Most anyone who toils away at an unsatisfying job dreams of chucking it all and venturing off to business on their own. The move just might be the path to success and happiness, but before you embark on a daring venture you need to take a reality check and identify your talents, motivations and expectations. [More]

business

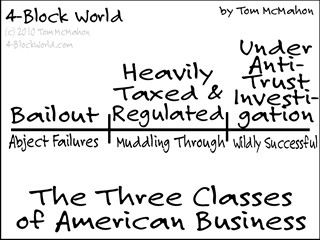

The 3 Kinds Of American Business

According to Tom, there are three basic types of American business. If that’s too many to remember, you can also organize them under them under the umbrella concept known as “screwed up.”

The Three Classes of American Business [4-Block World]

Chase Barrages Customer With Overdraft Fees

Just about everyone’s been smacked with an overdraft fee before, but Michael writes us about his partner who is drowning in a flood of such exploitative charges.

Private Jet Manufacturers Annoyed At Backlash, Claim Jets Are Practical

Did you know that private jets are actually quite practical? We didn’t. The Wall Street Journal says that private jet manufacturers are angry at the backlash against private jets and are speaking out to “counter business aircraft misinformation.”

Consumerist's Top 10 Business Debacles Of The Year 2008

As is our habit, we provided Ad Age with a list of our Top 10 Business Debacles of the Year. Are you ready for the pain?

The Secret To Business Success

Business is about doing shit for one supposedly inscrutable reason: to make money. Even if what you’re doing loses money, as long as you said you did it to make money, you’re cool.

Extended Stay Hotels Must Smell Really Bad

Okay, we got the bathroom humor of Kellog’s All-Bran commercial last year. We’re not sure if this commercial for Extended Stay Hotels, which shows guests so relaxed that they pass gas—or what the French call un petit éclatement—is quite as effective. Maybe they should change the tagline at the end to, “Our windows can be opened.”

United's Pilots Would Like You To Help Them Fire Their CEO

United Airlines’ pilots have had enough of Glenn Tilton, the CEO of United, and have started a website that calls for his resignation. In addition to listing Mr. Tilton’s various faults, the website asks you, the consumer, to help them by submitting your United Airlines horror stories. (CC: The Consumerist, naturally…)

The Secret Behind Zappos Otherworldly Customer Service? Pay Employees To Quit

Say you want to staff your call center with friendly, high energy, intelligent people who want to help customers and who enjoy their job. How do you find them? Well, apparently you hire people, train them, then offer them $1,000 to quit.

../../../..//2008/03/11/for-the-retail-managers-lurking/

For the retail managers lurking here: an analysis of data from a “US specialty retailer” shows that not reducing staff during lean times leads to an increase in profit margins. [The Times South Africa]

Macy's Sales Down, Will Eliminate Former Marshall Field's Headquarters, Fire 2,550

Macy’s Inc. plans to eliminate the former Marshall Field’s headquarters in Minneapolis and cut more than 2,000 jobs as part of a move to consolidate regional offices and boost sales and cut costs.

TigerDirect Will Take Over 16 CompUSA Stores

TigerDirect has gone through with its plan to purchase CompUSA, including its website, inventory, and “16 of the best CompUSA retail stores,” according to an email sent by CEO Gilbert Fiorentino to TigerDirect employees. The tipster writes, “This also includes Tiger absorbing a fair amount of their stock, though most of what’s in the stores IS going to get cleared out.”

Macy's Is Closing 9 Stores

Well now you’ve done it, shoppers of America: your refusal to spend enough money at Macy’s is forcing the department store chain to shutter nine “underperforming stores in Indiana, Ohio, Louisiana, Oklahoma, Utah and Texas,” reports Reuters. Seriously, what does it take to get you to buy stuff from them? They gave out coupons!

FCC Says Comcast Can't Buy More Cable Companies, But Murdoch Can Own Everything

Today, in an attempt to anger fans of both regulation and deregulation, the FCC approved two new rules. The first one restricts cable companies to owning no more than 30% of a market; the second one “gives owners of newspapers more leeway to buy radio and television stations in the largest cities.” One nice thing about the first rule is that Comcast can’t buy any more cable companies. One bad thing about the second one is that it will likely mean that Rupert Murdoch will win “permanent waivers to control two television stations in New York, as well as The New York Post and The Wall Street Journal.”

../../../..//2007/12/18/maybe-not-you-but-someones/

Maybe not you, but someone’s been doing a lot of shopping at Best Buy this year, because they just posted higher 3rd quarter earnings than they had predicted, based on “strong sales.” Sales were $238 million versus $150 million a year ago. [Reuters]

1 in 3 Lottery Winners Broke Within 5 Years

The sad news is that 1 in 3 lottery winners are in serious financial trouble or even bankrupt within 5 years. Why? The suddenly wealthy often never learn to manage their money.

When Business Traveling In London, Watch Out For Naked Sleepwalkers

Travelodge, which runs more than 300 budget business hotels in the UK, is training its staff on how to respond to the 70% surge in the past year of naked men sleepwalking through their hotels: “One tip in the company’s newly released ‘sleepwalkers guide’ tells staff to keep towels handy at the front desk in case a customer’s dignity needs preserving.” The sleepwalkers have been reported asking questions like, “Where’s the bathroom?,” “Do you have a newspaper?” and “Can I check out, I’m late for work?”

Home Depot To Sell Business Supply Division, Focus On Retail

Home Depot has agreed to sell its Home Depot Supply Unit to three private equity firms — Bain Capital, the Carlyle Group and Clayton Dubilier & Rice for $10.3 billion, the buyers announced this afternoon, confirming a report by DealBook.

Yay! Home Depot’s troubled supply division has long been fingered as the cause of their notoriously crappy customer service. One can only assume that resources once diverted to the business supply division can now be refocused on consumers. Let’s hope that’s how it goes. —MEGHANN MARCO