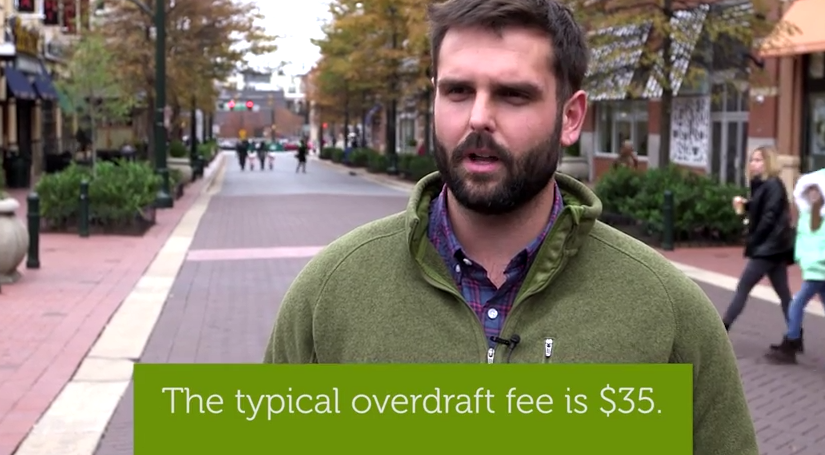

Under federal law, depository institutions are prohibited from charging overdraft fees on ATM and one-time debit card transactions unless consumers affirmatively opted in. But a new report suggests that those who do opt-in might not know the cost of such a decision, with opted-in frequent overdrafters spending about $450 more in fees each year than non-opted-in frequent overdrafters. [More]

checking accounts

My Bank Overdrafted My Account By Putting Two Holds On One Deposit; Doesn’t Care

Imagine that you do everything you can to avoid overdrafting your bank account, only to find that your bank has gone ahead and pushed you into the red — and that it doesn’t really care. [More]

Banks Attract New Customers, New Fee Income With Check-Cashing Services

Instead of imposing new fees on their existing customers, banks have an exciting new idea: attract new customers and charge them fees. Specifically, banks are looking to low-income and lower-middle-income people who might normally use check-cashing stores or check-cashing services in retail stores to gain immediate access to their money. These customers may not make large deposits, but what customers who want access to their cash right away do generate are lots of fees. [More]

Banks Continue To Improve Consumer Safeguards, But Progress Isn’t Coming Fast Enough

Opening a checking account with a bank is a rite of passage of sorts for many consumers, but the plethora of small-print disclosures, fees and other services are enough to confuse even the most seasoned account holder. While banks attempted to simplify their practices over the years, a new Pew Charitable Trusts report shows that some banks – and regulators – have a long way to go before they’re truly doing everything they can to protect consumers. [More]

Many Americans Still In The Dark About Overdraft Fees & Other Bank Practices

While millions of consumers contribute to the $32 billion in overdraft fees collected each year, a new video shows that many checking account holders don’t fully understand the way overdrafts work or how much they spend on the fees each year. [More]

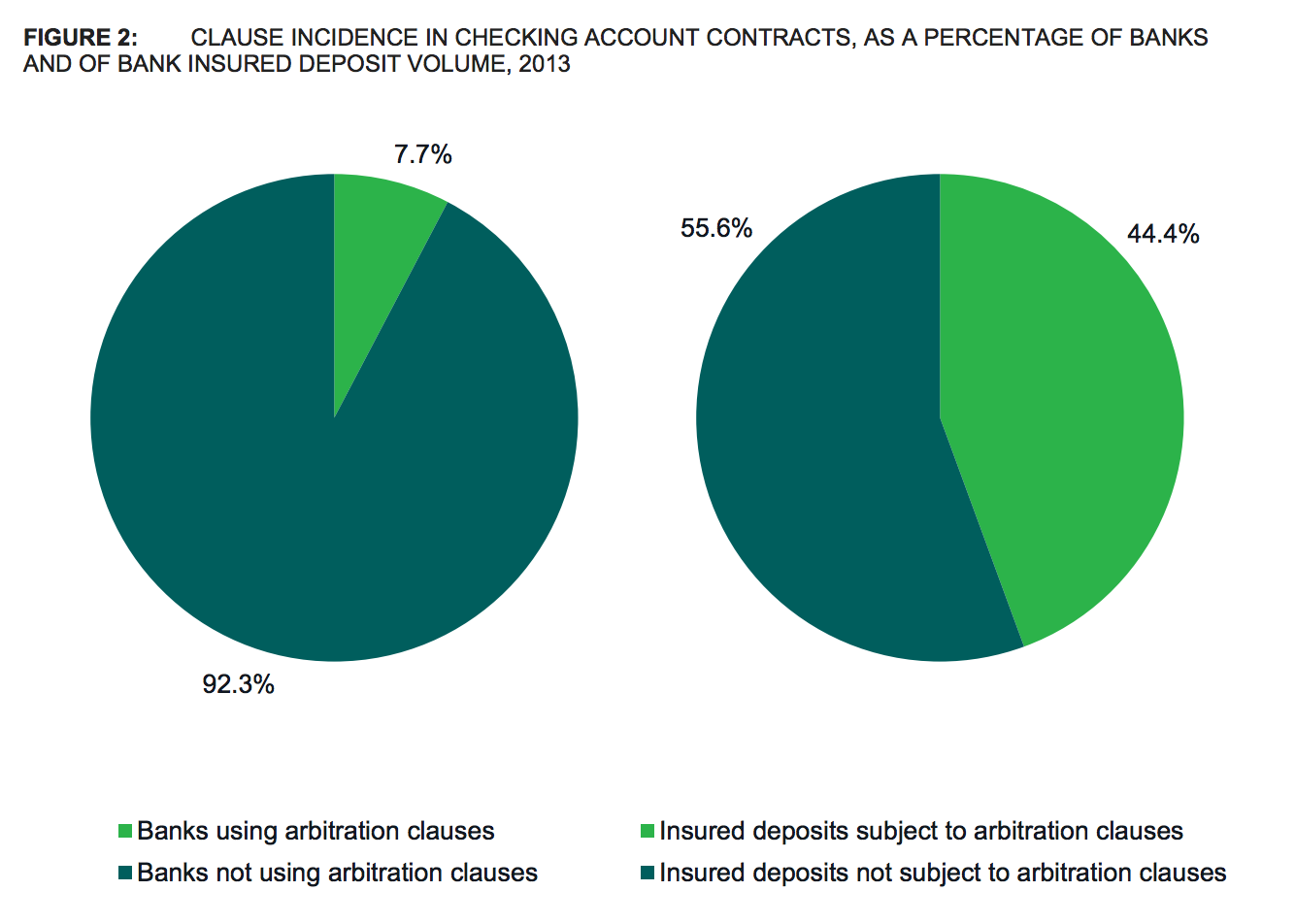

In Wake Of Arbitration Report, Consumer Advocates Ask CFPB To Revoke Banks’ “License To Steal”

This morning, the Consumer Financial Protection Bureau released its final report on forced arbitration, showing how banks and credit card companies use contractual clauses to short-circuit class-action lawsuits from their customers. Now that the Bureau has done its research, consumer advocates are calling on regulators to use their authority to end the practice. [More]

Banks & Credit Card Companies Saving Millions By Taking Away Your Right To Sue

Tens of millions of American consumers have clauses in their credit card, checking account, student loan, and wireless phone contracts that take away their rights to sue those companies in a court of law, and more than 93% of these people have no idea they’ve had this right taken away from them. The companies involved are presumably quite happy about this lack of awareness, as it results in millions of dollars in savings that aren’t being passed on to you. [More]

Walmart Continues Acting Like A Bank, Now Offering Low-Fee Checking Accounts

It appears that Walmart is taking consumers’ willingness to do their banking outside of traditional banks to heart. The mega-retailer unveiled plans today that would put low-cost checking accounts into the hands of just about any consumer across the country. [More]

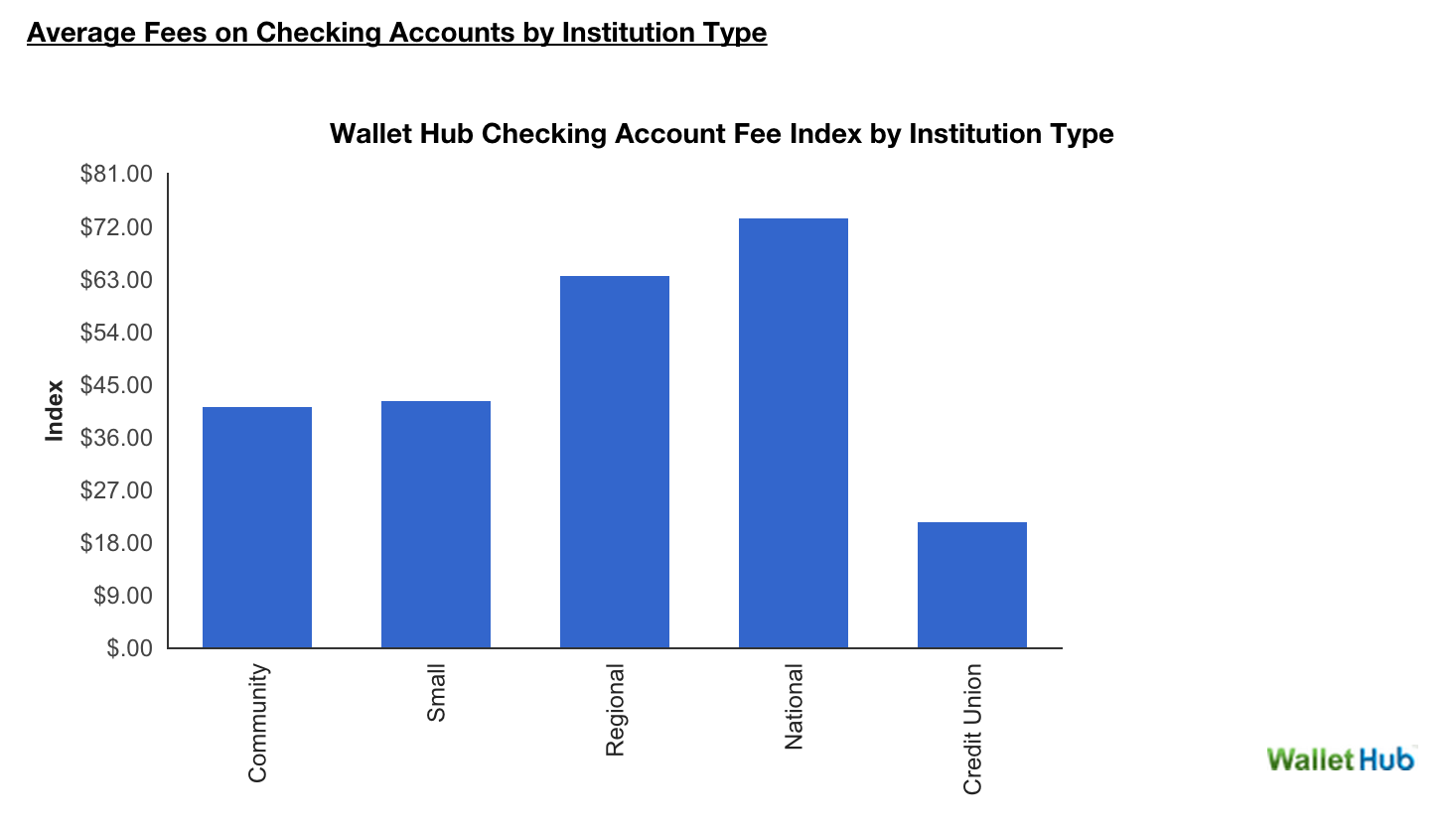

Until Banks Settle On Single Way To Disclose Fees, It’s Hard To Compare Checking Accounts

Most banking services come with a laundry list of small-print, hard-to-read disclosures detailing how much one might expect to pay for things like depositing a check, talking to a teller or checking an account’s balance. Knowing that information before signing on the dotted line for a new checking account is paramount if you don’t want to be saddled with some of the billions of dollars consumers spend on checking account fees each year. However, as a new report continues to show, actually finding that information online can often be an exercise in futility. [More]

Banks Improve Disclosures, Falling Behind On Overdraft Fees, Binding Arbitration Clauses

Checking accounts come in all shapes and sizes to fit every consumer’s needs – fine, not every consumer. While options can be good when you’re shopping around for a new bank, they also lead to a plethora of fees and risks for consumers. While some practices have improved, a new Pew Charitable Trusts report shows banks have a long way to go and it’s time the Consumer Financial Protection Bureau took action. [More]

How To Not Suck… At Teaching Your Kids About Money

Even if you have one of those fabled money trees (a distant cousin of a ticket oak) in your yard, there’s going to come a time that you need to teach your children the birds and bees about money. [More]

Prepaid Debit Cards: Salvation From Overdraft Fees Or Putting Your Money At Risk?

No overdraft penalties, no overspending and sometime low but occasionally ridiculous fees are all perks that have led consumers to an increased use of prepaid debit cards in the last year. And while the cards are convenient there are plenty of reasons consumers should by wary. [More]

Free Checking Accounts Are Vanishing And Consumers Are Letting It Happen

U.S. consumers and businesses currently have $1.4 trillion stashed away in checking accounts and banks and credit unions around the country. That’s more than ever before, and most of that cash is being held in accounts that earn absolutely no interest. At the same time, financial institutions are continuing to cut down on the availability of unconditional free checking. [More]

Would You Pay For A Checking Account If You Had The Option Not To?

The “pay whatever you want” way of doing things has often worked for music groups, museums and other artistic institutions, mostly because while some people will pay nothing, others will pony up cash in appreciation for the benefits they receive from the product or art. But one new online bank is well, banking on the fact that that model could work as well. [More]

New Legislation Seeks To Rein In Overdraft Fees

Bank overdraft fees can pile up rapidly, making it increasingly more difficult for a consumer to get back to zero, which is why Congresswoman Carolyn Maloney of New York recently introduced legislation aimed at limiting how much and how frequently banks can ding account holders for these fees. [More]

Pew Says Checking Account Fees Are Still Too High & Complicated

Even though banks have had a whole year since the last time the Pew Charitable Trust looked into potentially harmful practices related to checking accounts, the latest news from Pew indicates those banks haven’t done a whole lot to improve things for consumers. [More]