The gift of flight turned into a nightmare for a California woman when the Southwest Airlines gift card she purchased for her daughter was mysteriously canceled without notice, and then the funds vanished into thin air. [More]

citibank

Citibank ATMs Will Replace Chase At Many Walgreens Locations In NYC, Chicago

If you’re a Chase bank customer in Chicago or New York City who relies on the ATM at your local Walgreens/Duane Reade to avoid withdrawal fees, we’ve got some bad news for you. But if you’re a Citibank customer, well, we’ve got some great news for you: more than a thousand ATMs will be transitioning from Chase to Citibank. [More]

Citi CEO Determined To Fix Customers’ Complaints About Costco Card Deployment

Costco recently ended its long monogamous relationship with credit card partner American Express, leaving to only accept Visa cards and partner with Citibank for a store-branded card. AmEx could lose up to 10% of its customers over the switch, since the number of people who had cards with them just for Costco is huge. The switch went badly for some Costco customers who didn’t get their cards, couldn’t activate them, or had other problems with the switch. Citi’s CEO promises that he’s going to fix this. [More]

Costco’s AmEx To Visa Transition Isn’t Going Great For Some Customers

Costco’s decision to switch from only accepting American Express credit cards to only accepting Visa cards is a big deal for their customers (and for American Express) and has been in the works for a long time. That should have given Costco and Citi plenty of time to make sure the transition was smooth and everyone would have their cards working and on time, right? No, of course not. [More]

Will Costco’s Switch From American Express To Visa Affect My Credit?

In June, Costco will officially change its store-branded credit card from American Express to a Visa card issued by Citi. The wholesale club is promising a seamless transition, but some longtime Costco customers have concerns: Will my credit score or history be dinged? Can I opt-out? [More]

Citi Will Send Members’ New Costco Visa Cards In May

This June, things will change at Costco: the warehouse retailer will change its official, store-endorsed credit card from a Costco-branded American Express card to a Costco-branded Visa card from Citi. We now know that the new cards will start being mailed out in May, and what kinds of rewards users will be able to expect. [More]

Costco Credit Cards Will Officially Switch To Citi, Visa In June

For more than a year now, Costco has been preparing to take its store-branded credit card business in a new direction. Specifically, it’s transferring its credit card network from long-time partner American Express to Citigroup and Visa. After hitting a few snags in the road, the shopping club now plans to make things official in June. [More]

Citibank Caught Screwing Up Credit Card Debt Collections, Must Refund $5M

If you had a hunch that Citibank’s credit card division wasn’t terribly good at its job, you were right. Citi sold credit card debt to buyers with inflated interest rates, failed to tell those debt buyers when it accepted payments on these cards after the debt had been sold. [More]

Wells Fargo Reportedly Under Federal Investigation Related To Student Loan Servicing

According to a new report, Wells Fargo is the latest big-name bank to be scrutinized as part of the Consumer Financial Protection Bureau’s ongoing investigation into student loan servicing practices.

[More]

Citigroup Facing Federal Investigation Into Student Loan-Servicing Practices

Just last month federal regulators announced that an ongoing probe into potentially unscrupulous student loan-servicing practices resulted in nearly $18.5 million in refunds and fines from Discover Bank. Now, regulators appear to have Citigroup in their crosshairs, as the financial company announced it was party to an investigation. [More]

Banks Run Free Classes For Rich Kids On How To Be Super-Rich

Being a young adult who will inherit billions of dollars isn’t all fabulous parties, designer clothes, and supercars. It also means learning responsibility: at minimum, you’ll be responsible for caring for your own billions, and you could also end up running the family business or a foundation. There’s no degree, not even in business administration, that can prepare you for life as a billionaire, but some banks would really like to help. [More]

Discover Bank Must Pay $18.5 Million Over Illegal Student Loan Servicing Practices

As federal regulators continue to probe potentially unscrupulous student loan servicing practices, the Consumer Financial Protection Bureau has ordered Discover Bank and its affiliates to pay nearly $18.5 million in refunds and fines for, among other things, overstating amounts due on student loans and failing to notify borrowers of their rights. [More]

Citibank Must Pay $700M Over Illegal Marketing, Collection Practices

The Consumer Financial Protection Bureau ordered Citibank and one of its subsidiaries to pay $700 million in relief to more than 8.8 million consumers for engaging in a string of illegal credit card practices, including deceptively marketing and billing for debt protection and credit monitoring services, and misrepresenting fees related to debt collection actions. [More]

Citigroup Quietly Cuts Back On Its Consumer Banking Business

Citigroup is about to become a slightly smaller group. Here in the United States, for example, the global bank once sought retail banking customers in fourteen cities. In cities where there are fewer Citibank branches, the company has been quietly selling their branches and leaving town. [More]

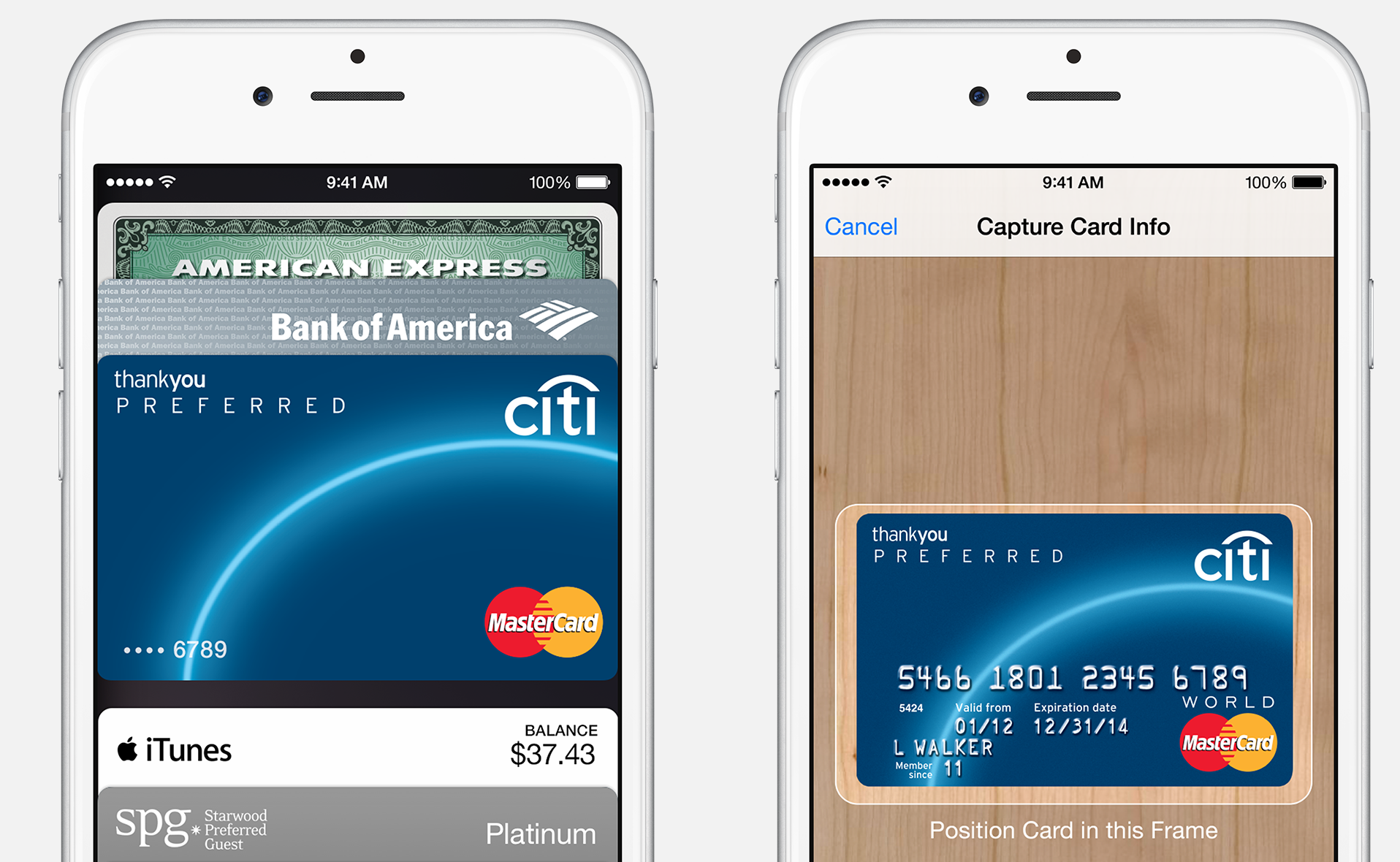

Apple Pay Lets Man Scan, Use Wife’s Citi Credit Card Without Additional Verification

One of the neat features of the new Apple Pay system is that it lets iPhone 6 users quickly scan and verify credit cards into their Passbook so they can use those accounts without ever providing participating businesses with their card numbers. But how easy is it to just scan in someone else’s card and start using it without that person’s permission? [More]

Citibank Raises Fees For Accounts, But Plans To Offer Free Credit Reports To Some Customers

Citibank is poised to become the second financial institution to provide customers with free credit scores each month. But that’s only if customers stick with the company after its latest fee hike. [More]

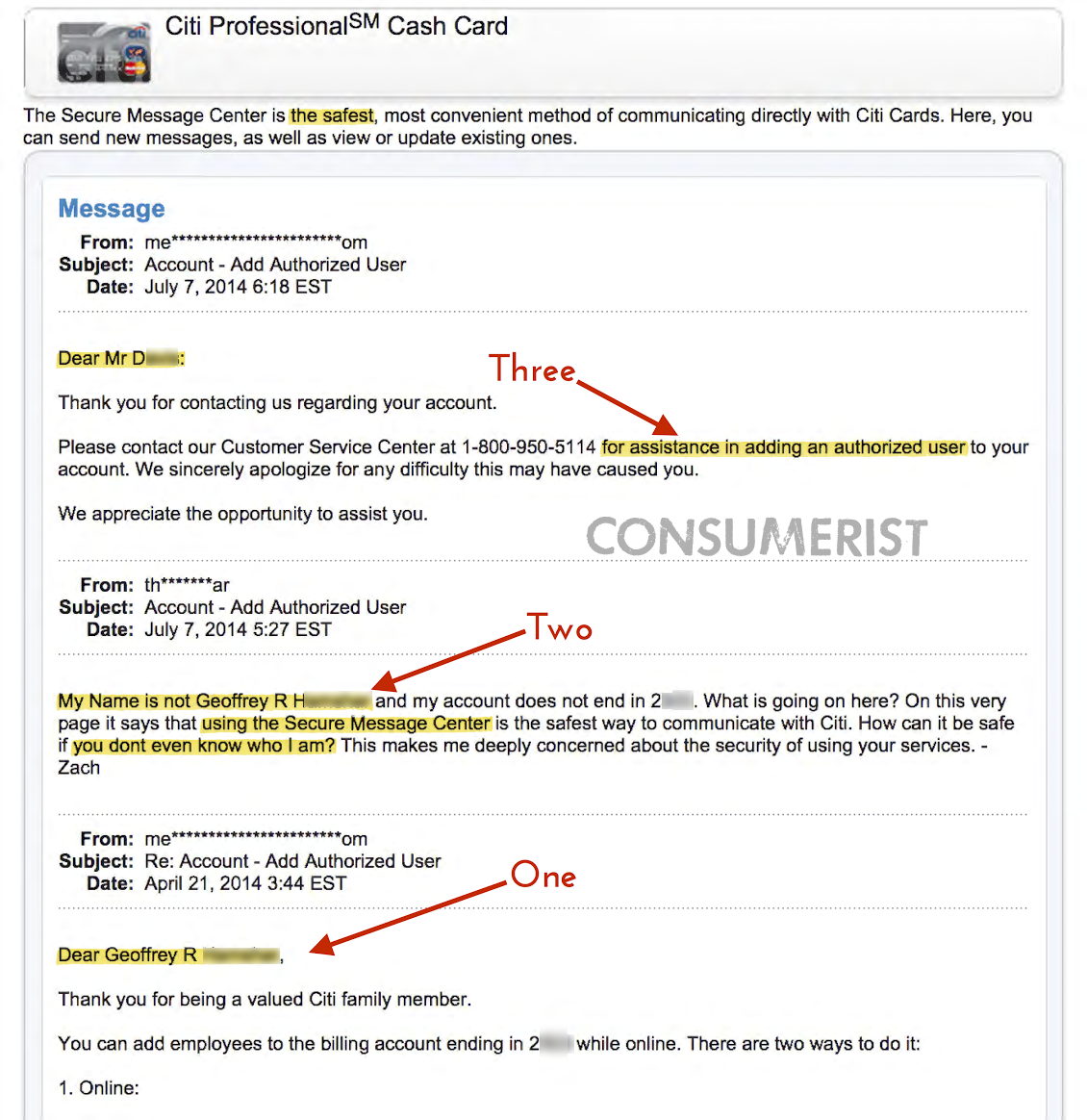

Citi’s “Secure Message Center” Run By Idiot Robots Who Don’t Care They Sent E-Mail To Wrong Person

If you’re a customer of any of the big banks, you’ve likely gotten a few messages in an online inbox that is only available via the bank’s website. You probably ignore most of these because they’re either about site downtime or upsells for add-on products you’ll never buy, but you probably assume that — unlike your gmail, yahoo, hotmail, or AOL account — this inbox doesn’t include messages that are intended for someone else. Wrong. [More]

Citibank Demands That Hearing-Impaired Customer Call Them, Hangs Up When She Does

Kerry has lost her hearing as an adult, and you can’t call her on the phone. This seems pretty self-explanatory, but apparently it isn’t. At least not to Citibank. They want Kerry to call them to verify a suspicious transaction, but hang up on her whenever she calls. [More]