All that junk promotional mail that ends up in your mailbox or e-mail inbox is presumably written by a human being. But many of these items are just variations on themes that have been played so many times that you could teach a machine how to write them. Which is apparently why some investors are putting their money into a startup that aims to automate the copywriting process. [More]

citi

Startup Claims It Can Automate Copywriting Process, Leaving Copywriters Time To Finish Their Novels

Forgot To Return A Purchase? Maybe Your Credit Card Issuer Can Help

While racking up unsecured debt is generally a bad thing, there can be hidden advantages to using your credit card for everyday purchases. Two benefits that we often recommend as weapons for consumer justice are chargebacks and warranty extensions, but here’s another one that you may not be aware of: return period extensions. Yes, buying with some credit cards can give you longer to return an unwanted item to the retailer. [More]

Petition Demands Big Banks Give Consumers Back Our Right To Sue

Since 2011, when the U.S. Supreme Court affirmed that it was perfectly okay for companies to take away a consumer’s right to sue — and their ability to join other wronged consumers in a class action — by inserting a paragraph or two of text deep in lengthy, unchangeable contracts, the rush has been on for almost every major retailer, wireless provider, cable company, and financial institution to slap these mandatory binding arbitration clauses into their customer agreements. Now one petition is gathering signatures, calling on the nation’s largest banks to put an end to the practice. [More]

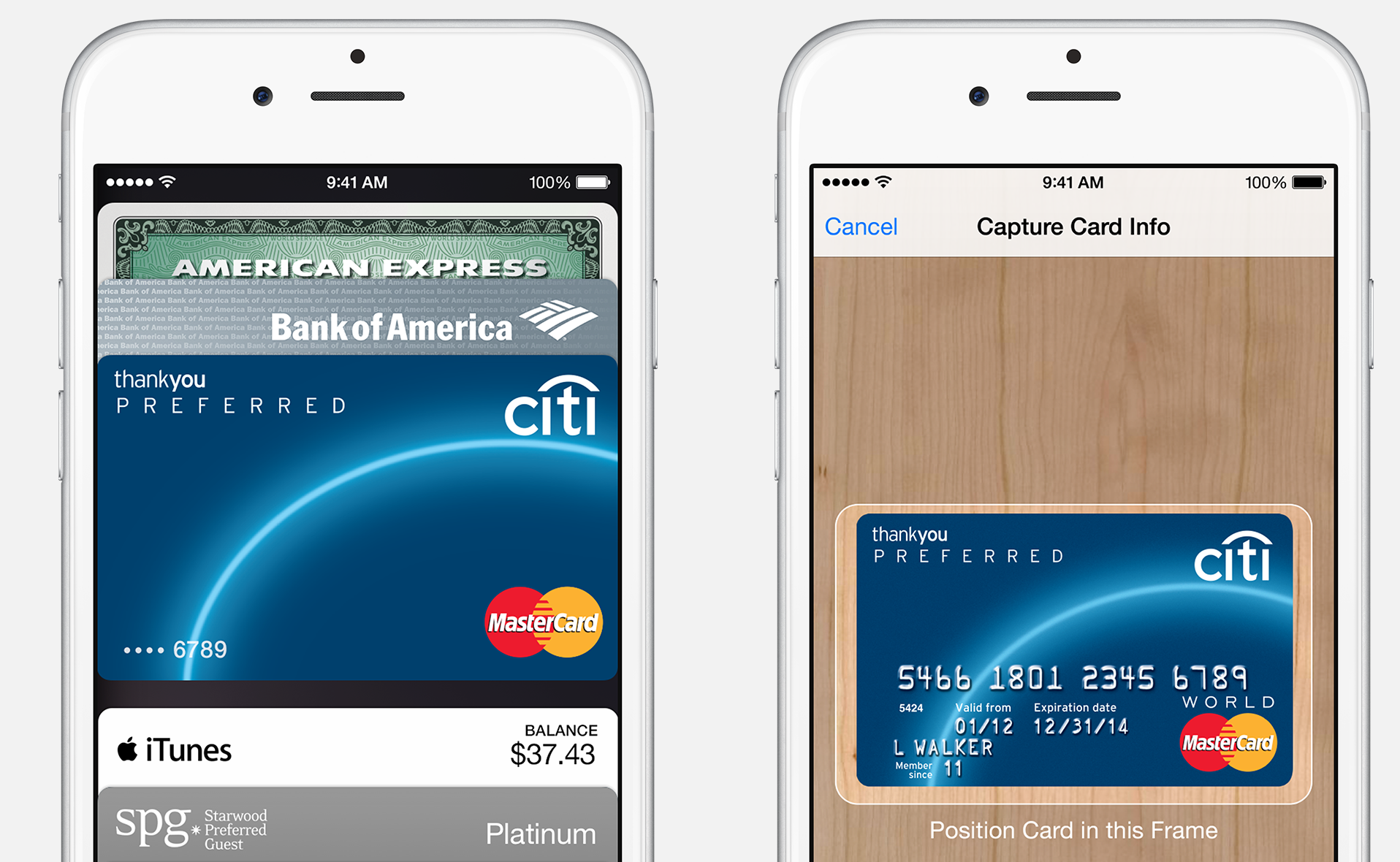

Apple Pay Lets Man Scan, Use Wife’s Citi Credit Card Without Additional Verification

One of the neat features of the new Apple Pay system is that it lets iPhone 6 users quickly scan and verify credit cards into their Passbook so they can use those accounts without ever providing participating businesses with their card numbers. But how easy is it to just scan in someone else’s card and start using it without that person’s permission? [More]

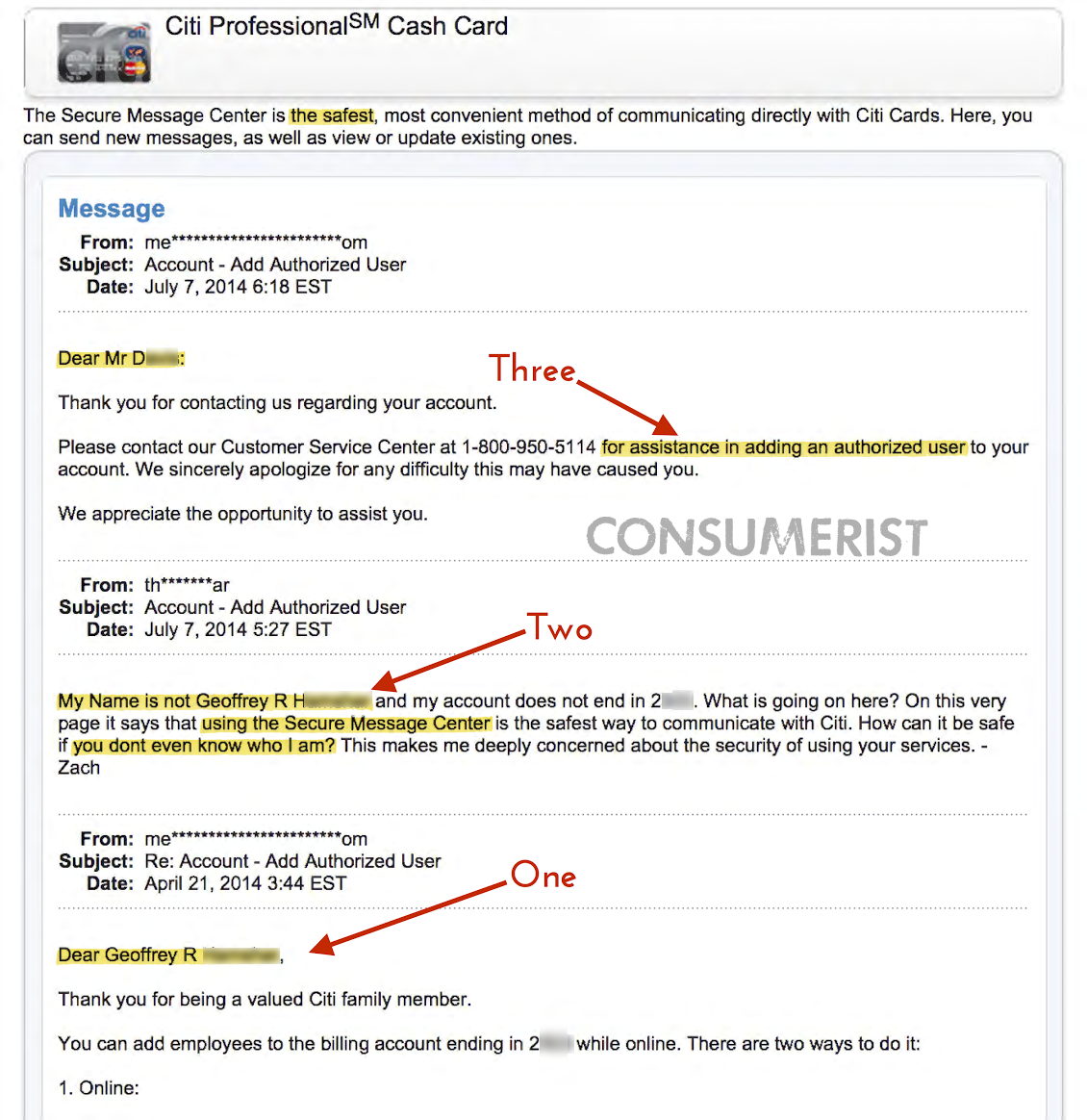

Citi’s “Secure Message Center” Run By Idiot Robots Who Don’t Care They Sent E-Mail To Wrong Person

If you’re a customer of any of the big banks, you’ve likely gotten a few messages in an online inbox that is only available via the bank’s website. You probably ignore most of these because they’re either about site downtime or upsells for add-on products you’ll never buy, but you probably assume that — unlike your gmail, yahoo, hotmail, or AOL account — this inbox doesn’t include messages that are intended for someone else. Wrong. [More]

Study: Credit Card Applications Becoming More User Friendly, But Still Lack Valuable Informaton

Credit card companies love to advertise all the perks of being a cardholder — rewards points, cash back, airline miles, etc. — but card issuers have historically hidden the not-as-good stuff in the fine print of card applications. A new study finds that banks are doing a better job of making things more transparent — but not about everything. [More]

Citi To Pay $7B To Settle Mortgage Investigation; Includes $2.5B In Consumer Relief

Nearly a week after it was first reported that Citigroup and the U.S. Justice Dept. had reached a deal to close the government’s investigation into toxic mortgage-backed securities sold by the bank in the years leading up to the crash of the housing market, Citi has now confirmed a settlement valued at a total of $7 billion. [More]

Citi Reportedly Ready To Pay $7 Billion For Selling Shoddy Mortgages

A half-decade on from the collapse of the housing bubble, it looks like the Justice Dept. and Citigroup may have finally reached a deal that will have the bank forking over several billion dollars to close the book on allegations that it sold off a large number of worthless mortgages in the lead-up to the 2008 crash. [More]

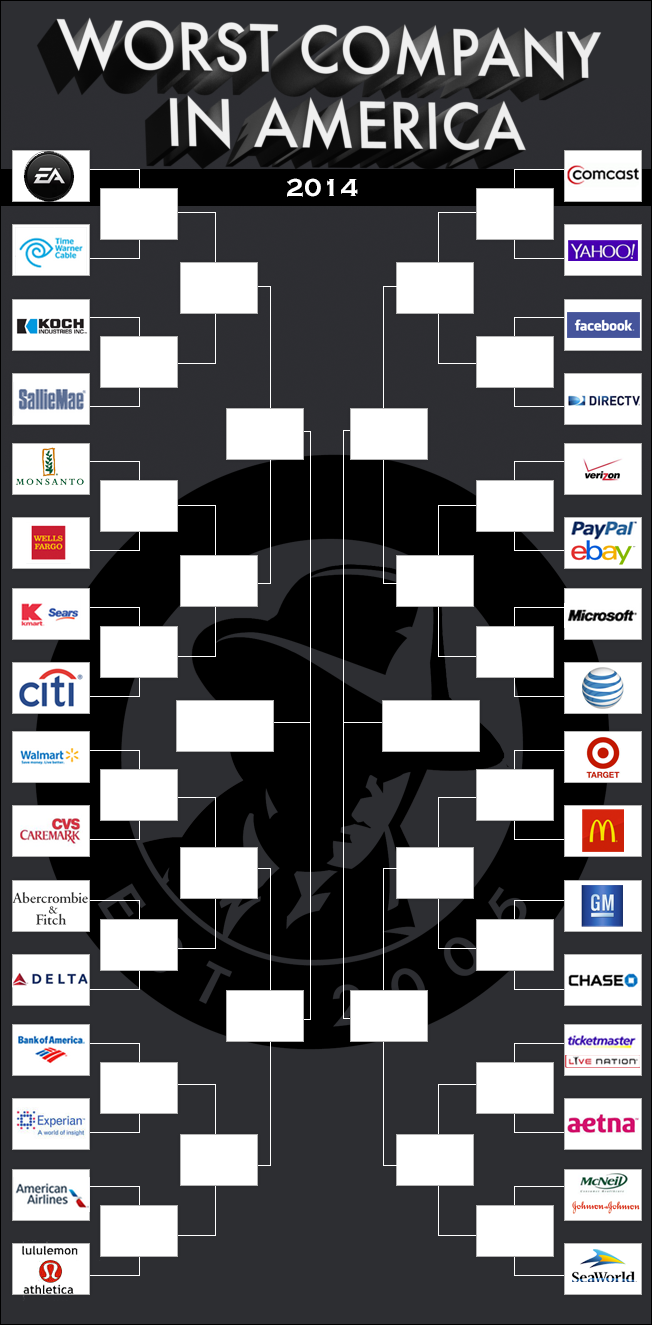

Time Warner Cable Ekes Out Another Win, To Face Monsanto In Worst Company Quarterfinals!

Two weeks ago, 32 bad businesses entered the Worst Company in America velodrome. But since they didn’t all bring their racing bikes with them, they just began beating the holy snot out of each other for our readers’ amusement. Giants fell, upstarts pulled upsets, and battle-hardened vets relived their glory days when they could more easily lay claim to the Golden Poo. Now, after two rounds of out-and-out, completely organized mayhem, eight contenders still stand, but to quote the greatest movie ever made in the history of films with the word “highlander” in the title: There can be only one. [More]

Facebook Gets The Thumbs-Up From Haters, Takes Final Spot In Worst Company Not-So-Sweet 16

After more than a week of bloodshed, half of the contenders that dared to dip their toes into the Worst Company wading pool (stocked with laser-equipped piranha and some ill-tempered guppies) have been carried out in Consumerist-branded body bags. The 16 fighters that remain are bruised, but not broken, and one of them will soon be crowned with the coveted Golden Poo. [More]

Have Fun Breaking Down This Year’s Worst Company In America Bracket

The above bracket will be updated at the end of each day of WCIA competition to reflect that day’s results.

——————

After going through all of your nominations, then having y’all rank the contenders and eliminate the chaff from the wheat, we’re proud to present the first round match-ups for this year’s Worst Company in America tournament! [More]

Here Are Your Worst Company Contenders For 2014 — Help Us Seed The Brackets!

After sorting through a mountain of nomination e-mails, we’ve whittled down the field of competitors for this year’s Worst Company In America tournament to 40 bad businesses. Here’s your chance to have your say on how these players will square off in the bracket, and which bubble teams will get left out in the cold. [More]

Citi To Replace Debit Cards Linked To Target Hack

A month after Target first revealed that its in-store credit and debit card payment system had been breached, Citi has finally announced plans to replace all debit cards for customers whose account information was stolen in the hack. [More]

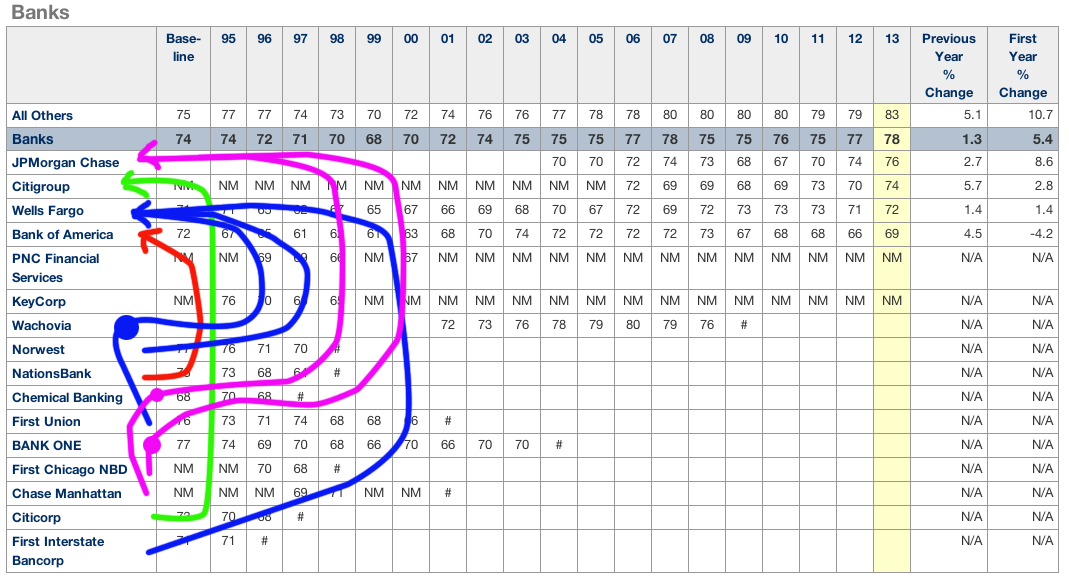

This Bank Customer Satisfaction Chart Is A Sad Reminder Of Rampant Consolidation

Maybe last week’s news that there are now fewer banks in the U.S. than ever before didn’t bother you. But here’s a chart of historic customer satisfaction scores that stands as a reminder of how so many banks have been absorbed into larger banking Voltrons in just the last two decades. [More]

BofA’s Customers Don’t Hate Bank As Much As Non-Customers (But They Aren’t Happy)

It’s no secret that Bank of America is the most-reviled of the nation’s large banks, mostly for its handling of the mortgage mess, including the most recent allegations that it deliberately deceived troubled borrowers in order to nudge them toward foreclosure. But even though BofA’s customers gave it the lowest marks in a new survey of banks’ reputations, those customers don’t hate the bank anywhere near as much as people who have no financial ties to it. [More]

Big Banks Failing To Comply With All The Rules For National Mortgage Settlement

Remember that massive $25 billion settlement between the nation’s largest mortgage servicers — Bank of America, Wells Fargo, Chase, Citi, Ally — and attorneys general from around the nation? Well, it comes with a lot of rules for these institutions to follow. But the person in charge of monitoring the settlement says most of the banks are failing to comply fully. [More]

One Complaint To CFPB Fixes Mortgage Snafu That 9 Months Of Dealing With The Bank Couldn’t

As Consumer Financial Protection Bureau director Richard Cordray pointed out in his testimony before the Senate Banking Committee this morning, more than 130,000 American consumers have used the agency’s numerous complaint portals to help resolve their problems with financial institutions. Consumerist reader Charles is just one of those people who still has a house because the CFPB was able to accomplish in a few days what no one else could in almost a year. [More]