Executives for Volkswagen’s U.S. operations told lawmakers during a hearing on the company’s deceptive emission systems, that he’s confident the 500,000 so-called “clean diesel” vehicles secretly set up to cheat on emissions tests can be fixed with little disruption for owners. [More]

congress

Federal Perkins Student Loan Program Set To Expire At Midnight

After 57 years of assisting nearly 20 million low-income students to finance their dreams of obtaining a higher education, the Federal Perkins Loan program could soon be grinding to a halt. [More]

Why Don’t Huge Privacy Flaws Result In Recalled Smartphones?

When a car has a major flaw, like a potentially lethal airbag, it gets recalled. Same for a coffeemaker, or a surfboard, or a prescription drug. But when that major flaw is in a product’s software — like a huge exploit that puts literally a billion consumers’ privacy and personal data at risk — there’s no universal process out there for remedying the situation. Do we need one? And if so, how can we get one? [More]

Cheaper, More Competitive Broadband: Not Gonna Happen Anytime Soon, Analyst Tells Congress

A committee in Congress yesterday held a hearing on promoting broadband infrastructure investment. That is, getting more wires put in the ground so more people can get online faster and more reliably. That’s a laudable goal that we here at Consumerist tend to cheer on. But one theme became clear from the testimonies of the assembled analysts, industry members, and local public companies who spoke: real improvement is going to be a long, ugly series of fights… and consumers are going to keep paying a lot more while it happens. [More]

Takata Plans To Stop Using Ammonium Nitrate, Phase Out Certain Airbag Inflators

A day before representatives from Japanese auto parts maker Takata are set to appear in front of the House Energy and Commerce subcommittee to discuss the more than 34 million defective airbags linked to six deaths and more than a hundred injuries, the company announced it would stop using an often volatile chemical in its safety devices moving forward and call back some airbags replaced during earlier recalls. [More]

Lawmakers Propose Bill To Prevent Businesses From Suing You For Complaining About Them

Most of the time, consumer interactions with businesses go just fine. We give a company our money, they provide us with goods or services, and everyone is happy. But sometimes, things go awry. The customer isn’t happy, the business doesn’t make it right, and we complain: not just to the business, but to Facebook, Twitter, or Yelp. And that, too often, is when the story starts to get even uglier. [More]

Legislators Once Again Trying To Delay New Lending Protections For Military Personnel

The Department of Defense is trying to do something good for servicemembers by closing loopholes in the Military Lending Act that can leave military personnel vulnerable to predatory lenders. But these safeguards are now the target of a Congressman who has received substantial campaign contributions from payday lenders. [More]

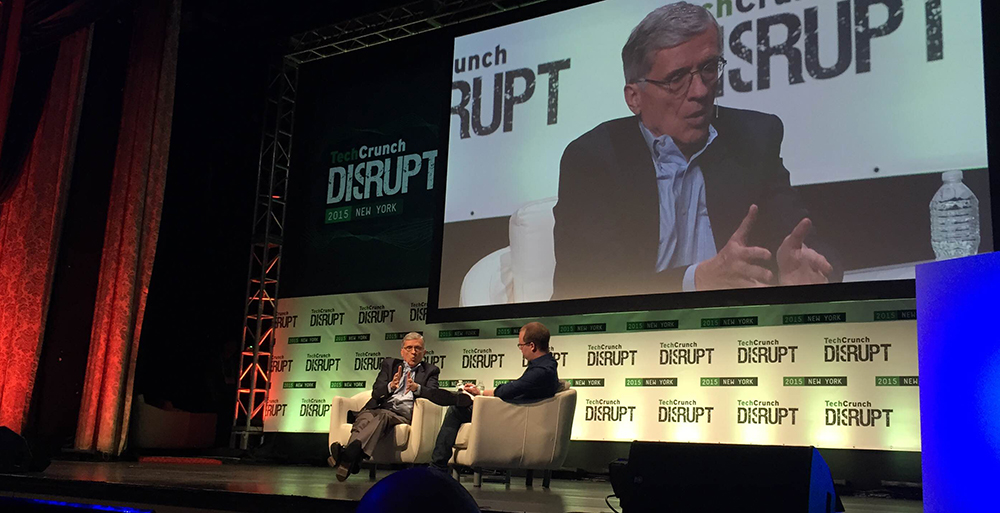

FCC Chair: Comcast Made Right Decision Scrapping Merger; Plan For Net Neutrality Is “Not To Lose”

We’re barely into May, and it’s already been an incredibly busy year for the FCC. Even major issues like a spectrum auction and a ruling on municipal broadband were overshadowed by the two huge proceedings around net neutrality and the Comcast/TWC merger. And so when FCC chairman Tom Wheeler sat down for a “fireside chat” at the TechCrunch Disrupt conference in New York this week, he had a lot to say. [More]

House Panel Strikes Provision That Would Delay Added Military Lending Act Protections

Yesterday we reported that Congress would make a decision whether or not it would intervene to slow the Department of Defense’s work to create new rules aimed at closing loopholes in the Military Lending Act that often leave military personnel vulnerable to predatory financial operations. Thankfully, legislators saw the need for more protections regarding military lending and determined the rules could go into effect as planned. [More]

Congress Has One Month Left To Change Or Renew Controversial Bulk Phone Data Surveillance Program

It’s been two years since we found out that the NSA has been quietly scooping up basically everyone’s phone records, willy-nilly, without warrants. The revelations of widespread surveillance freaked plenty of people out, but under existing law, the agency has acted legally. To get change, then, you’d need to change the law… and Congress has 33 days remaining in which to do exactly that. [More]

Consumer Groups Ask Congress To Ensure That For-Profit Schools Are Held Accountable

When the new gainful employment rules take effect later this year, for-profit educators would need to demonstrate that their programs are actually training graduates to earn a living. But a pending piece of legislation seeks to give these schools a free pass to billions of dollars in federal student aid.

Congress One Step Closer To Granting Fast-Track Authority For Passing Mysterious Trans-Pacific Trade Treaty

Global trade deals are kind of arcane stuff. Diplomats spend years or decades negotiating them, in an endless series of meetings around the world. Not only do all the i’s need to be dotted and t’s crossed, but every a, an, and, if, then, and but needs to be reviewed, revised, discussed, and agreed upon ten times over. It’s a laborious process. [More]

House Committee Asks Same Net Neutrality Questions As The 4 Previous Committees

FCC chairman Tom Wheeler was once again called before Congress today. His task: to justify the commission’s vote to protect consumers from the potential, likely harms of monopoly ISPs out to make a buck in any way they can. Or, in other words, to defend the agency’s recent vote on net neutrality. [More]

Bill Seeks (Again) To End Over-Use Of Antibiotics In Farm Animals

Antibiotic resistance is a big problem. Farmers know it. Consumer advocates know it. Doctors, the CDC, and the FDA all know it. You know it. And the largest contributor by far to the crisis is the 80% of antibiotics that are used in industrial farming. And Congress is, once again, taking a stab at making agricultural antibiotic abuse against the law before it’s too late. [More]

Senators Introduce Legislation To Make Private Student Loans Dischargeable In Bankruptcy

Since 2005, student borrowers have been unable to discharge their private student loans through the process of bankruptcy. But that could soon change after a group of 12 senators introduced a bill aimed at addressing the current student debt crisis by restoring the bankruptcy code to hold private student loans in the same regard as other private unsecured debts. [More]

Will Congress Try To Kill The Consumer Financial Protection Bureau?

Since its creation as part of the 2010 Dodd-Frank financial reforms, the Consumer Financial Protection Bureau has been a target of pro-bank, anti-regulation lawmakers who contend that the agency lacks legislative oversight and puts too much authority in the hands of a single director. With the recent political power shift in the Senate and another presidential election on the horizon, some advocates are concerned that the anti-CFPB movement may take hold on Capitol Hill. [More]

Lawmakers Want To Know Who’s Tracking You Online, And Where The Info Goes

Everything you do online — on your phone, on your computer, with anything — leaves a digital wake. Put those trails together and you’ve got one massive big data industry that can (and does) track it all and sell it to the highest bidder. After decades of digital detritus building up, regulators and Congress both are contemplating some steps that would help protect consumers’ info. [More]