Seven months after launching its credit card complaint portal, the Consumer Financial Protection Bureau has started taking complaints from checking and savings account customers — and actually expects banks to respond. [More]

checking accounts

Chase Plans On Caring Even Less About Customers With Less Than $100K In The Bank

Are you a JPMorgan Chase customer with less than $100,000 dollars deposited? Then you are not making the bank enough money and it probably wants nothing to do with you going forward. [More]

Citi Jacks Up Monthly Fees And Minimum Balance Requirements For Checking Accounts

While Bank of America is inflaming consumers’ anger by saying it will soon start charging some debit card customers a monthly fee, the people at Citibank have been busy figuring out just how much to inflate the monthly fees and balance minimums for many of their checking account customers. [More]

64% Of Americans Can't Pay For $1,000 Emergency

If you had to fork over $1,000 right now, would you be able to do so without borrowing money or using your credit card? If so, then a new survey from the National Foundation for Credit Counseling says you’re in the minority. [More]

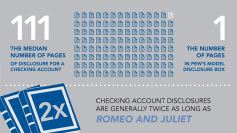

Checking Account Disclosure Documents Are Longer Than Romeo & Juliet, Contain Less Teen Sex

We recently wrote about the PIRG study showing how fewer than 40% of banks were willing to clearly disclose checking account fee schedules. Now a new report from the Pew Charitable Trust demonstrates just how far banks are willing to go to make it difficult for consumers to know what they are getting with their checking accounts. [More]

Study: Less Than 40% Of Bank Branches Willing To Openly Disclose Account Fees To Customers

In spite of legislation requiring banks to disclose all fees associated with consumer deposit accounts, a new study from the Public Interest Research Group shows that only around four out of 10 bank branches don’t make it difficult or impossible for consumers to see the full schedule of fees.Additionally, banks are reluctant to let customers know about the availability of free checking accounts. [More]

Zombie Wells Fargo Account Rises From Dead, Collects Overdraft Fees

Leigh thought that she had laid her Wells Fargo checking account to rest. It was closed, gone, out of her life forever. When some forgotten auto-payments hit the account, though, instead of rejecting the payments, the bank zombified the account, brought it back to life, and charged Leigh and her husband a $35 overdraft fee for each item that hit their account. Wells Fargo put them on a payment plan to repay their balance, then turned around and sent the account to collections less than a month into the agreed-upon payment plan. Now they’ve been flagged as overdrafters in the Chexsystems database, and are still watching the account to make sure that no erroneous auto-payments hit it and trigger more overdrafts. [More]

TD Bank Charging Customers $2 To Get Cash From A Non-TD ATM

As Congress today debates over proposed caps on debit card swipe fees that would limit bank profits and lower costs for merchants, TD Bank has announced they’re going to start charging customers a $2 fee whenever they take cash out of a non-TD bank ATM. That’s going to be on top of any fee that you already pay the ATM. The only way to avoid the fee is to be in a higher-tier checking account. [More]

HSBC Just Assumes You Want The $90 Check-Printing Service

Adam never received checks for his new HSBC account, so he stopped by his branch to order some. He must have struck bank employees as the kind of guy who demands nothing but the best, since branch employees handed him the order form for the most expensive checks. The ones that cost $90. [More]

Chase Closes Couple's Bank Account Because They Deposited Checks Written With Red Ink

A California couple lost their Chase checking account because the bank’s system couldn’t read the red ink on a pair of $100 checks from one of their grandmothers. [More]

All I Needed To Drain Her Checking Account Was Her Wallet — Good Thing I'm Her Husband

Marc has a problem with Bank of America’s security. He called the bank and, using alarmingly little information, was able to get access to his wife’s account. He’s worried a thief would have been able to do the same. [More]

Free Checking Accounts Heading The Way Of The Dodo

For much of the last decade, more and more banks had been offering checking accounts with no monthly fees or minimum balance requirements. But a new study from BankRate.com shows that this trend appears to have ended. [More]

Wells Fargo Closes My Overdrawn Account 28 Days Before It Says It Would

Sean’s Wells Fargo checking account dipped into the negatives on charges he disputed. He says Wells Fargo said he’d have nearly a month to sort out the issue, but it turned out that by “30 days” the bank meant “48 hours,” because two days later the account was as incapacitated as the 49ers’ offense. [More]

Chase Approves Transaction Anyway After Customer Declines Overdraft Protection

Paul opted not to sign up for Chase’s overdraft fee trap–oh wait, they call it “protection”–but Chase happily ignored this fact and approved a transaction anyway, which led to a $34 overdraft fee that they refuse to reverse. The loophole they’re using to get around Paul’s opt-out is that the vendor was someone he’d authorized in the past, and therefore this new transaction isn’t protected from the bank’s “protection” fee. [More]

North Dakota Court Says Bank Can Rob Customer Of $12K In Overdraft Fees

If you live in North Dakota and find yourself buried in overdraft fees, don’t go crying to the state’s Supreme Court. Judges ruled that a bank was within its rights to stick a hog farmer with $12,000 in overdraft charges. [More]

BofA Customers, Watch Out For Overdraft Protection Auto-Enrolling

Will was meticulous about avoiding the succubus that is overdraft protection in his Bank of America checking account. So you can imagine what happened to him: The bank automatically stuck him with the so-called protection thanks to an automatic function that stuck him with a $100 credit card cash advance, along with the accompanying finance charges. [More]

HSBC Closes Bank Account Over 14 Cent Overdraft

“Don’t overdraw your bank account” is pretty sound advice. However, reader Phil advises that if you do happen to overdraw your HSBC account–even by a few cents–the bank will mercilessly close your bank account with no warning. That’s what happened to him. [More]

When It Comes To Overdraft Opt-In, Chase Won't Take No For An Answer

According to Robert, Chase is taking the Steve Urkel approach to persuasion, asking him again and again if he would like to partake in its delicious overdraft protection, brushing off his continuous “no” answers as Steve always did to Laura in Family Matters. [More]