Just days after losing access to federal student financial aid because it allegedly falsified records and overcharged students, the for-profit Marinello Schools of Beauty has shuttered all of its campuses. [More]

college

College Students Sue Google For Scanning School-Issued Gmail Accounts

Nearly two years after Google agreed to stop data-mining email accounts provided through its Google Apps For Education (GAFE) program, a group of current and former college students have sued the Internet giant for the snooping that did occur for years on the Gmail accounts provided by their university. [More]

No, It’s Probably Not A Great Idea To Rent Your Dorm Room On Airbnb

If you were traveling to Boston, an Airbnb listing for a private, one-bedroom unit with a great view of Boston Common might sound pretty attractive. For one college student, however, his success in renting his downtown dorm room was not applauded by his school’s administrators. [More]

Two For-Profit College Chains Lose Government Funding Over Misrepresentations, Inflated Job Placement Rates

If you hear a for-profit college touting its high job-placement rate, you’ve got good reason to be skeptical. Federal regulators have cut of government funding to two more for-profit education chains caught inflating placement stats.

[More]

High School Grads Failed To Claim $2.7B In College Grant Money Last Year

If you’re planning to attend college in the fall but haven’t gone through the not terribly difficult process of filling out a Free Application for Federal Student Aid, you’re potentially giving up your chance to claim thousands of dollars in free money. But you wouldn’t be alone; a new analysis shows that U.S. students failed to claim upwards of $2.7 billion last year because they didn’t take the time to fill out a piece of paper. [More]

Looking Ahead: 5 Big Issues To Follow For 2016

Now that 2015 is done and we finally learned that Luke Skywalker is actually Faye Dunaway’s daughter (and sister!), it’s time to take off the party hats, sweep up the confetti, and do the walk of shame forward into the uncharted territory of the year to come. [More]

Pizza Hut Latest Company Offering To Help Send Employees To College

What do a car manufacturer, a coffee chain, a health insurance giant, and a pizza joint have in common? They all offer to foot the bill — or at least some of it — so their employees can further their education by obtaining a college degree. [More]

7 Things We Learned About Federal Student Loans & The Companies That Profit From Them

Fifty years ago, Congress created the federal loan program as a way to help Americans realize their dreams of a better life through higher education. While millions of students have no doubt benefited from the program, millions of others have found themselves burdened by mountains of debts, fielding calls from debt collectors and loan servicers, and watching as their paychecks are whittled down by garnishments. Today, seven million former college students are in default with a record $115 billion in federal loans. While those figures may be oppressing borrowers, it’s providing a stream of income – and profit – for companies contracted by the government to collect payments from debtors. [More]

Starbucks Expands Tuition Program To Cover Spouses & Kids Of Military Employees

Since announcing a tuition reimbursement program for its workers in June 2014 – and an expansion to cover four years of schooling – Starbucks has sent more than 4,000 employees on a path toward an online bachelor’s degree from Arizona State University. Now, the company plans to expand the offering once again: covering the full tuition for a spouse or child of a veteran or active-duty servicemember working for the mega-coffee chain. [More]

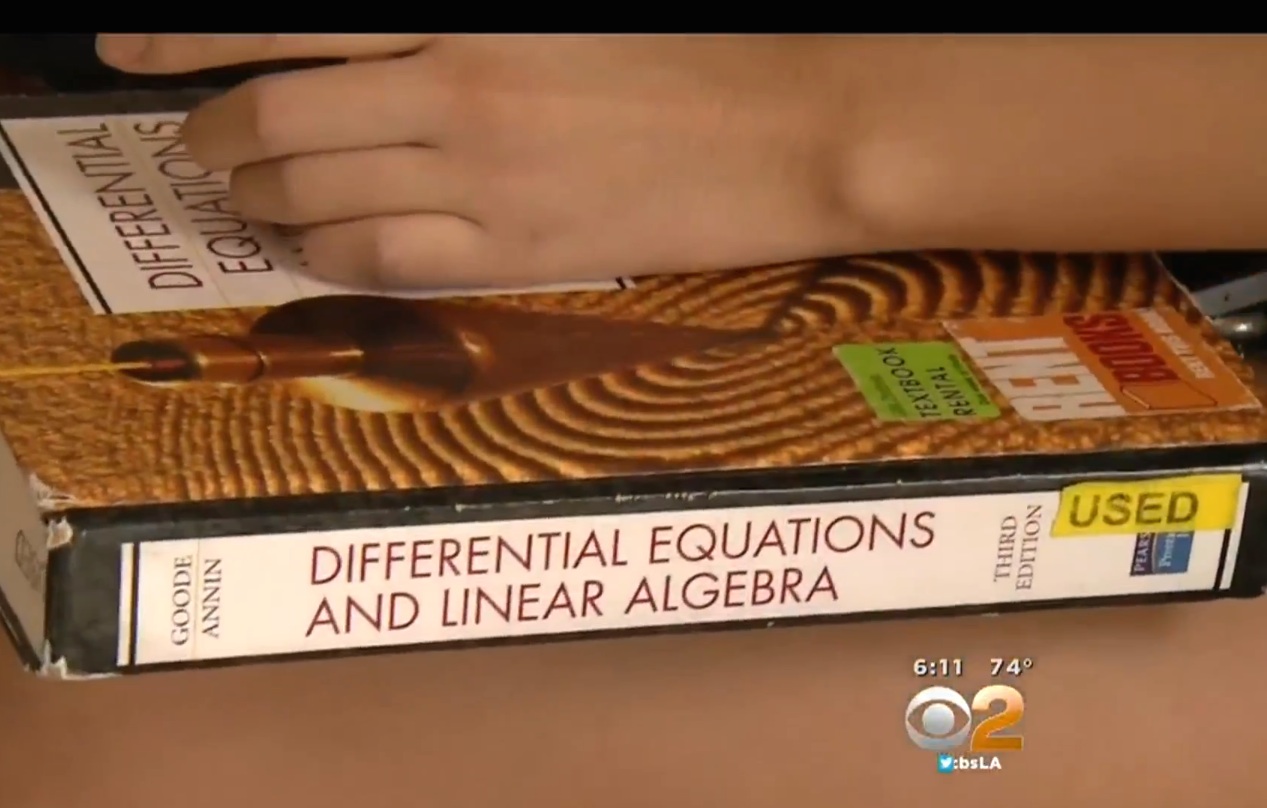

Math Professor Wants To Use Cheaper, Better Textbook, Clashes With Department

The argument over a textbook at Cal State Fullerton combines many different issues in academia: the cost of textbooks, deference to authority, and academic freedom. A math professor wants to do something really simple: use different textbooks from other faculty who teach the same course, because he thinks that a different pair of books is better. Those books also happen to cost less. However, the standard $180 textbook happens to have been written by the chair of the department. [More]

Student Loan Debt For Recent College Graduates Increases Again

With college tuition prices continuing to rise, you might assume that college students are entering the real world with more debt on their shoulders. According to a new report, that assumption would be correct.

[More]

Conflicts In Patient Privacy Laws Often Leave Student Health Records Vulnerable

When a college student seeks medical treatment at a campus healthcare facility, they probably expect they will be afforded the same discretion as all consumer are under HIPAA (the Health Insurance Portability and Accountability Act). But thanks to a separate, often conflicting federal law, that isn’t always the case. [More]

New Test Program Lets You Use Federal Loans To Pay For Intensive Career & Coding Training

If you want to boost your resume by taking one of those intensive “bootcamp” training programs but don’t have the funds to pay for it, a new experimental offering from the Department of Education would allow you to use federal student loans to cover the cost. [More]

University Of Phoenix Barred From Military Bases, Using New Tuition Assistance Funds

For-profit college chains like the University of Phoenix spend a lot of time and money recruiting active-duty military personnel. But the school has come under fire in recent months for allegedly crossing some legal lines in its efforts to attract students from the armed forces. Yesterday, Phoenix’s parent company revealed that the school is currently barred from recruiting on U.S. military installations, and that Department of Defense tuition assitance funds can not be used to pay for classes for new students. [More]

Colleges Paying Sketchy Agents To Recruit Rich Foreign Students

With schools looking for ways to bolster their bottom lines without having to rely on federal funding, a growing number of colleges are paying recruiters to bring in well-heeled students from overseas — even though some of these agents have been caught trying to fake applicants’ transcripts. [More]

Federal Perkins Student Loan Program Set To Expire At Midnight

After 57 years of assisting nearly 20 million low-income students to finance their dreams of obtaining a higher education, the Federal Perkins Loan program could soon be grinding to a halt. [More]

White House Unveils New “College Score Card” To Help Students Select Schools

With student loan debt now well past the $1.2 trillion mark — due in no small part to students that paid top-shelf tuition prices but ended up with bottom-shelf educations and job prospects — there’s a need to provide American students and their families with all the relevant information they need when it comes to picking the right school for their goals and their wallets. [More]