The Illinois AG filed a lawsuit this week against Countrywide, alleging that the now imploded mortgage lender steered blacks and Latinos into riskier subprime loans more often than whites, even when they qualified for safer mortgages. [More]

countrywide

FTC: Countrywide Mowed Your Lawn, Marked Up The Cost And Called It A Fee

The FTC says that Countrywide (now part of Bank of America) has agreed to pay $108 million to settle charges that the company “collected excessive fees from cash-strapped borrowers were were struggling to keep their homes.” So, what exactly did they do? Well apparently, while acting as a mortgage servicer, the company actually hired vendors to service properties after the homeowners had fallen behind on their mortgages, marked up the cost of the services (lawn mowing and property inspections, for example,) and then passed the cost along as fees. Doesn’t sound legal? It wasn’t. [More]

Countrywide Settles Class-Action Suit For $624 Million

Bank of America took a little kick in the shins today as Countrywide Financial Corp, the mortgage lender they acquired in 2008 as it suck into the quicksand, has agreed to a $624 million settlement of a class-action lawsuit accusing it of misleading investors about its lending practices. [More]

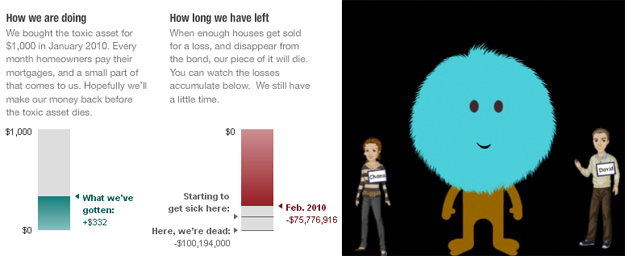

Reporters Buy Up Toxic Assets

To dig right into the meat of the story they’ve been tracking for over a year, NPR Planet Money reporters David Kestenbaum, Chana Joffe-Walt plunked $1000 down and bought up a securitized pack of Countrywide mortgages. At one point it was worth $75,000. Will the homeowners pay their mortgages and the reporters make their money back or will too many houses get sold at a loss and the asset implode? Follow along and find out. [More]

Reach Countrywide Executive Customer Service

Here is some Countrywide executive customer service info. Even though Bank of America acquired Countrywide, some of this contact info is still valid. Former Countrywide customers who experiencing post-integration account difficulties have reported success using it. [More]

Will A Human At BofA Finally Please Modify My $160,000 Underwater Mortgage

Jim and Susan’s mortgage is underwater by $160,000. They want to live up to their obligations, they want to keep their home, but they can’t do it with a $370,000 mortgage on a house that’s only worth $210,000. An attorney told them to send some “jingle mail,” just pop the house keys in an envelope, mail it to the bank, and move away. What they really want is a modification so they can stay in their house, but Bank of America has been jerking them around and they don’t have faith that this last hurdle will actually get them a mod. Isn’t there a decision-making human at BofA that can finalize this deal for them? [More]

Insiders: Countrywide Made Racist Sub-Prime Loans

The Wells Fargo racist sub-prime mortgage lawsuit reminded me of an old post we did where an ex-Countrywide employee alleged that that loan company had racist practices too. Here’s the insider email we posted back in February, 08:

Lawsuits: Countrywide Ex-CEO To Feel Wrath Of SEC

His extreme orangeness, former CEO and founder of Countrywide Home Loans Angelo Mozilo, is about to be slapped with civil fraud charges, according to the Wall Street Journal.

Worst Company In America: FINAL FOUR Comcast VS Bank Of America

A big cable company vs a big bank. A repeat of our final match-up of 2008. Last year Countrywide (now part of Bank of America) prevailed. Which one will you choose?

Worst Company In America: Starbucks VS Bank of America

Expensive coffee that “tastes burnt”? Or the owners of Merrill Lynch and Countrywide?

Battle Of The Most Hated Companies: Countrywide Sues AIG

Last year’s Worst Company in America winner, Countrywide Home Loans, has sued AIG for not paying their claim on losses from failed real estate loans that they had insured with the company.

Consumerist's Top 10 Business Debacles Of The Year 2008

As is our habit, we provided Ad Age with a list of our Top 10 Business Debacles of the Year. Are you ready for the pain?

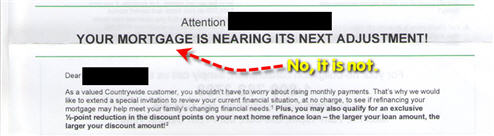

Countrywide To Fixed Rate Customer: Your Mortgage Is About To Adjust!

Countrywide either doesn’t know, or doesn’t care that reader Graham has a fixed rate mortgage, because they keep sending him “notices” that his mortgage is about to “adjust.”

5 More Wall Street Dudes Who Deserve A Punch In The Face

WallStreetFighter has listed 5 more Wall Street dudes that deserve the old “Dick Fuld” right in the face. Guess which Wall Street loser is most punchable?

Ex-Countrywide Employee Sells Your Data, They Offer Credit Monitoring Service, Hang Up When You Ask For It

Re: Countrywide Sends Fraud Alert Letters: ‘Your Info May Have Been Sold,” Reader Esqdork writes, “Yesterday, I phoned Countrywide to get them to extend the credit monitoring service [that they offered in their apology letter] to my co-borrower and was promptly hung up on.” The only surprise here is that they even picked up in the first place.

Countrywide Sends Fraud Alert Letters: 'Your Info May Have Been Sold'

I received a letter from Countrywide today that says: