Only days after beleaguered ITT Tech ceased enrolling new students over financial concerns and the possible loss of accreditation, another for-profit educator owned by ITT’s parent company has also revealed that its future may be in peril. [More]

college

For-Profit College Operator Sues Feds After Non-Profit Status Rejected

Earlier this month, the Department of Education denied non-profit status to a chain of for-profit career colleges, accusing the schools’ operators of trying to avoid accountability with the switch. This week, the Center for Excellence in Higher Education fired back, suing the Department, alleging the government has a political agenda of putting career schools out of business. [More]

Retailers Trying To Lure College Customers Now So They’ll Become Lifelong Shoppers

Often when a shopper is loyal to a brand, product, or company, it’s simply because they have a long history with it. That’s why retailers are trying to hook college-age students now — even before full-time jobs bring them a disposable income — in the hopes that they’ll become lifelong shoppers. [More]

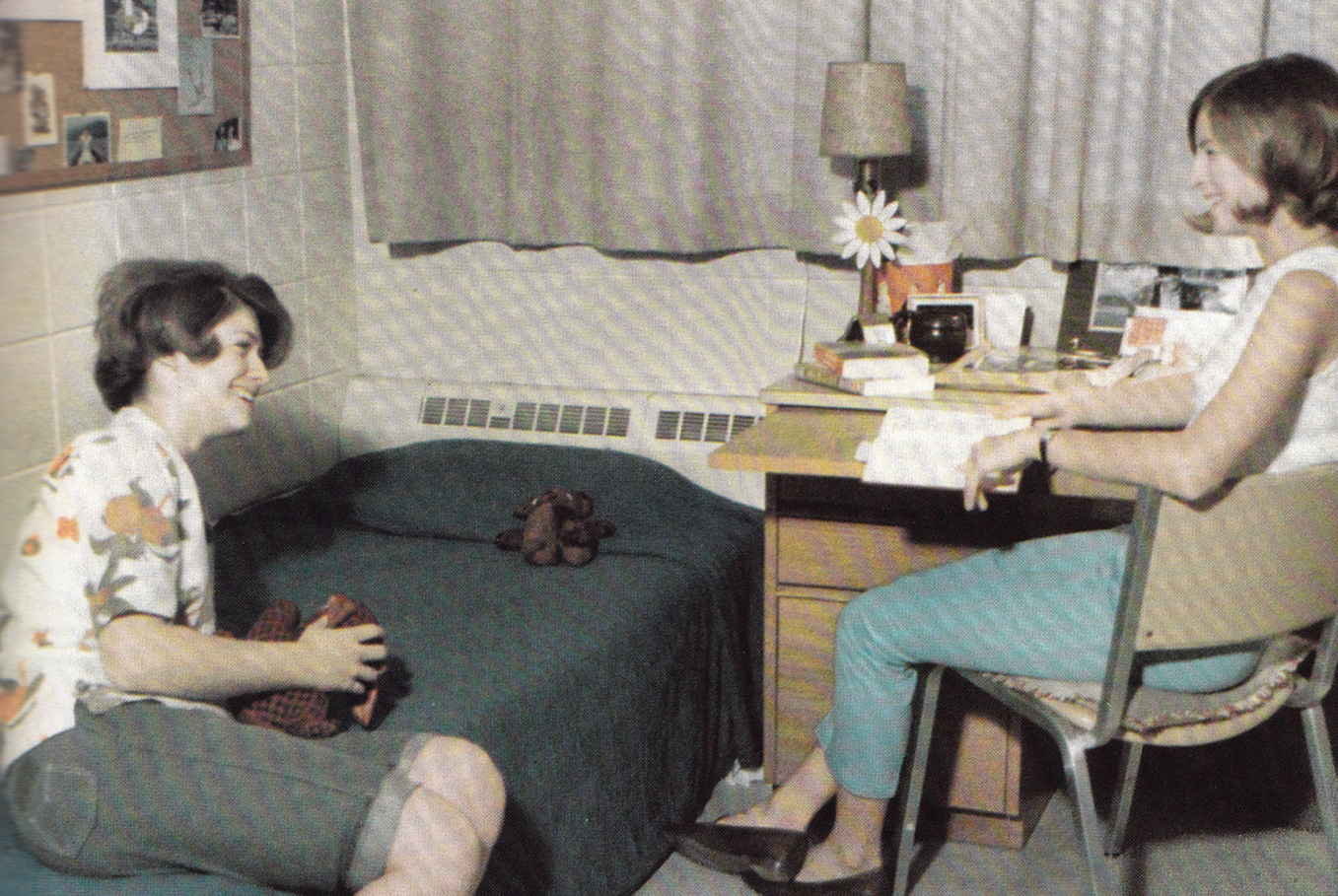

Here’s What You Should And Shouldn’t Bother To Buy For College

It’s back-to-school season, when stores stack their aisles high with folding chairs and mini-fridges meant for students heading to college or back to college. What do you actually need, though, and how should you shop for it? What should you spend a lot on, and what can you leave behind? Our colleagues down the hall at Consumer Reports have some ideas about what new students should shop for, and how to shop for it. [More]

For-Profit ITT Expects New Student Enrollment Will Drop By Up To 60% This Fall

Facing multiple lawsuits, the possible loss of its accreditation (from an accrediting body that is in trouble on its own), and demands from federal regulators that it have enough cash on hand to cover losses in case things do collapse, ITT Educational Services now says it will likely see new student enrollment drop by up to 60% this year. [More]

For-Profit College Or Fictional School: Can You Tell Them Apart?

When coming up with the name for a institution of higher learning, you often want to find that sweet spot where academia, history, and marketability meet; and you also have to make sure no one else is already using that name. [More]

Proposed Rule Stops Colleges From Stripping Students Of Their Right To Sue

A recent study found that almost all of the nation’s largest for-profit college chains have enrollment agreements that block students from suing the school and prevent them from joining in class actions against these colleges. Following the 2015 bankruptcy and collapse of mega-chain Corinthian Colleges Inc., the sagging numbers at University of Phoenix, last week’s death knell for Brown Mackie College, and pending investigations and lawsuits against ITT and others, the Department of Education has decided that maybe these schools — which reap billions in federal aid each year — should probably have to be held accountable in a court of law when they screw students over. [More]

Are You A Brown Mackie College Student Or Staffer? We Want To Hear From You

This morning, for-profit educator Brown Mackie College announced it was gradually closing all but a few of its more than 25 campuses in 15 states. While we’ve seen what the school is telling students and employees about the situation, we want to hear directly from those who are most affected by this news. [More]

Graduation Rates: The Telltale Sign Of Success Or Indicator Of Failure?

For millions of students, attending college is a means to a better life: more job prospects, and higher earnings over a lifetime. While students who enroll and graduate from an institution of higher learning often reach those goals — despite graduating with thousands of dollars in loan debt – millions of others never graduate and face mounting financial obstacles. [More]

20,000 For-Profit College Students Ask Education Dept. To Cancel Their Student Loans

As the fallout continues from the collapse of Corinthian Colleges Inc. — former operator of Everest University, WyoTech, and Heald College — the Department of Education is trying to sort through nearly 20,000 loan-forgiveness requests from former students who claim that CCI and other for-profit colleges misled them into taking out huge student loans. [More]

University Of Phoenix To Stop Stripping Students Of Their Right To Sue School

A recent study found that student enrollment agreements at virtually all of the nation’s biggest for-profit colleges have forced arbitration clauses that strip students of their rights to file a lawsuit against the school, and in most cases bar students from joining their similar or identical disputes together. Under pressure from lawmakers and consumer advocates who questioned how these schools could continue to take billions in federal aid while trying to avoid accountability in the courtroom, the nation’s biggest for-profit educator has decided to stop using the controversial arbitration clauses. [More]

U.S. Government Used Fake University To Catch Visa Brokers, Swept Up Students Too

To root out the education brokers who guide international students to fake colleges that are only visa mills, the Department of Homeland Security set up its own fake university. Yet should the institution’s students, most of whom came from China and India, have known that the school wasn’t legit when it had full government approval and accreditation? [More]

Defunct Beauty School Settles Whistleblower Suit Accusing It Of Falsifying Records

Two months after abruptly closing its doors as a result of losing access to federal student financial aid, the for-profit Marinello Schools of Beauty has settled a whistleblower case that accused the school of engaging in various schemes to defraud the government of federal financial aid dollars. [More]

Screwed Over By A For-Profit College? You Probably Signed Away Your Right To Sue

When Corinthian Colleges Inc. collapsed, leaving thousands of students in the lurch with student loan debt and credits that they didn’t know would be usable at other schools, they were generally unable to sue the failed for-profit educator because the students had unwittingly signed away their right to a jury trial or class action. CCI wasn’t the only for-profit operator with this anti-consumer practice, and a new report tries to get a grasp on the scope of the problem. [More]

How Does JetBlue’s New Employee College Tuition Program Compare To Others?

Just like a 401k, health insurance, and other benefits, more and more companies are offering to pay for employees’ college education — or at least part of it — as a way to keep them on the payroll. Joining the increasingly growing list that includes Pizza Hut, Starbucks, Anthem Insurance, and Fiat Chrysler, JetBlue announced today that it would offer crewmembers a program to obtain a college degree. [More]

Midwest Career College Abruptly Closes Doors, Files For Bankruptcy

Thousands of students attending Wright Career College in Oklahoma, Nebraska, and Kansas are now scrambling to figure out how to finish their education after the school abruptly closed its doors and filed for bankruptcy. [More]

Appeals Court Shuts Down For-Profit College Industry’s Effort To Avoid Accountability

The for-profit college industry lost an important legal battle today, when a federal appeals court upheld last year’s lower court ruling in favor of new regulations intended to hold these controversial schools accountable. [More]