The fallout continues from the May 10 breach of Citi’s credit card account files by hackers. The bank now says that a total of around $2.7 million was stolen from a relatively small percentage of the 360,000 breached accounts. [More]

citigroup

Report: Citi Knew About Credit Card Hack For Weeks Before Going Public

Last week, Citigroup announced that around 200,000 credit card accounts had been compromised by hackers, but a new report from the Wall Street Journal says the bank knew something was wrong weeks earlier. [More]

Citi Beats Bank Of America At One Thing: Getting Bailout Money

The Congressional Oversight Panel overseeing the TARP program has finally made public the data on exactly how much each of the various bailed-out banks received from the combined coffers of TARP, FDIC and the Federal Reserve. The winner: Citigroup’s $476.2 billion. [More]

Worst Company In America Round One: Bank Of America Vs. Citi

Consumerist’s 6th Annual Worst Company In America tournament tips off today with this battle of beastly bankers! [More]

Citibank's Rewards Provider Ships Your Prize 1500 Miles Away, Shrugs

Rick moved and changed his address with his credit card company, CItibank, but didn’t change it with the bank’s rewards program vendor. No problem: just put in a different shipping address when he placed the order, right? Not exactly. Now the company’s best option is for him to wait for the package to be sent to the address where he no longer lives, complain of non-delivery, and wait for a new package to come. This seems a bit inefficient. [More]

Avoiding Student Loan Default At Citibank: A Cautionary Tale

It’s an enormous relief to find someone at a large, powerful company who is kind, helpful, and able to solve your problems. Unfortunately, reader Flora learned that just because a person is kind and helpful, that doesn’t mean that you shouldn’t document your conversations with them in case things go horribly wrong. [More]

Citigroup Still Selling Mortgages That Violate Quality Standards

15% of the mortgages Citigroup sold to government-owned Freddie Mac from the second half of 2009 and the first part of 2010 were riddled with flaws, according to an internal report obtained by Bloomberg. The error rate should be about 5%. The mistakes included missing insurance docs, missing appraisals and income miscalculations. [More]

CitiMortgage Launches "Call-A-Thon" To Answer Distressed Homeowner Questions

Tomorrow CitiMortgage is kicking off a special 1-day “call-a-thon” where people in trouble with or confused about their mortgages with Citi can call in and talk to foreclosure prevention staff. In addition, “senior managers and increased numbers of supervisors will be on hand to provide additional support,” says Citi. [More]

Banks Hired "Burger King Kids" To Process Mortgages

JPMorgan & Chase had a cute name, the “Burger King Kids,” for the workers with little no experience or qualifications it hired to process the reams of mortgages it plowed through at the height of the housing bubble. These walk-in hires “barely knew what a mortgage was,” writes the NYT. The newbies Citigroup and GMAC/Ally Bank outsourced the work to sometimes tossed paperwork into the garbage can. [More]

How The Looming Mortgage Bond Scandal Could Dwarf The Foreclosure Fraud Crisis

If you thought the fake doc foreclosure fraud crisis is bad, wait till you get a load of what could happen once people start looking at the pending mortgage bond meltdown. Reuters blogger Felix Salmon dug into the documents and he says it looks like banks have been lying to investors about the quality all this time. [More]

Lawsuit: Citigroup Used Recession To Fire Female Employees

If the plaintiffs in a new discrimination lawsuit against Citigroup are to be believed, the headline-making “Sexy Banker” wasn’t the only one who may have been improperly shown the door by the bank for lacking a Y chromosome. [More]

Does The "S. Larson" Who Always Signs Citibank Customer Letters Really Exist?

For decades, “S. Larson” has been the named that signed the bottom of Citibank’s letters to customers. But does this person actually exist or are they a construct? [More]

Sexy Banker: Chase Told Me To Shut Up About Citibank Lawsuit

You remember last week’s story of the former Citibank employee who claimed she was fired for being too sexy? Of course you do. Now she’s claiming that her current employer, JP Morgan Chase, has asked her to stop her public campaign against a fellow banking giant. [More]

Did Citibank Fire This Woman For Being Too Sexy?

A former banker at a Manhattan branch of Citibank has filed a lawsuit against parent company Citigroup, alleging that she was fired from her job for just being too attractive. [More]

Cuomo: Banks May Have Misled Raters On Mortgage Securities

New York Attorney General Andrew Cuomo has opened an investigation of eight major banks, to find out whether they gave misleading data to rating agencies to pump up the ranking of mortgage-backed securities. The companies in the crosshairs are Citigroup, Goldman Sachs, Morgan Stanley, Credit Suisse, Deutsche Bank, UBS, Crédit Agricole and Merrill Lynch (aka Bank of America). [More]

Goldman Riskier Than Citigroup

Bond markets slammed Goldman Sach this week, making the firm pay more for cashizzle then even the bailed-out Citigroup. Goldman’s yield rose to 2.79 percentage points over Citigroups’ 2.29. At the end of March, before the legal and regulatory headaches began, Citigrouop’s spread was wider than Goldman’s by .45 percentage points. Higher yields on debt usually indicate a higher risk of default or other negative credit events. Concerns continue to mount over how long and how deep the firm will be tainted by the SEC’s civil lawsuit and the investigation by federal prosecutors, and what other skeletons the scrutiny might shake out.

Blankfein’s Bonds Are Riskier Bet Than Pandit’s: Credit Markets [Bloomberg]

Treasury Dept. Selling Its 7.7 Billion Shares Of Citigroup For Big Profit

The Treasury Dept. announced today that it plans to sell off all of the 7.7 billion shares of Citigroup it acquired as part of the bailout of the bank. This could mean a profit of upwards of $8 billion for the federal government in just a few months. [More]

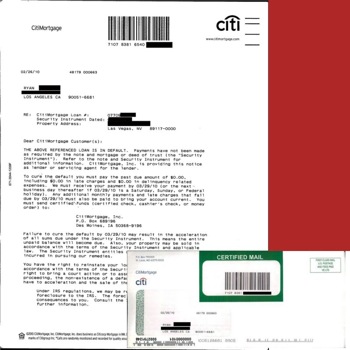

Citi Demands You Pay $0 Or They Will Foreclose On Your House

In these tough times, homeowners with difficulties paying their mortgage dread receiving that letter from the bank informing them that their loan is in default. Except for Consumerist reader Ryan, who recently got some certified mail from CitiMortgages telling him his home was at risk of foreclosure, unless he immediately forked over $0.00 [More]