The federal government recently filed a lawsuit over a Countrywide scheme dubbed “The Hustle” that removed impediments to a mortgage approval so the company could sell as many mortgages as possible to Fannie Mae and Freddie Mac. Now comes news that a Countrywide exec who ignored warnings about the Hustle is currently running Chase’s foreclosure review initiative. [More]

countrywide

Exec Who Looked Other Way As Countrywide Sold Off Bad Mortgages Is Now Running Chase’s Foreclosure Review Dept.

Can Bank Of America Argue Its Way Out Of Federal Lawsuit?

Last week, the federal government reminded Bank of America once again of how stupid an idea it was to acquire Countrywide Financial, filing the latest in a slew of lawsuits that have already cost BofA an estimated $40 billion. But some say that the bank might have some legal wiggle room in this case. [More]

Feds Sue Bank Of America Over $1 Billion In Bad Loans Sold To Fannie Mae, Freddie Mac

Bank of America continues to crawl through the legal spanking machine because of its ill-fated, idiotic, utterly stupid decision to buy Countrywide Financial and its mountain of toxic mortgages in 2008. This time, it’s the U.S. government that has sued the bank over all the rotten loans it sold to Freddie Mac and Fannie Mae, both of which were bailed out by the feds in 2008. [More]

How Much Have The Big Banks Been Penalized Over Mortgage Mess And Where Is All That Cash Going?

The last few years have seen numerous settlements between the nation’s biggest mortgage lenders and various federal and state authorities. And while we hear numbers like “a total of $25 billion,” exactly which banks are responsible for the biggest chunks of these settlements? [More]

DOJ Settles With BofA For $335 Million Over Countrywide Pushing Minorities Into Subprime Loans

Nearly four years ago, we first reported on allegations that Countrywide Financial, the failed lender that was bought by Bank of America after it collapsed, had their system set up so that non-white loan applicants were steered toward subprime loans, even if they could have qualified for a standard mortgage. Well, the wheels of justice turn remarkably slowly in Washington, DC, but today the Justice Dept. finally announced a settlement with BofA for $335 million over these allegations. [More]

Bank Of America Confirms 30,000 Jobs To Be Cut In Coming Years

Only a few days after a report that Bank of America could be looking to axe upward of 40,000 employees in the next few years, the bank has released a statement today that gives the actual number of positions to be eliminated as 30,000. [More]

Investigation: Banks Took $6 Billion In Home Insurance Kickbacks

According to a HUD investigation, big banks raked in over $6 billion in a decades-long insurance kickback scheme that violated RESPA. [More]

Could Bank Of America Put Countrywide Into Bankruptcy?

Three years after breathing life into a drowned Countrywide Financial, Bank of America is probably wishing it had just let the lender sink. BofA has already lost $8.5 billion in one lawsuit, with others still pending that could more than double that amount. So what’s the nation’s largest bank to do? Maybe put Countrywide in bankruptcy. [More]

Bank Of America Sued Again Over Countrywide Loans

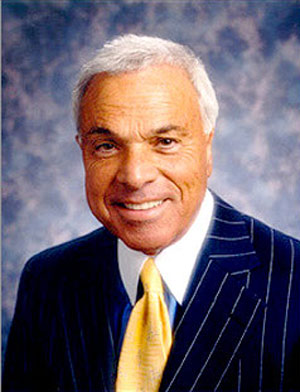

We’re willing to bet that Bank of America CEO Brian Moynihan’s office has two dartboards: one featuring the curiously orange face of former Countrywide head honcho Angelo Mozilo, whose company made countless loans to people it knew could never properly repay them; the other with the smirking face of Moynihan’s predecessor Ken Lewis, who was stupid enough to think Countrywide was worth buying, a decision that continues to haunt the nation’s largest bank. [More]

FTC Sends Out $108 Million In Refund Checks To Overcharged Countrywide Customers

Earlier today, the Federal Trade Commission announced it is mailing out refund checks to the nearly half million American homeowners who were charged excessive fees on their mortgages by former Worst Company In America champ Countrywide Home Loans. [More]

Investors To Challenge $8.5 Billion Bank Of America Settlement

Last week’s $8.5 billion settlement agreement between Bank of America and 22 investment groups over tainted securities, is being challenged but not by BofA. Rather, one group of bondholders claim the bank got off too easy. [More]

Analyst: Bank Of America's Takeover Of Countrywide "The Worst By A Mile"

Three years ago this week, the acquisition-hungry CEO of Bank Of America looked at the menu of failing financial institutions and came upon a bargain bit of junk food called Countrywide that he could gobble up for only a couple billion dollars in BofA stock. Surely this little trifle couldn’t do any damage to his bank’s ironclad insides, right? But since that first bite of Countrywide, the nation’s largest bank has been praying at the porcelain god, barfing up billions in losses. [More]

Bank Of America Posts 36% Drop In Profits

Perhaps hoping to garner sympathy votes in our Worst Company in America contest, Bank of America today reported a 36% drop in profits for the first quarter. One of the big drags on business continues to be the toxic landfill of mortgages the bank gobbled up when it bought Countrywide Home Loans. Never trust a man who is completely orange, I always say. [More]

Homeowner Turns SUV Into Anti-BofA Collage

A homeowner has affixed their SUV with a creative anti-Bank of America collage and slogans on posterboard and parked it outside a BofA branch in Austin, Texas. Reader Jeff is at the SXSW festival and sent in this picture he snapped of the scene. The driver of the car apparently has a loan with Bank of America and is accusing them of “fraud” though I can’t decipher from the medley of images what kind they had in mind. Nice pirate flag, though. [More]

Congress Issues Subpoena For Info On Countrywide's VIP Mortgage Program

Let’s look back to the summer of 2008, when it was revealed that Angelo Mozilo, the curiously orange former CEO of Countrywide, had the company offer below-market “VIP” mortgages to certain politicians and other influence peddlers. Fast forward to the present, where Congressman Darrell Issa, chairman of the House Committee on Oversight and Government Reform, has issued a subpoena to Bank of America, looking for related documents, e-mails and names. [More]

Allstate Sues Bank Of America Over Bad Countrywide Mortgages

Think Bank of America is regretting the day it decided to salvage Countrywide? The acrid aftertaste of that acquisition just got a little worse with the news that Allstate Corp has sued BofA and 18 other defendants, alleging losses on more than $700 million of mortgage securities Allstate purchased from Countrywide. [More]

14 Reasons Why Countrywide Is In The Worst Company Hall Of Fame

As the news breaks that Angelo R. Mozilo, the curiously orange former CEO of Countrywide Financial, has agreed to pay millions of dollars in fines, we decided to take a walk down Countrywide’s Memory Lane… which happens to be a street littered with abandoned and foreclosed houses. [More]

Bastard Ex-Countrywide CEO Must Pay $67.5 Million

Angelo R. Mozilo, former CEO of Countrywide Financial Corp, winner of the 2008 Worst Company In America award, and oddly orange-tinted bastard, has settled with the Security and Exchange Commission and will to pay fines and forfeit ill-gotten gains in excess of $67 million. [More]