Citizen Bank customers expecting to see their paychecks added to the balance of their accounts Friday morning were disappointed to find that wasn’t the case: A glitch in the bank’s system prevented paychecks and other direct deposits from being processed. [More]

Citizens Bank

Citizens Bank Must Pay $31.5M In Fines, Refunds For Failing To Credit Full Deposit Amounts

Several federal agencies teamed up like your favorite buddy-cop movie to bring down the bad guy today. In this particular case the bad guy was Citizens Bank, which must now pay a total of $20.5 million in penalties and $11 million in refunds to the owners of accounts it allegedly failed to credit for full amounts of deposited funds. [More]

The Hot Potato Principle: Why This Grandma’s Bank Stuck Her With Counterfeit Cash

Counterfeit currency operates on the “hot potato” principle. Like the children’s game, the last person caught with the object loses. Once you accept counterfeit cash–even if it’s from a financial institution–it’s yours. This made for a very disappointing birthday gift for a 14-year-old from his grandmother. [More]

These Smug Citizens Bank Ads Show Exactly What’s Screwed Up About Banking

If a bank wants to offer a checking account that isn’t as terrible as most of what’s out there, that’s fine. But that bank shouldn’t pat itself on the back and act like it’s doing consumers a favor just because it gives them a slightly easier way to avoid being nickel-and-dimed. [More]

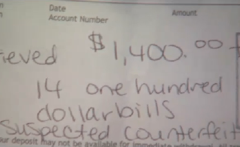

UPDATE: Bank Says $1,400 In Counterfeit Bills Weren’t Counterfeit After All

Yesterday, we told you about the Massachusetts man who withdrew $1,800 from Sovereign Bank, then took it over to pay his mortgage at Citizens Bank, only to have $1,400 of it confiscated for allegedly being counterfeit cash. Except it wasn’t. [More]

Citizens Bank Manages To Make Debit Card Number Breach Even More Unpleasant

Mobile apps that can pay for things are pretty neat, but lead to a huge headache if your phone is lost or stolen. Especially if you don’t have a credit card, and use your debit card number instead. When Megan’s iPhone was stolen, she was ready to deal with the annoyance of getting a new debit card and changing her information on each app. She didn’t expect a cascade of incompetence and obnoxiousness from Citizens Bank. [More]

CFPB Complaint Portal Resolves Problem That Years Of Phone Calls Could Not

In March the Consumer Financial Protection Bureau launched a complaint portal for people with unresolved issues tied to their checking and savings accounts. Now we’re hearing the first of what we hope are numerous success stories from Consumerist readers who have tried the CFPB portal. [More]

Citizens Bank Now Charging An Overdraft Protection Fee

Lynne writes, “Citizens Bank is now charging customers an annual overdraft protection fee. This is a charge for linking your savings account to your checking account. Customers can be removed from the program and can get the fee back.” We don’t know when this started—they just say there might be fees involved and call for details on their website—but if you’re a customer of the bank you might want to make sure you haven’t been enrolled without knowing it.