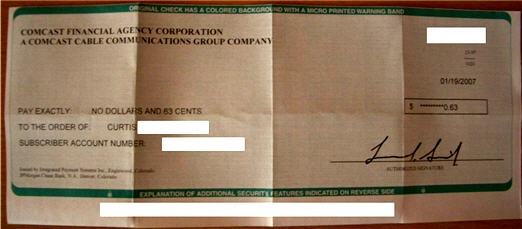

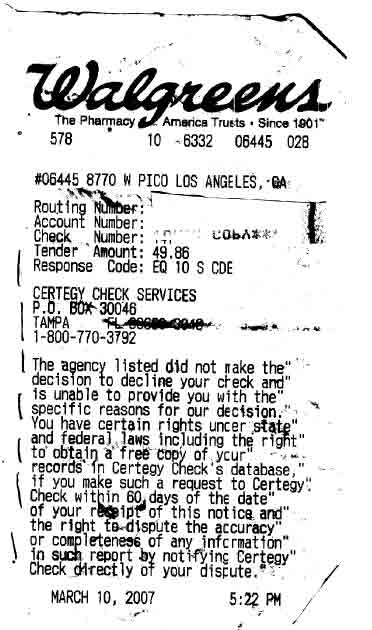

Old-fashioned check fraud is coming back into style as banks tailor their anti-fraud efforts to safeguard internet commerce. Check fraud cost banks almost $1 billion in 2005. The LA Times took the time to test the effectiveness of one resurgent scheme, check washing:

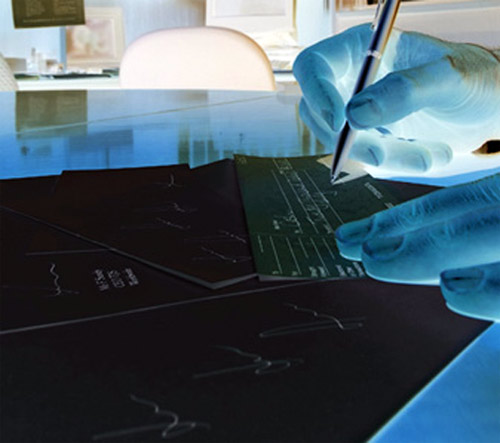

In a test at The Times — following directions supplied by a local security expert — the writing in the “Pay to the Order,” “Dollars” and signature areas on a check was dissolved in less than 15 minutes. Printed information — including the bank routing numbers and the name and address of the account holder — remained intact.