While racking up unsecured debt is generally a bad thing, there can be hidden advantages to using your credit card for everyday purchases. Two benefits that we often recommend as weapons for consumer justice are chargebacks and warranty extensions, but here’s another one that you may not be aware of: return period extensions. Yes, buying with some credit cards can give you longer to return an unwanted item to the retailer. [More]

chase

Chase Data Breach Hit 76M Households, 7M Businesses; Account Info Not Stolen

Remember that coordinated hack attack against JPMorgan Chase and other banks from August? Chase now says information — but apparently no payment data — on some 76 million households and 7 million small businesses was compromised. [More]

Chase Proactively Replacing Some Debit, Credit Cards Involved In Home Depot Breach

Home Depot has yet to confirm the estimated number of customer credit and debit card accounts that were compromised during the data breach that affected thousands of stores for five months, and it’s not known whether much of the stolen card info will ever be sold by the hackers now that everyone knows about the massive theft. Regardless, JPMorgan Chase has already begun the process of replacing some cards for customers who may have been affected. [More]

Ohio Woman Sues Chase For Alleged Mortgage Law Violation

When you don’t follow the rules, you’re likely to get into a bit of trouble. In this case, JPMorgan Chase found itself party to a lawsuit alleging the company violated a law aimed to protect homeowners. [More]

Presenting The Final Four Contenders For Worst Company In America 2014

Can it be? Has there really been so much bloodshed is so little time? It seems like only yesterday when the field of contenders stood before you at the opening ceremonies, waving their logo flags while proudly sporting their WCIA sweaters that Ralph Lauren’s distant cousin Kevin designed especially for the occasion. Now the industrial grade carpeting of the Worst Company Padded Playroom is stained with… well, you don’t actually want to know what all is in there; don’t worry, our friend Terry got us a good deal on a cleaning service and you’d be surprised what a well-placed area rug can cover. But back to more pressing matters… [More]

Time Warner Cable Ekes Out Another Win, To Face Monsanto In Worst Company Quarterfinals!

Two weeks ago, 32 bad businesses entered the Worst Company in America velodrome. But since they didn’t all bring their racing bikes with them, they just began beating the holy snot out of each other for our readers’ amusement. Giants fell, upstarts pulled upsets, and battle-hardened vets relived their glory days when they could more easily lay claim to the Golden Poo. Now, after two rounds of out-and-out, completely organized mayhem, eight contenders still stand, but to quote the greatest movie ever made in the history of films with the word “highlander” in the title: There can be only one. [More]

Latest Worst Company Voting Results Confirm: People Hate Banks

After a brief breather, it was back to pummeling the living heck out each other for the remaining contenders in this year’s Worst Company In America tournament. And even though the nation’s largest airline and biggest fast food chain looked like they might have had what it takes to challenge for the Golden Poo, one has to always remember an ages-old truth: People just plain hate banks. [More]

Facebook Gets The Thumbs-Up From Haters, Takes Final Spot In Worst Company Not-So-Sweet 16

After more than a week of bloodshed, half of the contenders that dared to dip their toes into the Worst Company wading pool (stocked with laser-equipped piranha and some ill-tempered guppies) have been carried out in Consumerist-branded body bags. The 16 fighters that remain are bruised, but not broken, and one of them will soon be crowned with the coveted Golden Poo. [More]

Comcast, Abercrombie, Chase Victorious In First Day Of Worst Company Competition!

The 2014 Worst Company In America competition got off to a big start today with readers turning out in droves to vote on the tournament’s first three match-ups that saw a former Golden Poo champ flexing its muscle, a tournament mainstay making its case for the WCIA title, and the year’s first upset. [More]

Citi To Replace Debit Cards Linked To Target Hack

A month after Target first revealed that its in-store credit and debit card payment system had been breached, Citi has finally announced plans to replace all debit cards for customers whose account information was stolen in the hack. [More]

JPMorgan Chase To Pay $2 Billion For Failing To Notice Madoff Was Giant Scheming Schemer

It’s only the first week of January and already it’s an expensive year for giant bank JPMorgan Chase. Just blame Bernie Madoff. [More]

Thieves Smash Chase Branch, Drive Off With Entire ATM

“Needless to say, you’re not going to be able to use this ATM this morning,” observed a TV reporter standing in front of the Orlando, Florida Chase branch where an automated teller machine was ripped from the building. No. No, you’re not. [More]

Chase To Pay $389 Million Over Illegal Charges For Credit-Monitoring Services

It’s not been a banner week for JPMorgan Chase, which has agreed to pay out nearly a billion dollars to close investigations related to the 2012 “London Whale” trading fiasco, and now is told it must pay out $309 million in refunds and $80 million in penalties over illegal credit card charges for ID and fraud-protection services customers never ordered. [More]

Chase: Refunding A Scam Victim Is The Same As Forgiving A Debt

When you successfully convince your credit card company that you were scammed out of thousands of dollars and that a chargeback should be issued, you’d think that would be the end of the story, but not for one Chase credit card customer who just found out — two years after receiving the money back — that Chase now says the refund is actually a forgiven debt, and that he must pay income taxes on it. [More]

Woman Returns $20,000 Bag O’ Cash To Chase Bank, Gets $500 As Reward

When a currently out-of-work schoolteacher in Texas came across a bag containing enough cash to buy a car, she did what some other wouldn’t even think of — she took it to the nearest bank and returned it. [More]

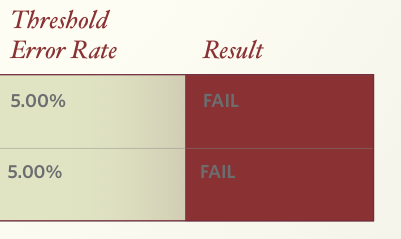

Big Banks Failing To Comply With All The Rules For National Mortgage Settlement

Remember that massive $25 billion settlement between the nation’s largest mortgage servicers — Bank of America, Wells Fargo, Chase, Citi, Ally — and attorneys general from around the nation? Well, it comes with a lot of rules for these institutions to follow. But the person in charge of monitoring the settlement says most of the banks are failing to comply fully. [More]

Chase Won’t Stop Robocalling About My Low Account Balance: I Don’t Have An Account

Late last year, Dennis got a new phone number. That shouldn’t be anything to complain about, and indeed he has no complaints about his mobile carrier or about his new phone. The problem is that Chase Bank keeps calling him about his account balance, which he would appreciate if he actually had an account with Chase or a low account balance. He does not. [More]