A month after Target first revealed that its in-store credit and debit card payment system had been breached, Citi has finally announced plans to replace all debit cards for customers whose account information was stolen in the hack. [More]

citibank

Capital One Is The Most Complained-About Credit Card Company

Since the Consumer Financial Protection Bureau opened its credit card complaint portal in Sept. 2010, more than 25,000 complaints have been filed with the CFPB. And while the 10 largest credit card issuers account for 93% of all those complaints, one company is responsible for more than 1-in-5 of all complaints filed with the Bureau: Capital One. [More]

Citi To Pay Nearly $1 Billion To Fannie Mae For Toxic Mortgages

Ever since taxpayers bailed out Fannie Mae, the mortgage-backer has been trying to get some of the nation’s largest lenders to buy back the toxic loans that had been sold to the company before the housing bubble went POP. Today, Citi announced that it has agreed to pay $968 million to Fannie Mae to put an end to its part in the matter. [More]

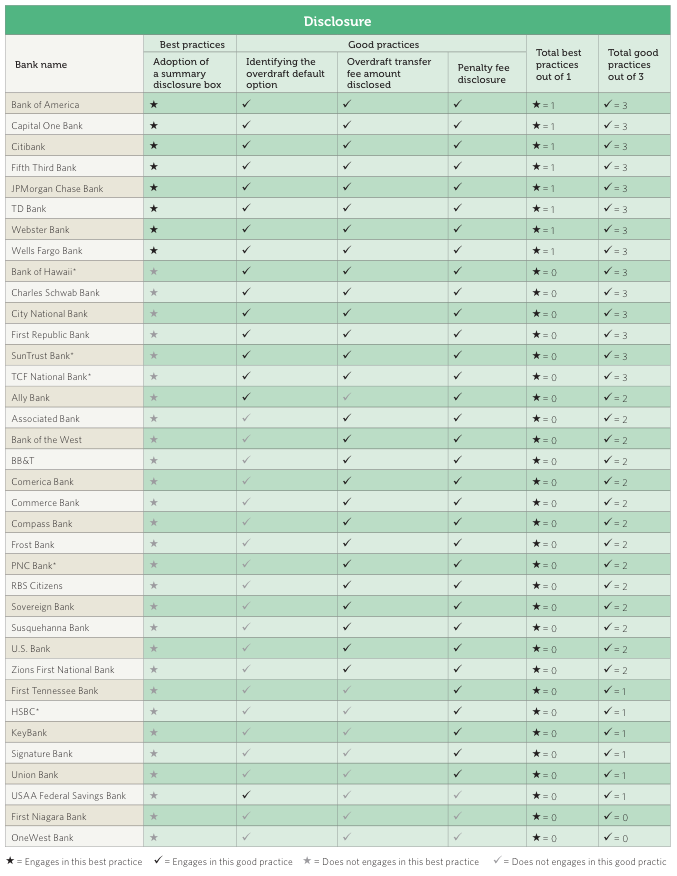

Consumer-Friendly Checking Account Practices Vary Wildly From Bank To Bank

Unless you’ve been hiding under a bed for the last six years, you probably know that the banking industry isn’t exactly beloved by many American consumers. As a reaction to public sentiment (and threats of regulation), a number of banks have begun phasing in some more consumer-friendly practices, but a new study shows these changes are not industry-wide and that several banks are still years behind. [More]

Citibank Doesn’t Understand The Word ‘Minimum,’ Cancels Deployed Soldier’s Student Loan Forbearance

Benjamin is in the military, and currently serving in Afghanistan. We’d thank him for his service, but Citibank says not to. They think that he’s not there anymore, and have ended the active-duty forbearance on his student loans. Calling up Citi and sending them documentation is tricky when you’re you know, in Afghanistan, but he’s doing his best. Nothing he sends is good enough for Citibank to actually believe him. [More]

Man Who Helped Citigroup Become A Megabank Says Megabanks Should Be Broken Up

Call it an about-face, a switcheroo or an epiphany, but whatever you call it, ex Citigroup CEO Sandy Weill is surprising plenty of people in the industry by saying megabanks should be broken up. This, from the man who helped steer Citigroup to its current ginormous conglomerate status. [More]

Citibank Locks Man Out Of Bank Account Until He Repays The $84K Worth Of Gas He Didn’t Buy

There is no car gas tank that would fit $84,522.54 worth of gas. But who cares about simple physical limitations when it comes to charging such a large purchase to someone’s bank account? Citibank somehow took a man’s $30 fill-up and multiplied it by about 2,800 his statement, and now won’t let him back into his bank account until it gets that money back. [More]

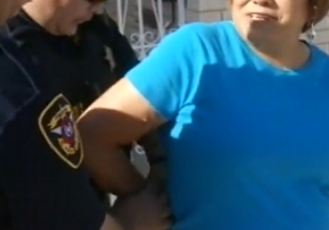

Woman Forcibly Removed From Home, In Spite Of Restraining Order Against Citibank

A woman in El Paso has been fighting foreclosure for several months, saying she was making payments and that Citibank was crediting them to an escrow account without telling her or explaining why. A federal court recently issued a temporary restraining order preventing the bank from foreclosing while the case is litigated, but that didn’t stop county constables from forcibly removing her from her home last week. [More]

At Sears Card, 24-Hour Customer Service Means 'Whenever We Feel Like It'

Citibank now administers the Sears Card, but in order to keep their branding consistent, Citi is sure to keep the experience of dealing with Sears Card just as confusing and customer-unfriendly as dealing directly with Sears. That’s what Cat discovered while trying to contact their customer service, anyway. While the number on the card promises “24-hour customer service,” in the evening, there’s actually no way to get through. [More]

Citibank Doesn't Want Your Gross Punctuation Marks

Sandra wanted to contact Citibank about a fee, and figured that contacting them using secure account e-mail from within their site was a good way to do it. When she tried to send the message, the system rejected it, telling her to remove any special characters. “What special characters?” she asked. Turns out the e-mail form didn’t like quotation marks. At least it wasn’t apostrophes? [More]

Discover Accidentally Steals From Foundation To Pay My Credit Card

Phil (no, not the one who works here) had to make a payment to an art foundation, and learned that he could use his Discover card to do so. Neat! So he put the payment through, and all was well…until he learned that somehow the transaction went through backwards, transferring the money from the foundation’s bank account to pay his Discover bill. Oops. This seems like it would be easy enough to reverse, but Discover won’t do anything unless the foundation calls them up and nicely asks for their money back. [More]

Alleged Thief Picked Billionaire Microsoft Co-Founder To Defraud

Maybe stealing from someone super rich seemed like a good idea at the time, but using the credit card of the co-founder of Microsoft? Someone’s bound to notice that. The FBI says a U.S. soldier changed the address on a bank account belonging to Paul Allen and then had a debit card sent to his home. [More]

Worst Company In America Sweet 16: Bank Of America Vs. Citi

A perennial Golden Poo favorite slips into a red, white and blue unitard and struts into the WCIA Rollerball arena to the strains of Hulk Hogan’s “Real American,” thinking this is the year they win it all… Well, not if a scrappy underdog from New York City has anything to say about it. [More]

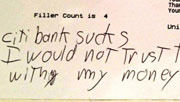

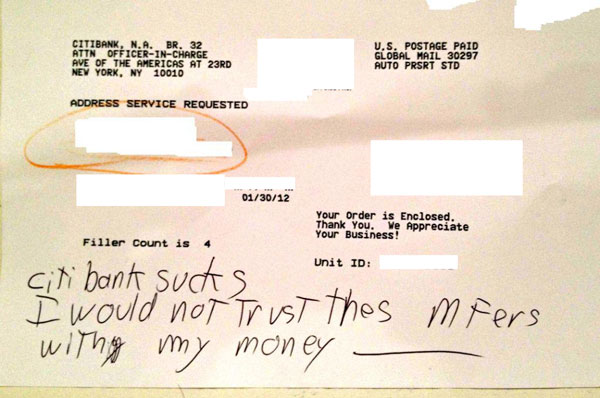

Helpful Stranger Delivers Your Mail, Curses Out Your Bank

It’s just plain heart-warming when a stranger does something nice for you. When Efrem’s box of new checks from Citibank went astray, the person who did receive them brought them by, with a helpful note about Efrem’s choice of financial institutions. “Citibank sucks,” the Good Samaritan wrote. “I would not trust [these] MFers with my money.” [More]

Citibank Closes My Credit Card Due To Security Breach, Doesn't Tell Me Until I Sign In Online

It’s great that Citibank went ahead and closed Sylvia’s account after it was breached, thus saving her from thievery and other unpleasant security concerns. One thing that would’ve been even better, though, would be to let Sylvia know they’d gone ahead and done that. [More]

Citibank May Have Double-Charged Customers Using Its Bill-Pay App

Whoopsadaisy! Citigroup has accidentally been charging many customers more than what they owe for months, with some of them not even realizing it was going on until the bank sent out a notification. Cit’s bill-pay app for iPads was the culprit in many cases, charging customers twice what they owed for bills or mortgage payments. [More]

Banks To Offer Foreclosure Reviews To More Than 4 Million People

Millions of Americans have lost their homes in the last few years and — as any reader of Consumerist knows — the banks who foreclosed on those properties have also made more than their fair share of errors. Thus, starting today, 14 of the country’s largest mortgage servicers are contacting millions of foreclosed-upon former homeowners to offer them the opportunity to have their cases independently reviewed. [More]