The Fair Isaac Corporation – better known to consumers as FICO – is on the verge of turning the credit score game on its head with the release of a new credit-scoring approach that would consider consumers’ monthly bills, such as those for utilities and wireless plans, when determining creditworthiness. The change is purportedly intended to help consumers on the low end of the credit spectrum, but some consumer advocates are concerned that lower-income Americans could be the ones most adversely affected. [More]

consumers union

Potential FICO Credit Score Changes Could Hurt, Rather Than Help Some Consumers’ Creditworthiness

Outline For Payday Lending Rules A Good Start, But Not Enough To Fully Protect Consumers

Today, the Consumer Financial Protection Bureau released the first details of long-awaited regulations governing payday loans and other small-dollar lines of credit known to thrust consumers into a devastating cycle of debt. While consumer advocates were quick to applaud the Bureau’s work, and those in the financial industry to voice displeasure with aspects of the potential rules, both groups agreed that the coming months will involve more time and effort to craft meaningful protections for both sides of the issue. [More]

Can New Payday Loan Rules Keep Borrowers From Falling Into Debt Traps?

Nearly one in four consumers continue to turn to high-cost, short-term financial products like payday loans, auto-title loans and other pricey alternatives when struggling to make ends meet, even though research shows these expensive lines of credit often leave consumers worse off than when they began. After nearly three years studying the issue, the Consumer Financial Protection Bureau is now announcing its first attempt to protect consumers from predatory lenders. [More]

More Than 100 National Consumer Groups Urge The CFPB To Issue Rules Over Forced Arbitration Clauses

Just weeks after the Consumer Financial Protection Bureau released a report showing that tens of millions of Americans have clauses in their credit card, checking account, student loan and wireless phone contracts that take away their rights to sue those companies in a court of law, more than 100 consumer groups have signed a letter urging the Bureau to address the use of forced arbitration clauses by issuing rules forbidding the clauses. [More]

Why Do Robocalls Continue In An Age Of “Do Not Call” And Strict Telemarketing Rules?

Even though millions of Americans are on the federal Do Not Call list to limit unwanted telemarketing calls, and even though it’s illegal for anyone to make a commercial prerecorded robocall to a consumer who hasn’t given their express consent to receive such calls, the problem persists and is getting worse, with no cure-all solution in the offing. [More]

200,000 Consumers (And Counting) Ask Their Phone Companies To Just Let Them Block Robocalls Already

You still hate robocalls. We still hate robocalls. And over 200,000 other Americans hate robocalls, too, and have signed on to a petition asking their phone companies to just roll out the darn tech to block them already. [More]

Legislation Aims To Make It Harder For Kids To Snack On Yummy-Looking Detergent Pods

Federal safety agencies and poison control centers have continuously expressed concern that the ever-popular, and convenient detergent pods are extremely dangerous to children, with more than 17,000 kids being poisoned by ingesting the detergent since they came on the scene three years ago. Today, the House and Senate took steps to ensure the single-serve detergent packs no long threaten childrens’ safety by introducing legislation that would enact stricter packaging standards for liquid detergent. [More]

From Applause To Lawsuits And Legislation: What Key Players Are Saying About Net Neutrality

Over the summer, we rounded up what all the key players in broadband and online were saying about the potential for the FCC to write a clear net neutrality rule. Earlier today, the FCC actually went and made that rule; here’s what everyone has to say about it now. [More]

Proposed Rules Target Fees Collected By Retirement Financial Advisers, Brokers

When visiting a financial adviser for consultation about retirement savings one might assume those counselors have their best interests in mind. Unfortunately, that’s not always the case. To better ensure consultants are working for consumers and not for fees, the Labor Department will propose new rules to increase standards for brokers who recommend investments for retirement accounts. [More]

Demand That Phone Companies Give Consumers Free Tools To Block Robocalls

While federal regulations and the Do Not Call list have significantly cut down on some auto-dialed, prerecorded messages, the problem of illegal robocalls still persists, mostly because scammers don’t care if they break the law. There are various technologies that phone companies could use to preempt even more of these calls but most consumers don’t have access to them. [More]

Consumer Advocates Ask Congress To Please Consider Actually Helping Consumers This Term

The new month and new year brought with them a new Congress, and with that comes an all-new legislative agenda. Lawmakers get to start over with the process of introducing bills and hopefully passing some laws, and consumer advocates are calling on the President and all the legislators on Capitol Hill to get moving on an agenda to help American consumers. [More]

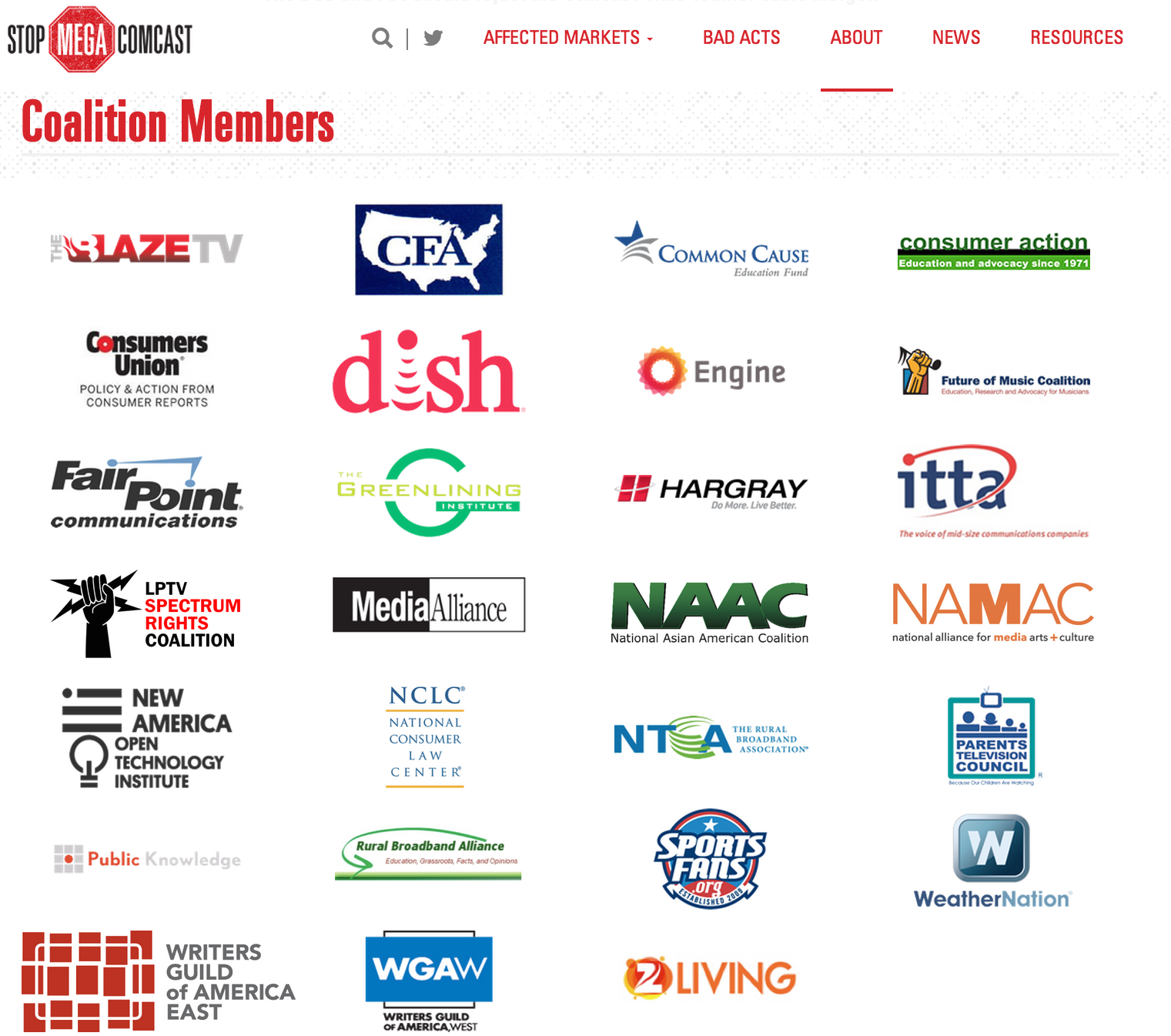

More Groups Pile Onto “Stop Mega Comcast” Coalition

Only a month ago, a coalition of more than a dozen groups formed in an effort to work together in stopping the pending merger between Comcast and Time Warner Cable. And while the federal regulatory review process inched forward on this deal, more and more groups have joined in the fight to prevent Comcast from dominating the consumer broadband market in the U.S. [More]

Consumer Advocates Head Back To FCC, Continue Urging Agency To Reject Comcast/TWC Merger

After a long pause, the FCC’s review of the Comcast/TWC merger is back underway. Now, the wave of comments in response to Comcast’s last data dump are starting to roll in, once again asking the agency to block the merger. [More]

Consumer Advocates Shine Spotlight On Too-Common Credit Reporting Errors

By now we know that credit reporting agencies are notoriously difficult to work with when it comes to fixing errors on one’s credit report. While legislators and consumers groups have long called upon credit reporting agencies to provide better service to disputing customers, little has been done to actually affect change. Now, advocates with Consumers Union are putting the spotlight on how devastating these errors can be for consumers. [More]

Consumer Advocates Urge Justice Dept. To Block Comcast/TWC Merger

The FCC isn’t the only agency reviewing the Comcast/Time Warner Cable merger; the Antitrust Division of the Department of Justice is all over it, too. And while the full public doesn’t get to have its riotous say with the DoJ the same way we did with the FCC, businesses and consumer advocates can file in opposition (or support). Our colleagues down the hall at Consumers Union, the advocacy arm of Consumer Reports, have now officially chimed in to ask the DoJ to watch out for the interests of consumers, and block the merger. [More]

The Best Way For Students To Avoid High Fees With Campus Banking Products Is To Barely Use Them

All around the country, new and returning college students are being handed IDs they can use as debit cards or they’re being told they can have their aid disbursals deposited straight onto a school-branded card. It all seems incredibly convenient, especially for those who have limited experience handling their own finances, but these school-backed banking products are rarely the best available options for students, who could end up being nickel-and-dimed into debt.

[More]

Here’s What Netflix, Dish & Others Said To The FCC About The Comcast/TWC Merger

The period for leaving a comment about the Comcast/TWC merger with the FCC closed on Monday. Roughly a zillion members of the public — individuals, nonprofits, state and federal politicians, telecom companies, tech trade groups, and consumer advocates — have weighed in, including several big names in pay TV who are staunchly against the deal. [More]