With the cost of college tuition continuing to increase, it likely comes as no surprise that more borrowers are finding themselves in default. In 2016 alone, 1.1 million borrowers entered default for their federal student loans. [More]

cfpb

More Than 1.1M Federal Student Loan Borrowers Entered Default Last Year

Appeals Court Will Rehear Case Involving Constitutionality Of Consumer Financial Protection Bureau

Four months after a three-judge panel issued a 2-1 ruling that the structure of the Consumer Financial Protection Bureau is unconstitutional, the full Court of Appeals for the D.C. Circuit has agreed to rehear the issue. [More]

Lawmakers Introduce Legislation That Would Abolish The CFPB

The future of the Consumer Financial Protection Bureau continues to remain in question with yet another attack being lobbed at the Bureau this week as lawmakers introduced new legislation both in the House and Senate that would abolish the agency. [More]

Trump Order Targeting Dodd-Frank Reforms Is Largely Symbolic, Still Cause For Concern

This morning, President Trump began to fulfill his campaign promise to “get rid of Dodd-Frank,” putting his name to an executive order that directs federal regulators to revise the rules established by the 2010 financial reforms. While this latest directive from the Oval Office is largely symbolic and does little to change existing regulations, consumer advocates say there are still reasons to be concerned. [More]

Feds Order MasterCard, RushCard Owner To Pay $13M Over Oct. 2015 Outages

Nearly 15 months after tens of thousands of users of the prepaid RushCard were cut off from their funds because of an apparent technical glitch, the company behind the card, UniRush and its payment processor MasterCard have been ordered to pay $13 million in refunds and penalties. [More]

Consumer Advocates, 17 States Willing To Defend CFPB In Court If Trump Administration Won’t

The Consumer Financial Protection Bureau is barely five years old and its future is already in doubt after a divided federal appeals court ruled that the CFPB’s leadership structure is unconstitutional. The Bureau’s legal battle is far from over, but the new Trump administration would likely not fight a court ruling the White House seems to agree with. That’s why a number of consumer advocates and more than a dozen state attorneys general have stepped up, seeking to defend the CFPB if the new executive branch won’t. [More]

CitiFinancial, CitiMortgage To Pay $28.8M Over Mortgage Servicing Issues

Millions of consumers lost their homes when the housing market bubble burst. But federal regulators say some of those people may have been able to stay in their homes had mortgage lenders fulfilled their requirements. To that end, the Consumer Financial Protection Bureau has ordered two Citigroup subsidiaries to pay $28.8 million to resolve allegations that some of its mortgage units harmed home borrowers. [More]

Student Loan Giant Navient Sued By CFPB & Two States Over Alleged Illegal Practices

Eighteen months after Sallie Mae spin-off Navient revealed that its wholly-owned subsidiary Navient Solutions Inc could one day be on the receiving end of a federal lawsuit related to its student loans servicing practices, the day has come to pass. The Consumer Financial Protection Bureau, along with two states, filed lawsuits against the nation’s largest student loan company for allegedly cheating borrowers out of repayment rights. [More]

Justice Department Calls For Rehearing On Constitutionality Of Consumer Financial Protection Bureau

With only weeks to go before President-elect Trump could possibly replace the Director of the Consumer Financial Protection Bureau with someone of his choosing, the U.S. Justice Department is asking a federal appeals court to rehear arguments in a case involving the constitutionality of the Bureau’s structure. [More]

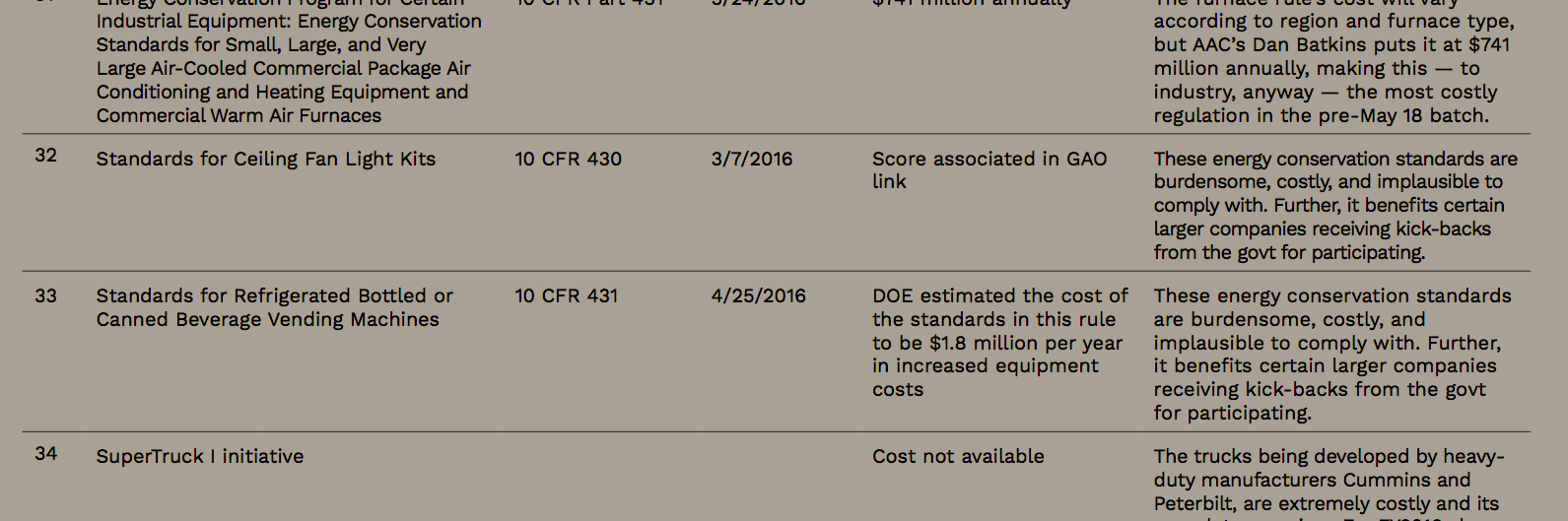

House ‘Freedom Caucus’ Asks Trump To Undo 232 Rules On Net Neutrality, Tobacco, Nursing Homes & Ceiling Fans

What’s on your wish list this holiday season? For the few dozen members of the House of Representatives Freedom Caucus, the hope to see President-elect Donald Trump undo or revise more than 200 federal rules involving everything from tobacco to food labels to ceiling fans to your constitutional right to bring a lawsuit against your credit card company. [More]

Banks Ask Congress To Alter Consumer Financial Protection Bureau, Roll Back Pro-Consumer Regulations

While virtually all federal agencies will soon see a change in leadership when President-elect Trump enters the White House, the future of the Consumer Financial Protection Bureau and its Director remain in question. In an effort to work around those legal concerns, the banking industry has called on Congress to legally change the structure of the CFPB, and to roll back a number of the CFPB’s recent and pending regulations on banks and lenders. [More]

21 Lawmakers Come Out To Defend The Consumer Financial Protection Bureau

While most federal agencies will soon see a change in leadership and direction after President-elect Donald Trump takes office, the head of the Consumer Financial Protection Bureau is supposed to be shielded from such sudden changes. A recent court decision put that protection — and the future of the CFPB itself — in question, but today a group of 21 federal lawmakers, along with a coalition of consumer advocates and civil rights groups, asked the court to keep the CFPB’s structure intact. [More]

Financial Regulators Race To Finish New Rules, But Congress Can Still Try To Roll Them Back

The wheels of government turn slowly, especially when it comes to rulemaking — the process by which a federal agency proposes, drafts, and finalizes new rules. It can take anywhere from a few months to a few years for this process, but with the incoming Trump administration giving every indication of having a light-touch on regulation, financial regulators have reportedly kicked things into high gear to finish up pending rules in the next two months, even though Congress may be able to roll them back. [More]

Consumer Financial Protection Bureau Challenges Ruling That Its Structure Is Unconstitutional

Last month, a split three-judge panel of the D.C. Circuit Court of Appeals ruled that the structure of the Consumer Financial Protection Bureau is unconstitutional as it puts too much authority in the hands of one person. Now the CFPB is challenging that ruling, petitioning for a review of the matter by the full D.C. Circuit, in what the Bureau claims “may be the most important separation-of-powers case in a generation.” [More]

Future Looks Dim For Consumer Financial Protection Bureau Under Trump Presidency

On the campaign trail, President-elect Donald Trump made his disdain for the 2010 Dodd-Frank financial reforms clear, leaving many to wonder what a Trump White House would mean for the Consumer Financial Protection Bureau — the financial services regulator created by the 2010 legislation. Now that pieces are beginning to fall into place for the Trump transition plan, the outlook for the CFPB does not appear very bright. [More]

From Healthcare To Financial Protection: How Will The Trump White House Affect Consumers?

Elections always bring change; some more so than others. With yesterday’s results in the box and tallied, we now know that we are expecting not only a Trump administration next January, but also to have both houses of Congress and the White House all aligned under control of the same political party. That means that for at least two years, until the next midterm elections, the party in charge — in this case, the Republicans — has the ability to push through changes to policy and law, and we can expect it to do so. [More]

Feds Go After “Massive, Illegal” Debt-Collection Operation

A large, nationwide debt-collection operation that allegedly brought in tens of millions of dollars through illegal means — like impersonating law-enforcement officers, or threatening arrest for non-payment — is the target of a joint legal action by the Consumer Financial Protection Bureau and the New York state attorney general. [More]