Overdrafting your checking account might only hit you for $35, but when that happens a few hundred million times each year, it really adds up. A new report estimates that banks in the U.S. are now making $17 billion a year from fees for overdrafts and insufficient funds.

[More]

center for responsible lending

Banks Making $17B A Year From Fees For Overdrafts & Insufficient Funds

New Campus Banking Rules Hope To Protect Students From High Prepaid & Debit Card Fees

Back in May, the Department of Education proposed rules to govern college prepaid and debit cards in order to afford students proper protections from excess fees and other harmful practices. Fast forward five months, and those rules have are now finalized. [More]

When Comparing Colleges, It Would Help To Know If A School Is Under Investigation

Many consumers thinking of pursuing a higher education weigh the pros and the cons of a specific college: tuition, convenience, available areas of study. Last month, the Department of Education announced it would make the college shopping experience a little easier for prospective students by creating a consumer-facing online college comparison system. While the tool will no doubt be helpful, consumer advocates warn that, as it stands, the system will be missing a vital information: whether or not schools are party to investigation, lawsuits or settlements over harmful and deceptive practices. [More]

Abusive Lending Practices Can Lead To Negative Long-Term Consequences For Borrowers, Communities

Every year, more than 12 million Americans spend $17 billion on payday loans, despite the fact research has shown these costly lines of credit often leave borrowers worse off. Yet abusive lending practices are not relegated to borrowers in need of a couple hundred dollars to stay afloat until their next paycheck; there are mortgages, car loans, and other traditional lines of credit that can leave the borrower in a bind. Even if you never find yourself on the wrong end of a predatory loan, these products can still be a drain on your entire community. [More]

Dept. Of Education Proposes Rules To Govern College Prepaid Credit & Debit Cards

College students’ federal aid has increasingly been put at risk by the cozy relationship between institutions of higher education and credit card issuers over the years. While consumer advocates and legislators have debated whether or not products like student IDs that double as credit or debit cards provide an actual benefit to students or if they’re just a way for schools and banks to rake in the big bucks, the Department of Education finally took steps today to ensure students are afforded proper protections from excess fees and other harmful practices with the proposal of regulations targeting the college debit and prepaid card marketplace. [More]

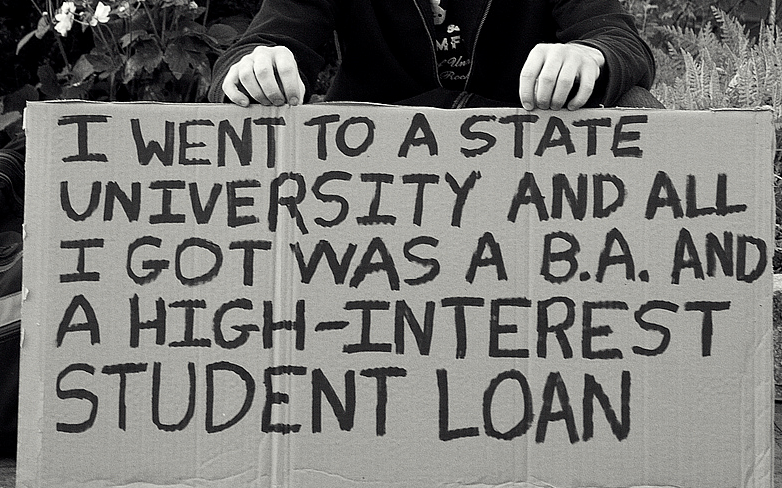

More Banks Are Offering Student Loan Refinancing, But Is It Really Safe & Beneficial?

For the last several years legislators have repeatedly introduced a bill that would allow student loan borrowers to refinance their private and federal student loans to the lower interest rates at which new loans are currently being issued. Although the legislation hasn’t managed to make it into law, that hasn’t stopped banks and credit unions from creating their own refinancing programs to help alleviate the debt burden for student loan borrowers. [More]

Student IDs That Double As Debit Cards Carry Significant Overdraft Fees

The cozy relationship between institutions of higher education and credit card issuers has come under increased scrutiny in recent years as consumer advocates and legislators have debated whether or not products like student IDs that double as credit or debit cards provide an actual benefit to students or if they’re just a way for schools and banks to rake in the big bucks. According to a new report from the Center for Responsible Lending, the excessive overdraft fees surrounding the use of the cards suggest the latter point. [More]

U.S. Department Of Education Cuts Ties With Five Debt Collection Agencies To Protect Borrowers

Consumer advocates applauded the Department of Education’s announcement last week to end contracts with five private collection agencies that provided inaccurate information to borrowers. [More]

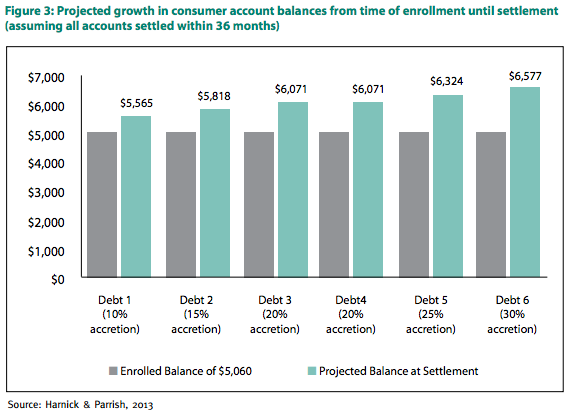

Debt Settlement Programs Often Do More Harm Than Good For Consumers

In the past we’ve told readers about the a number of bogus debt-relief operations that scammed already vulnerable consumers. But a new report from the Center for Responsible Lending points out that it’s not just shady companies that hurt consumers. Sometimes legitimate debt settlement programs can leave consumers in more debt than they started out with. [More]

Am I Completely Screwed If My Student Loan Co-Signer Dies?

Imagine this scenario: You’ve been out of college for several years, have a good job and you have no problems making your student loan payments in full and on time. Then tragedy hits; your parent dies or declares bankruptcy. If this loved one was a co-signer on your student loan, this change can trigger an often-overlooked clause that allows the lender to claim you are in default on your loan, potentially wreaking longterm havoc on your credit and finances. [More]

Report: Debt Collectors Now Using Court System To Unfairly Force Consumers To Pay Up

Debt collection is a big business that doesn’t look to be shrinking anytime soon. But along with the rapid expansion of the industry, there has been an increase in abusive and predatory collection practices. One of those practices, obtaining default judgements against consumers, has led the Center for Responsible Lending to call for stricter regulations over the process of selling debt to collectors. [More]

States’ Attempts To Reform Payday Lending Are Often Just Smoke & Mirrors

Payday lending has been getting a makeover of sorts recently. A number of banks, including Wells Fargo, have discontinued their payday-like direct deposit advance programs after federal regulators tightened their guidance over the high-cost products. Now, a number of state legislatures are discussing payday lending reform bills, which they say will make short-term loans safer for consumers. But are they truly helpful to those who need them? Not quite, say consumer advocates. [More]

Car Dealers Charge White Customers Less Than Everyone Else, Study Finds

Things that are okay for a car dealer to do: charge a buyer seeking financing a different rate based on his or her credit history. Things that are completely not okay for a car dealer to do: charge a buyer seeking financing a different rate based on his or her race. And yet they just keep doing it anyway. [More]

And Then There Was One: Wells Fargo, U.S. Bank Discontinue Payday Loan Products

The small victories are adding up in the battle against predatory loans this week. Wells Fargo and U.S. Bank announced they will discontinue high-risk payday lending programs. [More]

A Small Victory Against Predatory Lending? Regions Discontinues Payday Loan Product

It’s only a small victory in the battle against predatory loans, but there’s now one less bank offering a high-risk payday lending product to consumers. Regions Bank has closed the door on its payday loan-esque deposit advance product. [More]

Wells Fargo Called Out For Continuing To Offer Payday Loans

The Community Reinvestment Act of 1977 requires that FDIC-insured banks be examined and rated on whether or not they are meeting the banking needs in each of the communities in which they are chartered. But a pair of advocacy groups claim Wells Fargo deserves a lowered CRA rating because of loans that smell a lot like payday loans. [More]

Consumer Groups Urge CFPB To Provide Better Oversight, Rules Over Student Loan Servicing

Two months ago, the Consumer Financial Protection Bureau took the first steps in tackling issues within the student loan servicing arena by asking consumers and organizations to share their thoughts on the state of an industry that is tasked with recouping the more than $1.2 trillion in outstanding student loan debt in the U.S. Now, as the deadline to submit comments has come and gone, we know a bit more about just how the industry is perceived by those tasked with sticking up for consumers. [More]