have to. They can’t take legitimately negative things off your record and they can’t work magic. Any firm that promises or guarantees to improve your score isn’t telling you the whole truth and you should watch out.

Check Your Credit History Year-Round, For Free

Statistics show that 80% of credit histories have at least one error. Most of them are minor and inconsequential but some can have an adverse effect on your credit score, often costing your thousands on mortgages and car loans. I believe credit bureaus were so lackadaisical about accuracy because it forced consumers to buy their credit reporting services. You wouldn’t know there’s an error unless you paid Equifax for a copy of your report. Fortunately, federal law now makes it possible for us to police our own records and force bureaus to correct them, all on their dime. Here’s how:

Paying Cards Off Doesn't Mean Reported Balances Are Zero

Personal finance columnist Liz Pulliam Weston saw Rebekah’s story yesterday, “Is It OK To Use Credit Cards For Everything, If You Pay Them Off Every Month?” and wanted to clarify something important. If you pay off the cards in full, the balances reported to the credit bureaus will not be zero. More likely, it will be the balance from your last statement. Liz writes:

One Day Left To Register For TransUnion Class Action Lawsuit

September 24, tomorrow, is the last day to register for the class action against TransUnion for selling consumer’s private data to businesses without permission. If you held a credit card between January 1, 1987 to May 28, 2008, you’re eligible to receive benefits. You can choose from one of three options:

Steve Jackson Disses Lameo Free Credit Report Monitoring Service

Steve Jackson, a well-known game designer, got an offer for free credit report monitoring from his bank. When he called up the monitoring company, Intersections Inc, the customer service rep rattled off a boilerplate agreement and asked for his assent. When he asked if they would send him a copy, she said they don’t send out copies. When he asked then how he would have a record of what they agreed to, she got huffy and said, “This is free. You don’t need to worry about it.”

Really, Credit Bureaus, I'm Not Dead

I have been battling with a silly preconception the federal government has concerning my status as a deceased person, that causes them to routinely shut down credit cards that I am using, and stresses my ability to build credit. (All this despite being actively enlisted in the US Navy)…

Mailing Addresses For TransUnion, Experian, Equifax

Having trouble finding the mailing address for any of the three major credit bureaus, TransUnion, Experian, Equifax? Here they are:

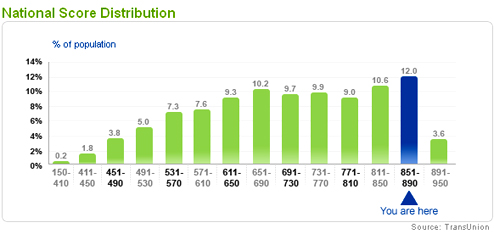

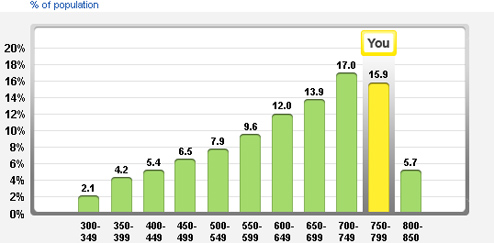

CreditKarma.com Makes Free Credit Score More Like FICO's

The CreditKarma.com site we told you about in our roundup of “5 No BS Ways To Get A Credit Score For Free” has changed its calibration system so the free, advertising-supported, credit score it gives you is now on the 300-850 range, just like your FICO score. It’s still not your FICO score, but it does make the approximation, based on TransUnion data, more relevant. If you’re do some major money moves, like getting a mortgage, you would still want to pay for the FICO score for total accuracy, but if you just want a general sense of how you’re doing, CreditKarma.com is a great way to do it for free.

After a multimillion-dollar verdict, attorneys get fee award, too

To add (just) insult to (just) injury, a Florida judge awarded $518,301 to Angela Williams’s attorneys (PDF link). Ms. Williams recently won almost $3 million in a lawsuit against Equifax for Equifax’s refusal to fix her credit report after her identity was stolen.

Know Where To Fix Your Credit Score By Getting Your Reason Codes

If you want to improve your credit score, a score from 300-850 that lenders use to determine whether you qualify for a loan and how much interest to charge you if you do, you’ll want to know your “reason codes.” These are 2-digit numbers that come with you credit score when you purchase it. Each bureau usually gives you four reason codes with their report, so get your score from each one for a total of 12. One wiki tutorial says that reason codes are listed in order of importance. Armed with that, The Mechanics Of Credit site decodes all the reason codes and prescribes solutions for each one. With this info and tactics, you should be able to boost your score a couple of points and save a bundle.

Reach Equifax Customer Care

If calling the regular Equifax “customer service” (cough, cough) line at 866-640-2273 doesn’t work for you, customer.care@equifax.com is an email address you can use to try to resolve problems with your Equifax credit report. Equifax really doesn’t give a damn about you because you’re not its customer, banks and lenders are, but a reader says that he was able to use this email address to get an Extended Fraud Alert that he didn’t put on taken off his account. You can also try 404-885-8000, which is a direct line into their Atlanta corporate headquarters.

How Can A Minor Get Their Credit Report?

“Why can’t I get my credit report?” one of our 16-year-old readers (obviously precocious in the personal finance responsibility department) wanted to know. It seems if someone under 18 tries to get it online, say through annualcreditreport.com, they’re told no. It turns out you can order your report, you just need to do it by an old-fashioned letter. You’ll want to to include in your request your name, address, and Social Security number. This is good not just for go-get-em kids like our reader who want to make sure no one is buying a $40,000 boat with their credit, but also parents who want to protect their children from identity theft. The addresses for each of the bureaus follow.

../../../..//2007/12/21/ftc-takes-heat-for-giving/

FTC takes heat for giving credit bureaus a special exception that allowed them to make lists of people who just filled out a loan application and sell them as leads to subprime lenders. [USA Today via U.S. PIRG Consumer Blog]

Consumer Wins $2.7 Mil Lawsuit Against Equifax For Screwing Up Her Credit

Angela P. Williams tried for more than a decade to clear up her credit report after Equifax confused her records with those of a person with bad credit but a similar name. The company denied any wrongdoing, right up until the jury awarded a $219,000 verdict in damages against Equifax, and $2.7 million in punitive damages for violating the federal credit-reporting laws. The decision is a victory for frustrated consumers at the mercy of these powerful institutions whose record-keeping errors can ruin innocent lives.